Colombia, officially the Republic of Colombia, is a country in northwestern South America, bordered by Panama on the northwest, by Venezuela and Brazil on the east, and by Peru and Ecuador on the south. The capital is Bogotá, and the population is largely concentrated in the mountainous interior. Colombia is a multi-party presidential democratic republic, whereby the President of Colombia is both head of state and head of government.

Colombia is one of the most geographically, linguistically, and culturally diverse countries in Latin America. The Spanish colonial era has left a lasting influence throughout the country, with a high rate of Roman Catholics in Colombian society.

The economy is traditionally based on agriculture (coffee and fruit production), but industries and services are increasing in importance. Colombia is the most populous nation of Spanish-speaking South America. However, it is also one of the countries with the highest income inequality and labor market informality in Latin America, with approximately one-third of the Colombian population living below the poverty line.

Colombia’s economy has recovered remarkably well from the COVID-19 crisis, and strong fiscal and monetary policy support have averted a stronger contraction of incomes.

Labor Code

The primary labor law in Colombia is the Código Sustantivo del Trabajo and is regulated by the Works Ministry. The employment law was last amended in 2021 and is known as the Substantive Labor Code. It governs the terms and conditions of employment such as working hours, holidays and rest periods, wages, overtime, and employment relationships.

The payroll cycle is biweekly or monthly, with payments being made on the last working day. However, it is also common in specific industries to pay biweekly with pay dates of the 15th and the last working day. Paying a 13th-month salary (equivalent to one month salary) is mandatory in Colombia. It is paid in two installments (June and December).

It is acceptable to provide employees with online payslips. Payroll reports must be kept for 20 years.

Minimum Wage

The monthly minimum wage in Colombia is COP 1,000,000.00 ($197.39 USD) and is mandated by the Columbian government.

The transport allowance has been revised from COP 106,454.00 to COP 117,172.00 ($23.13 USD) per month.

For employees who earn less than 10 times the minimum wage, the severance pay corresponds to 30 days of salary for the first year of service and 20 days for each subsequent year of service or pro rata.

Working Hours/Conditions

All employees are entitled to paid Sundays off from work. A regular workweek is 48 hours. Employers are allowed to let employees work a five day week if they wish to have Saturdays off, too. An employee who works between 10:00 p.m. and 6:00 a.m. must be paid 35% more than the equivalent daytime salary.

Overtime Pay

All employees are restricted to two hours of overtime daily or 12 hours weekly. Day employees are given pay and a quarter (1.25 times their hourly rate) for their overtime, unless they are temporarily working nights, and as such, their overtime rate increases to one and three quarters (1.75) their standard rate.

Employee Contracts

In Colombia, there are five types of employment contracts depending on the job and the nature of the business:

- Fixed-term employment contracts—These include a trial period of at least two months that can last for up to three years and be extended for as long as needed.

- Indefinite-term employment contracts—These include a trial period of at least two months and run for an unspecified amount of time.

- Contracts for a set task—These are given for fulfilment of a specific project.

- Occasional, accidental, or transitory contracts

- Provision of services agreements

The employer is obliged to notify employees of any decision to terminate a contract by its expiration date at least 30 days before the occurrence of the term agreed. The severance payment (Cesantía) consists of one month's salary per year of work. Cesantía is based on the last month's salary, provided it has not been modified during the last three months.

Taxes

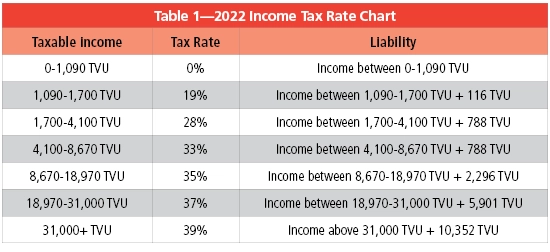

In Colombia, taxable income is expressed in units of COP 35,607 ($7.03 USD), or 1 UVT (Unidad de Valor Tributario). Those that make UVT 1,090 or less are exempt from income taxes. Employees contribute to Colombia’s social security. The social security program includes a pension fund, healthcare benefits, and a general labor risks system (employee screening process).

The Colombian tax system comprises taxes at the national, departmental, and municipal levels. Resident individuals and companies are taxed on worldwide income and assets (see Table 1). Nonresident individuals, nonresident companies, and permanent establishments of foreign companies are subject only to their Colombian-source income. The corporate income tax rate applicable to resident companies and permanent establishments of nonresident companies is 35% for fiscal year 2022. There is no local tax on individual income in Colombia.

As noted above, Colombia taxes are applied in 1 UVT or COP 35,607. The beginning tax rate is 19% on incomes greater than UVT 1,090 and the maximum tax rate is 39%.

Most employees are paid monthly, and taxes are withheld at that time.

Any citizen or resident (individual that lived in Colombia for more than 183 consecutive days, even if it occurred over more than one calendar year) is required to file their tax returns by their tax identification number (NIT). Usually, tax returns are filed somewhere in the time frame of late summer to mid-fall of the following calendar year.

Every employee has a NIT. During tax season (late summer to mid-fall), employees are assigned a tax filing due date. If they owe any taxes at the time of filing, they must pay those taxes by the due date or be charged an interest rate and late fees.

The corporate income tax is 35%. This rate applies to Colombian entities, permanent establishments in Colombia and foreign taxpayers with Colombian-source income that must file income tax returns in Colombia. For financial institutions with taxable income of more than 120,000 tax units (approximately USD $1.1 million), the law imposes a 3% surtax on income from 2022 to 2025 (for a total income tax rate of 38%).

Foreign corporations are taxed on their Colombian-source income and capital gains only. Generally, the withholding tax rate on payments made to nonresidents in respect of services rendered in Colombia is 20%.

Generally, the normalization tax rate is 17% and is applicable to income taxpayers that did not declare certain assets or claimed non-existent liabilities for tax purposes.

The general value-added tax (VAT) rates are 19% and 5%. The Colombia government announced the country will have three VAT-free days in 2022, on March 11, June 17, and December 2. During these days, sales of popular consumer goods, including clothing, toys, electronic goods, and home appliances, will be exempt from the 19% VAT.

The branch tax rate is 35%, plus a 10% rate on profits remitted abroad that have been taxed at branch level.

The capital gains tax rate is 10%.

Dividends that are not subject to tax at the corporate level will be taxed at a 35% flat rate.

Social Insurance Contributions

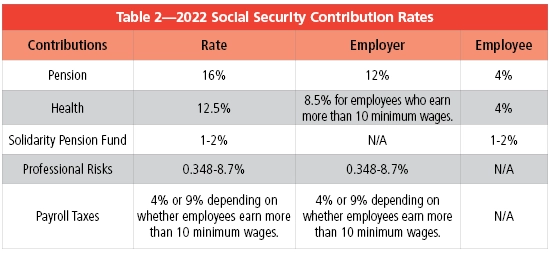

The basis for contributions in determined by the monthly salary earned by the employee. The contribution amounts are currently 28.5% of the monthly salary. Out of this percentage, 75% (approximately 20.5% of the monthly salary) must be borne by the employer and 25% (approximately 8% of the monthly salary) must be borne by the employee (see Table 2).

Employees in Colombia must be enrolled in the social security system (for pension, health, and labor risks), and employers are obligated to make the corresponding monthly contributions on time.

Foreign employees who are covered by the pension system in their home country, are not obligated to be enrolled in or to pay monthly contributions to the Colombian pension system.

Paid Time Off

Employers pay the employee for two days of sick leave, after which time, the government reimburses the employer for any paid sick leave.

Maternity leave is set at a minimum of 18 weeks, beginning one week prior to the due date. Paternal leave is granted in the amount of eight days.

All employees are entitled to at least 15 days (not counting Sundays) of paid vacation each year.

Colombia has 18 public holidays per year. Twelve of these are religious celebrations, such as Easter, Maundy Thursday, Good Friday, and Christmas Day. The rest are civic holidays, like Independence Day (20 July), the Battle of Boyacá (7 August), and Labor Day (1 May).

Foreign Hires

Typically, foreign workers are easily granted work permits and visas, as long as they agree to pay taxes like any other Colombian employee. As such, employees on a work visa may also benefit from social security and other government benefits to employees. All foreign hires must secure formal acceptance from the Colombian Consulate, Ministry of Social Protection, and the Administrative Department of Security (DAS). All foreign workers are given a work permit, Colombian ID, and NIT.