Few functions within the business world have been as deeply impacted by the events of the last three years as global payroll.

From changes in technology, service delivery models, and the role of payroll within the organization and in society at large, the COVID-19 pandemic has undeniably transformed the payroll industry.

Over this time, I’ve spoken with hundreds of payroll leaders at all kinds of organizations—from small startup companies to very large multinational corporations with tens of thousands of employees across multiple continents. What follows are some of the takeaways from those conversations.

Payroll’s Strategic Structural Function

Perhaps the biggest takeaway from the last three years is the continued recognition that payroll is not just a back-office function. During the pandemic, payroll took on a structural role in business and society.

In many countries, payroll teams played a direct role in managing wage subsidy schemes enacted by local governments to mitigate the effects of furloughs and lockdowns. In these cases, payroll acted as a conduit, funneling money from the government to workers, while coping with regular work and the added complexities of suddenly being remote and distributed.

Payroll is the only business function that played this kind of role throughout the pandemic. This speaks to the resilience of the people doing the work and to their empathy and willingness to go the extra mile for their coworkers.

As a result, organizations are seeing payroll in a new light, and payroll professionals are being recognized and rewarded by their organizations.

Digital Transformation of Payroll

Before the pandemic, remote work was uncommon in most large enterprises, especially in functions like payroll. This meant that processes and systems were not prepared for this change when it happened. Payroll teams had to learn very quickly how to get things done remotely, something that many were not used to.

In fact, one of the things we’ve learned from our conversations with payroll leaders is that a lot of payroll departments still rely on legacy systems and physical media to manage their processes.

This obviously presented a problem when everyone was forced to go remote overnight. One payroll leader shared a story about how someone on their team went into the office during lockdown to take pictures of their physical payroll calendar, so they had a reference to be able to digitize everything.

You’d think it was a mistake on their part to not have an easily accessible and up to date digital payroll calendar they could reference, but the truth is they had never needed one. Nothing like the pandemic had ever happened before, so there was simply no reason to not trust their physical payroll calendar.

Payroll is still a very people-driven business, and digitalization of payroll lags behind other business functions. However, the pandemic has jolted people into action, and many organizations are now undertaking the long-past-due digital transformation of their payroll.

More Focus on Efficiency, Shared Services

The wave of digital transformation sweeping payroll has also manifested in a push to adopt near-shore/offshore shared service structures.

Shared services models align with the goals of the transformation initiatives that many businesses are currently undertaking. Business are looking for ways to become more agile and cost-effective by consolidating distributed functions to benefit from economies of scale.

One of the biggest challenges for payroll is managing the complexities inherent in highly fragmented environments. If payroll is managed by teams positioned around the world, differences in time zones, languages, software systems, processes, and data formats create additional work for everyone.

They also make it harder to build resilience into your operations. If the team member responsible for payroll in one country is out sick, you can’t easily back them up with a payroll manager from another country.

Implementing a shared services model can eliminate many of these issues by centralizing management in a single location. However, running an effective shared services organization is not as simple as moving everyone to the same location. You need to establish common processes and tools to truly achieve the desired efficiencies and resilience in your payroll operations.

I expect that we’ll see more organizations making this shift, enabled by better technology that supports the centralization and standardization of payroll management tasks.

Customer-Centric Vendors

One of the defining traits of what is commonly known as the global aggregator model is its rigidity.

Aggregators require highly standardized inputs and processes to deliver service. The result is a feeling among payroll people that you’re the one working for your provider instead of your provider working for you.

One payroll leader we spoke to went as far as saying, “We pay them, so I should be telling them what my business is, rather than them telling me what process I need to follow.” The prevailing mindset among providers up until recently was, “This is the model, this is how we do this, and this is what you buy.” That approach simply doesn’t work anymore.

With more organizations reevaluating how to manage their payroll, vendors have been forced to become more flexible and customer-centric and have had to move away from a one-size-fits-all mentality.

Modular, low-touch, and low-cost approaches are now available thanks to technology, so organizations can be much more selective with their vendors and with the changes they make.

Hardship Breeds Innovation

It’s not a coincidence that the last three years have seen the emergence of more new players and new value propositions in payroll than any preceding period.

From alternative service delivery models that don’t take the aggregator approach to more overlap between fintech and payroll, traditional payroll providers have revamped their service offerings and their technology systems to respond better to customer demands.

The seeds of change were planted years ago, but they didn’t fully germinate until recently with payroll-focused software-as-a-service (SaaS) solutions, a much greater emphasis on data, cloud technology, and a push to replace services and spreadsheets with software and algorithms.

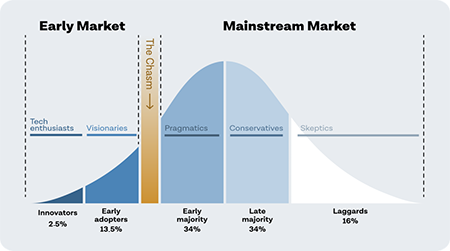

What’s interesting is that this innovation cycle is still in its infancy. Adoption of new technologies by multinational organizations is picking up, but it’s still decidedly niche. We are very much in the “early adopter” phase of the new technology adoption bell curve, which means there are still years of change ahead of us (see graph).

Even as certain innovations begin to take hold, we are seeing new ones from the bleeding edge of technology begin to emerge. With the mountains of data payroll manages, there is vast potential for artificial intelligence (AI) and machine learning (ML) to automate many of the more manual and repetitive tasks payroll teams conduct every cycle.

Overall, I’d say the pandemic has acted as a catalyst for transformation and innovation that was long overdue in payroll. In a sector where “don’t fix what ain’t broken” is the prevailing mentality, sometimes an external jolt to the system is needed to set things in motion.

I’m more excited than ever about the potential of the global payroll industry. I think more has changed in the last few years than in the previous decades. The speed at which payroll moves forward will only continue to accelerate as more technology is used to overcome the challenges payroll professionals face in their day to day lives.