Portugal, officially the Portuguese Republic, is a country located on the Iberian Peninsula, in southwestern Europe, and whose territory also includes the Atlantic archipelagos of the Azores and Madeira.

Portugal, officially the Portuguese Republic, is a country located on the Iberian Peninsula, in southwestern Europe, and whose territory also includes the Atlantic archipelagos of the Azores and Madeira.

One of the oldest countries in Europe, it is developed with an advanced economy that holds the 14th largest gold reserve at its national central bank.

Portugal is a semi-presidential representative democratic republic. It is a member of the United Nations, the European Union (EU), the Schengen Area, and the Council of Europe (CoE). Portugal was also one of the founding members of NATO, the eurozone, the Organisation for Economic Co-operation and Development (OECD), and the Community of Portuguese Language Countries.

Labor

Portugal’s labor laws follow the EU workers’ rights, providing considerable protection for those living and working in the country. The Portuguese Constitution (Constituição da República Portuguesa) and Labor Code (Código do Trabalho) cover the fundamental rights of workers. They regulate wages, working hours, health and safety, vacation allowance, work-life balance, and access to equal opportunities.

The Labour Code establishes two main types of contracts:

- Fixed-term contracts

- Open-ended (without a term) contracts

This distinction is important because of the ease of severability of the employment agreement differs substantially in fixed-term contracts than it does in open-ended contracts.

The other types of contracts in Portugal include:

- Contract of employment of unspecified duration

- Short duration contract of employment

- Part-time contract of employment

- Temporary work

- Provision of services

The minimum wages have been revised in Portugal and took effect on 1 January 2023. The minimum wages are as follows:

- For national (continent), from €705.00 to €760.00 per month and €9,870.00 to €10,640.00 per year

- For the autonomous region of Madeira, from €722.00 to €785.00 per month and €10,108.00 to €10,990.00 per year

Working Hours/Conditions

The average workweek is approximately 40 hours per week, breaking down as eight hours a day over five days. For each eight-hour day, employers must provide employees with a one to two-hour break period.

Overtime Pay

If an employee works more than eight hours per day or 40 hours per week, employers are obliged to pay the employees’ wage with an additional percentage for the first hour completed and 75% thereafter.

Overtime for employees within small companies is limited to 175 hours per year. The limit for larger businesses is 150 hours per year. Any overtime completed by employees must be reported to the Ministry of Planning.

Foreign Hires

Foreign workers have the same rights and duties as Portuguese workers. A citizen of the EU, European Economic Area (EEA), or Switzerland is allowed to live and work in Portugal without a visa or permit. Non-EU citizens, however, will need to apply for a work visa.

Visas

EU citizens are entitled to free entry and stay in Portugal with no time limit. If an EU member wishes to stay longer than three months, an application should be made to the Foreign Nationals and Borders Service or the local municipal council for a residency permit. Citizens outside the EU must apply for a temporary visa, residents visa, or residence permit to live and work in Portugal. A resident’s visa allows the employee to stay in the country for a total of four months. If the employees wish to stay longer, they must apply for a residence permit.

Taxes

Foreign workers in Portugal are entitled to the same rights in terms of tax and workplace laws as Portuguese citizens. Tax is a flat rate of 25% for income from employment, professional services, and business.

Other Taxes

Portugal has a tax system based on residency. If you spend 183 days or more in Portugal in a calendar year, you are considered a tax resident and must pay taxes in Portugal on your worldwide income. If you're a non-tax resident in Portugal, only income earned in Portugal is taxed.

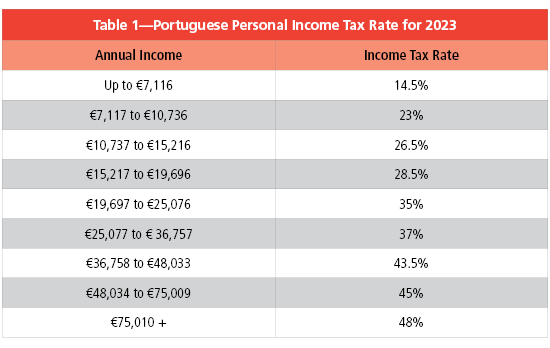

Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 14.5% to 48% for 2023 (see Table 1).

Portugal has the PAYE (pay as you earn) system for employed workers, where taxes are automatically deducted. Personal Income Tax (PIT) is known as Imposto sobre o rendimento das pessoas singulares (IRS).

Income Tax

Employers are obliged to deduct employee contributions from the employees’ gross wage and transfer tax deductions monthly to the Social Security Administration. These contributions cover benefits including sick leave, pensions, family benefits, parental leave, and unemployment insurance. All employers are obliged to file tax returns monthly and must summarize withheld amounts and present to employees by January of each year. The tax year in Portugal runs from 1 January through 31 December.

Taxable income for employees is based on the employees’ gross wage minus any allowable deductions. These deductions can include union costs, social security contributions, deductions for dependents, and subscriptions to professional bodies.

Corporate Tax

A flat corporate income tax (CIT) rate of 21% applies on the global amount of taxable income realized by companies that are resident for tax purposes in mainland Portugal (also applicable to Portuguese permanent establishments [Pes]of foreign entities).

Sales Tax

The sales tax rate is 23%.

Value Added Tax

Businesses in Portugal with a turnover of more than €13,500 on taxable goods and services must pay value added tax (VAT). This will rise to €14,500 in 2024 and €15,000 in 2025.

VAT in Portugal (Imposto Sobre o Valor Agregado, or IVA for short) was established in 1986, and comes with three chargeable bands:

- General rate: 23% on taxable goods and services

- Intermediate rate: 13% on food and drink goods and services

- Reduced rate: 6% on certain essential necessities including certain foods (e.g., meat, fruit, vegetables, cereal), books, newspapers, medicines, transport, and hotel accommodation

Separate IVA rates apply in the islands of Madeira (22%, 12%, and 5%) and the Azores (16%, 9%, and 4%).

Withholding Tax

The different types of withholding include the following:

- Dividends and interest income: Dividends and interest are liable to taxation at a flat rate of 28%. However, the taxpayer may opt to be liable to tax on dividends and interest received at the marginal rates varying between 14.5% and 48%, plus the solidarity tax rate if applicable (in 2023).

- Royalties: Royalties payments to nonresidents without a permanent establishment in Portugal are subject to a final withholding tax at a rate of 25%. Reduced rates may apply depending on the specific double tax treaty (DTT).

Social Insurance, Other Contributions

Social security contributions are shared by the employee and the employer. The contributions are due on the employee's gross remuneration at rates of 11% and 23.75% by the employee and the employer, respectively. These contributions cover family, pension, and unemployment benefits.

- Employee Social Security—11%

- Employer Social Security—23.75%

Time Off

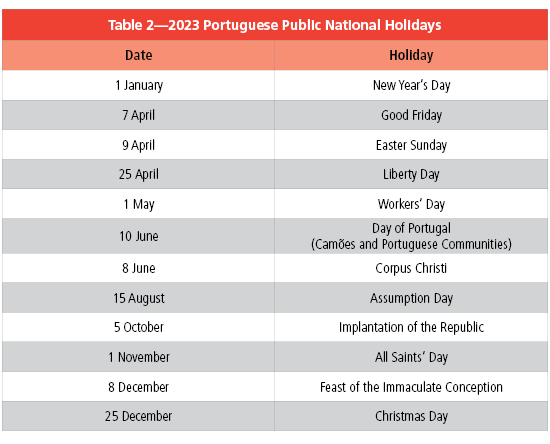

In 2023, of the 12 national public holidays in Portugal, there are 10 public holidays on working days (see Table 2).

Employees wishing to take maternity leave are entitled to up to 12 days off with their full salary paid by social security. The total number of days can be taken in its entirety after giving birth or can be divided into 30 days of leave prior to birth and the remaining 90 days after the birth.

In the case of paternity leave, fathers are entitled to take up to five days total leave.

Sick leave can be taken by employees once they have made at least six months of contributions to social security. Payment of sick leave is partially paid by social security and in most cases, employers supplement this pay.

The minimum duration of annual leave is 22 days.

Culture

Portugal is a predominantly Roman Catholic country with a close-knit family ethic. Its rich culture results from many influences, including Celtic, Lusitanian, Phoenician, Germanic, Visigoth, Viking, Sephardic Jewish, and Moorish.

In recent decades, the country has undergone a renaissance in the arts, and the cities of Lisbon, Porto, and Guimarães have all been designated European Capitals of Culture.

This “Country Guide” article was first published by Payslip.