In Part 1 of the article “Global Payroll Management Demystified,” published in the December 2019 issue of Global Payroll, the evolution of global payroll was introduced as a necessary component to enable international expansion and deliver employees’ wages in an innovative, compliant, and high-quality manner.

A holistic and best-practice approach toward global payroll management was discussed as a framework for implementation and to meet corporate expectations. This approach identifies four components that must be addressed holistically to ensure global payroll’s success. These four fundamental and interrelated components are listed below and seen in Figure 1:

- Global payroll strategy

- Global payroll governance model

- Global payroll operating model

- Global payroll operations

Figure 1—Four Components to Global Payroll Success

Each component is comprised of five sections that underpin the focus area of the component and, when present, ensure delivery at the highest standards.

In Part 2, we take a closer look at the first two components—global payroll strategy and the global payroll governance model.

Component 1—Global Payroll Strategy

Global payroll strategy, the most strategic component of global payroll management, is comprised of five sections:

- Purpose statement

- Strategic objectives

- Design principles

- Global payroll brand

- Staffing

Each section, having been briefly introduced in Part 1, will receive a closer look with practical examples provided.

Purpose Statement

A purpose statement must be designed to be evergreen. It provides inspiration and direction to your global payroll staff and expresses the impact the company can expect from global payroll. Colleagues reading the statement should feel the spirit of it. The statement must be concise and clear. It is in alignment with the wider function into which it reports: HR, finance, tax, or shared services. Senior executive buy-in is crucial for this alignment and endorsement of payroll’s strategic direction around the world. It will contribute toward future resource investment.

Given its company-specific focus, an example would not do justice to your particular company culture or strategic direction. To inspire, however, what follows is a generic example:

We deliver a pay experience of the highest quality that positively impacts the experiences and expectations that most matter for our employees.

Strategic Objectives

Strategic objectives follow directly from the purpose statement, making it actionable, and include performance metrics. These strategic objectives are set for the mid- to long-term while the performance indicators should change in that timeframe to monitor delivery of services and quality in a timely way. Objectives should be meaningful, specific, and balanced. They cover three categories: operations, compliance, and reporting.

- Operational objectives—include effectiveness (e.g., global payroll brand and process execution), efficiency (e.g., operational excellence), and the total cost of ownership (TCO).

- Compliance objectives—address adherence to laws and regulations set forth by regulators in all areas managed by the payroll function (e.g., zero audit failures, on-time filings, or zero fines).

- Reporting objectives—define delivery against internal and external and financial and non-financial guidelines (e.g., control effectiveness, financial reporting, and reconciliation).

These objectives must be well balanced. For example, when there is zero tolerance on noncompliance but the TCO is set unrealistically low, there are scarce resources to meet the challenging compliance objective. In this specific example, a best practice is to let the data reveal the risks and make a decision on resource allocation, including sourcing, staff, and technology.

Design Principles

Design principles are the key to strategic and aligned choices across all components of global payroll management. When these principles are clearly articulated and adhered to, they will define what matters most to ensure fulfillment of the purpose statement.

Design principles set the scope and functional boundaries and explain which capabilities are essential.

A best practice is to have no more than seven to 10 principles. These principles, often written in contrapositions, are company-specific. What follows are some generic examples (linked to the shared purpose statement):

- Centralization of service delivery while maintaining the quality of the employee’s pay experience

- Technology that adds complexity to the overall landscape must clearly provide added value for our people

- Low-touch pay-related interactions—must provide an answer within three clicks

- High-touch pay-related interactions—must result in locating the best-equipped payroll professional within one referral

Design principles are the foundation to all other sections.

Global Payroll Brand

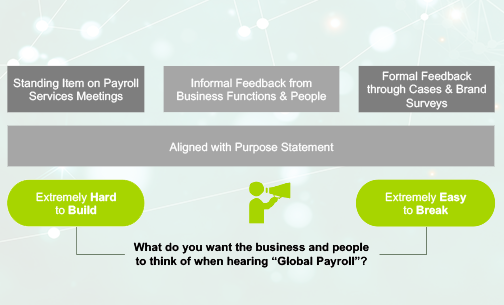

A brand combines the perception and expectations of what people think when they interact with your global payroll department. A brand is hard to build and can be fragile or easy to break. Memory is long for an employee who once received an incorrect paycheck. They may never receive a complete answer explaining what went wrong or who can ensure that the error will not reoccur. The sound of excellence is often the loudest and most rewarding sound in global payroll.

You must reach out to explore your organization’s global payroll brand. Ask leaders and their staff about their perceptions and expectations (see Figure 2). This will provide insight, change the way they interact with global payroll, and build a brand that is appreciated and recognized across your organization.

Figure 2—Ways to Get Perceptions, Expectations

As described in the purpose statement and design principles, “moments that matter” are vital. Your business and employees know what those moments are. Go and find out!

Staffing

Global payroll is a people business. Staffing, therefore, is of strategic importance and should be a topic for discussion at every strategic meeting. Staffing requires an understanding of the skills, knowledge, and abilities required now and in the future to meet strategic needs.

For instance, a different profile is required to manage an international, outsourced payroll compared to a domestic, in-house payroll. Focus on what people can do and further develop them, rather than focusing on what they cannot do. Improve on what is already good and incentivize your organization’s professional development. Help staff develop active learning skills, improve deep concentration, and provide them with high and balanced challenges. Staffing is about ensuring a good flow and having the right people focus on the sections of global payroll management at which they are best.

Component 2—Global Payroll Governance Model

The global payroll governance model is the second strategic component of global payroll management. It serves as a bridge between strategy and operating model and operations. Governance is composed of policies and standards, control and compliance, partnerships, organizational structure, and innovation. Each section, briefly introduced in Part 1, is more closely examined below with practical examples provided.

Policies and Standards

Policies are documented directives that drive process standards. Policies can cover a broad scope of things, including directives on how risks are evaluated, how control activities operate, how the creation of pay codes is governed, and how payroll calendars are reviewed.

This is where the aphorism “Global where you can, local where you must” comes into play. Policies are global standards but must allow for country variances. This governed flexibility allows for a less stressed relationship between global (or regional) functions and local teams. An appreciation for a strong global drive for standards should be matched by an equal appreciation for local nuances to ensure local compliance and cultural alignment.

As an example, let’s look at pay code governance. Pay codes are at the heart of unlocking the value of global payroll data and are required to effectuate policies and to deliver local statutory compliance. Pay codes have many dimensions, ranging from the text in local language and English to taxability and reportability to finance. This needs global governance, as local pay codes are often mapped to central bucketed pay codes that enable analytics and reporting, but also meet local statutory needs. Hence, a documented policy for pay code maintenance is necessary and drives standards.

Control and Compliance

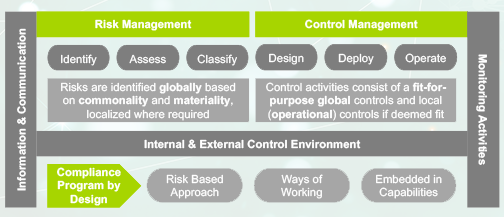

Compliance is at the heart of global payroll. We need to understand compliance requirements in all countries. It is a dynamic and challenging task. A best practice is to have formalized compliance programs to ensure that new or changed legislation is identified, assessed on cross-functional impact, and properly actioned.

Partnerships with vendors and consulting partners are often crucial in order to receive timely updates. From this understanding, risks can be identified and then controlled. This is where risk and control management plays a role. Risk management is the continuous identification, assessment, and classification of risks and is an iterative process. Control management is defined as designing, deploying, and operating effective activities with a risk-based approach (see Figure 3).

Figure 3—Roles of Risk and Control Management

A typical approach includes global controls (segregation of duties, variances, and reconciliations, etc.) that cover material risks and are enforced on all countries in the scope of global payroll. For local nuance and compliance requirements that often are part of the employee lifecycle (e.g., hire, move, and leave) and remuneration and benefit plans, local controls are operated. This should, however, be governed and properly documented to ensure visibility in how compliant global payroll actually is enabled by technology. Having a central control and compliance register of some kind is advised.

Partnerships

Partnerships is the collective term for contractual partners and internal and external stakeholders. In an increasingly multi-country, virtual, and sourced landscape, it is imperative to have proper oversight on who collaborates with whom, when, and how to ensure that partnerships flourish.

Contractual partnerships are the relationships global payroll has with its service and technology vendors and consulting partners. Managing these relationships is also referred to as vendor management. This goes beyond service reviews and viewing a slide deck with key performance indicators (KPIs). It includes partnering to achieve a common goal: purpose statement, strategic objectives, and upholding the global payroll brand.

Internal stakeholders are included, as they can impact the end-to-end global payroll process. Often, this includes interactions with HR, finance, legal, tax, and mergers and acquisitions, and requires tight integrations with those functions at every level (e.g., strategic, tactical, and operational). Global payroll requires early involvement in cross-functional projects. This means investing time to create partnerships with these other functions. Connect, interact, and share. External stakeholders are often regulatory bodies (e.g., financial authorities, tax authorities, and social security agencies, etc.) and, for instance, pension providers. Understanding their needs—governed centrally and locally—is a fundamental requirement.

Organizational Structure

In global payroll, there are a few common practices on how global payroll is organized in the form of an organizational structure. Common structures are:

- Truly global

- Regional (e.g., EMEA, APAC, Americas, or domestic and international)

- Local

- Hybrid, which might also allow for single-country exceptions

Organizational choices are dependent on a company’s global payroll footprint (more on this in Part 3) and where the global payroll function is in its journey.

Often, central management resides in a strategic location (e.g., headquarters or shared services) with service teams having a focus on a region, set of countries, and/or group of similar-sized-population payrolls. It is a best practice to use the four components of global payroll management to assign accountabilities to leaders or managers and then assign stewardships for each section to team leaders. This enables decision-making and drives accountability and empowerment to all global payroll staff. I would advise a leader to map this approach to global payroll management and identify any gaps in your current organizational structure.

Innovation

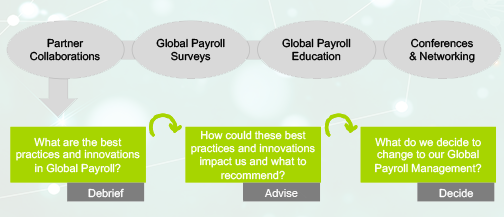

Innovation is increasingly a collective goal. Innovation is rightfully linked to technology, which is evolving exponentially and sometimes even disrupting how we operate global payroll. Innovation, however, is about so much more: best practices, not accepting the status quo, and being entrepreneurial. We hear and see so much around us when we attend conferences, as we network, attend classes, read thought leadership papers, and collaborate with partners and peers.

It can be difficult to conceptualize these lessons and bring back clear actions to a company. What does this mean for us? In global payroll management, the three-step approach toward innovation is a best practice: debrief, advise, and decide (DAD) with a next step of project delivery as part of global payroll operations (see Figure 4).

Figure 4—Three-Step Approach Toward Innovation

Try these three simple, consecutive, and easy-to-adapt steps to get the best value out of the possible innovation opportunities.

Global payroll strategy and global payroll governance set the strategic direction of global payroll and its sections to ensure that all aspects are addressed. When functioning—and when accountabilities and stewardships are clearly assigned—nothing can hold you back from reaching the highest standards in operating models and operations.

Coming in Part 3

In Part 3 next month, we will take a closer look at the last two components of global payroll management—the global payroll operating model and global payroll operations, with closing thoughts and considerations.

Max van der Klis-Busink, RPP, holds a Bachelor of Business Administration in Human Resource Management and is a Registered Payroll Professional (RPP) in The Netherlands. He currently holds the position of Payroll Manager Netherlands and Policy Lead, Global Payroll Strategy, at Shell’s global headquarters in The Hague. Over the past 13 years, Van der Klis-Busink held various roles in global payroll and has been active in developing the profession. He has developed a best practice method for being in control of global payroll and specializes in building payroll functions that continue to adapt to ever-changing business needs. Van der Klis-Busink has shared his passion for payroll through multiple articles in global payroll, webinars, and by co-developing and instructing certificated programs in global payroll, together with the Global Payroll Management Institute (GPMI). In 2018, Van der Klis-Busink was the first-ever recipient of the GPMI’s Global Vision Award.