Since June 2022, China has been relaxing some of its most stringent travel restrictions, including PU letter exemption for the application of Z-visa (work), M-visa (business), and F-visa (visitor); the shortened quarantine time for inbound travelers from the 14+7 model (14 days of centralized quarantine and 7 days of home quarantine) to a 7+3 model (7 days of centralized quarantine and 3 days of home quarantine); and the simplification of the work permit application process for foreigners.

All these updates indicate that mainland China has finally started to reopen its border and employers can generally resume the normal recruitment and employment of foreign employees.

Here is some basic but essential knowledge about hiring foreign employees in mainland China.

Mandatory Labor Contracts

A written labor contract is mandatory for hiring foreign employees in China.

According to relevant regulations, the maximum term of the labor contract for foreign employees is five years, while the minimum labor contract term is not stipulated.

However, from the perspective of work permit management, we would suggest the term of the first labor contract should be at least one year. Generally, it takes two to three months to apply for a new work permit and a residence permit for a foreign employee, and the duration of the work permit and residence permit needs to be the same as the labor contract period. If the labor contract term is too short, the employee will get a shorter-duration work permit, which needs to be renewed more frequently.

Probationary Period

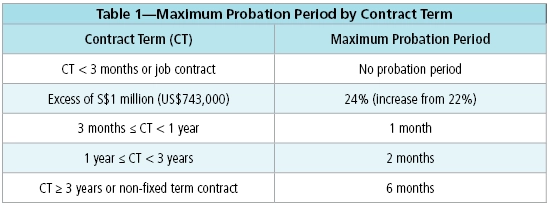

Employers may choose to set a probation period clause in the labor contract to enable the two-way choice with its employee. The probationary period for foreign employees is the same as that for Chinese staff and must abide by the relevant provisions of the Labor Contract Law (see Table 1).

Social Security

China’s social security system is made up of five different kinds of insurance (and one housing fund):

- Pension

- Medical

- Maternity

- Work-related injury

- Unemployment

Although both employer and employee are obligated to make contributions, it is generally the employer’s responsibility to correctly calculate and withhold the payments for both parties. The employer’s obligation to make adequate and timely contributions cannot be alleviated or exempted by reaching a mutual agreement with employees.

Foreign employees working in China have been required to participate in China’s social insurance scheme since 2011, but there are local variances, and this obligation can be exempted if they come from countries that have social insurance exemption agreements with China.

Notably, expatriates are generally not required to contribute to the housing fund scheme. Nevertheless, foreigners can make housing fund contributions on a voluntary basis in certain cities, such as Shanghai, Shenzhen, and Tianjin. This is a measure to attract talents rather than a mandatory obligation.

Work, Residence Permits

According to the Regulations on Employment of Foreigners in China, the Labor Contract Law of the People’s Republic of China, and the Labor Law of the People’s Republic of China, foreigners who want to work in China must first obtain a work permit. Therefore, Chinese regulations recommend that companies evaluate whether the candidate’s qualifications can successfully obtain a work permit in China before hiring foreigners, thus ensuring that companies can legally employ them in China.

Work Permit

The classification of work permits is based on the desirability and eligibility of the expatriates through a comprehensive evaluation system, which includes a point-based system, a catalogue for guiding foreigners working in China, a labor market test, as well as a quota administration system.

Among others, applicants are assigned points based on their education background, salary level, age, past achievements, work experience and length, and Chinese language level. Candidates applying to work in less developed areas may receive additional points.

The following are the three types of work permits in China:

- Type A—This applies to highly qualified top talents. In practice, the most common Type A work permit applicants are those whose salary is more than six times the social average salary of the city. Type A work permit applicants are eligible for service through a “green channel,” which offers paperless verification, expedited approval, and other facilitation measures. Also, Type A work permit applicants are not limited by education degree or working experience. Generally, the whole process can be completed in 1-1.5 months. The disadvantage of the Type A work permit is that in some cities, the first duration of the work permit is often short, such as six months. Upon expiration, the applicant is required to provide a tax payment certificate to prove that the actual salary meets the requirements of six times of local social average salary or above, otherwise the renewal cannot be approved.

- Type B—This is the most common type, which applies to professional talents in line with labor market demand. Generally, candidates with a bachelor’s degree and more than two years of work experience can apply for a Type B work permit. Candidates whose average monthly salary is not less than four times the local social average salary can also apply for a Type B work permit easily. The Type B work permit requires more documents, the most complex of which is a no criminal record certificate and a certificate of academic qualifications. Both documents need to be notarized by the relevant local institution and then verified at the local Chinese embassy before they can be used in the work permit application. It should be noted that the general validity period of the no criminal record certificate is half year (or even as short as three months), while the validity period of the academic certificate verification is permanent.

- Type C—This applies to other foreign talents in line with labor market demand, which is generally suitable for new graduates or applicants with no undergraduate degree with little work experience. A Type C work permit is subject to quota management, meaning that the number of applicants who can get this type of work permit is limited. But still, there is a high probability of obtaining a Type C work permit for new graduates who have obtained a bachelor’s degree or above in China.

The information provided is just a brief introduction to the three types of Chinese work permits and their most common application conditions. Employers should be aware that the actual work permit application process requires a comprehensive understanding and evaluation of the candidate’s information to ensure the applicant’s eligibility to obtain a work permit.

Residence Permit

Employees who receive their foreigner’s work permit in China are required to apply for a residence permit from the exit-entry department of the local public security bureau within 30 days after their entry into China. Receipt of a residence permit signifies the completion of the administrative procedures for hiring the foreign employee, allowing the employee to travel into and out of China as regularly as they require.

The validity period of the residence permit is generally the same as the validity period of the work permit. If the employee wants to bring their family members (spouse, children under the age of 18, parents, and parents-in-law) to China, they must clarify this need when applying for the work permit. The family member can apply for a residence permit to live in China after entering the country.

Individual Income Tax

The salary income of foreign employees is subject to personal income tax in accordance with China’s individual income tax (IIT) law. The employer has the responsibility to accurately calculate and withhold the employee’s IIT on employment income and pay the amount to the local tax bureau monthly. The IIT calculation of foreign employees is very different from that of Chinese employees.

Tax Residence Status

IIT taxpayers are divided into two categories: Resident taxpayers and nonresident taxpayers.

Foreign employees who have resided in China for 183 days or more cumulatively within a tax year are categorized as resident taxpayers, while foreign employees who reside in China for less than 183 days cumulatively within a tax year are categorized as nonresident taxpayers.

A tax year starts from 1 January of a calendar year and ends on 31 December. Only days where foreigners stay in China for a full 24 hours are counted as days of residence in China. The only exception is if an individual enters China at 0:00 of a day, the entrance day won’t count into this China residence period.

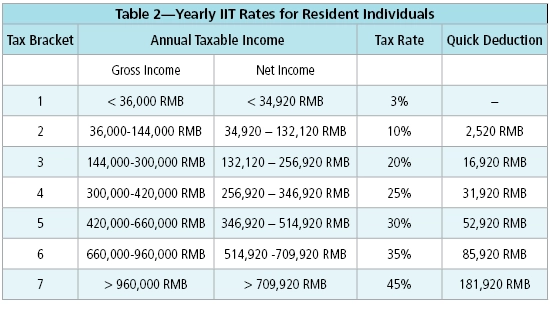

For resident taxpayers, the IIT on their comprehensive income–income from wages and salaries, remuneration for labor services, author’s remuneration, and royalties–is subject to yearly computation.

The taxable income amount of comprehensive income of a resident individual shall be the balance after deduction of the standard deduction (RMB 60,000 per year), as well as special deductions, special additional deductions, and other deductions determined pursuant to the law, from the income amount of each tax year.

The comprehensive income is subject to 3% to 45% of progressive rates on a whole, following the brackets in Table 2.

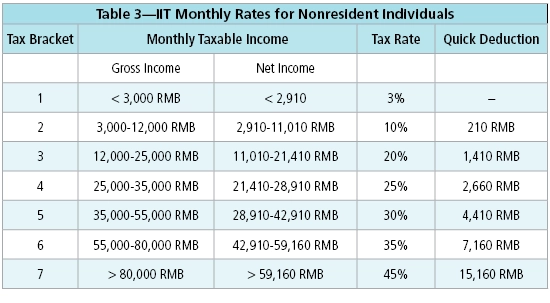

For nonresident taxpayers, their IIT on different incomes is computed separately per time or per month when it occurs. The taxable income amount for income from wages and salaries of a nonresident individual will be the balance after deduction of the standard deduction (5,000 RMB per month/$697.56 USD), as well as other applicable deductions.

The IIT rates for nonresident taxpayers are generally equal to those for resident taxpayers. But since it’s computed monthly, the brackets in Table 3 will be followed.

When a foreign employee joins a company, the company HR needs to pre-assess how many days the employee will spend in China throughout the year to decide the employee’s tax residence status. If the actual situation is inconsistent with the pre-assessment, the employer or the employee will be required to make tax settlements in the relevant tax departments, which will lead to the payment of more (or less) tax due to a change in the tax residence status.

Tax Planning for Foreign Employees

Both resident taxpayers and nonresident taxpayers can use the following tax-saving policies:

- Preferential treatment of one-time bonus: Resident taxpayers can take advantage of the preferential tax treatment for the annual one-time bonus until December 31, 2023, which can be used once every year. For nonresident taxpayers, they can enjoy similar treatment provided for nonresident taxpayers for the one-time bonus.

- Tax-exempt fringe benefits for expatriates: Foreign employees working in China are allowed to deduct certain fringe benefits before calculating the tax liability on their monthly salary until 31 December 2023. Such fringe benefits include housing subsidies, meal subsidies, laundry expenses, business travel subsidies, relocation expenses, home visits to and from the workplace and home country (twice a year), language training fees, children’s education fees, etc.

- Double taxation agreements: China has signed double taxation agreements (DTAs) with more than 100 countries, and foreign employees use DTAs to prevent being double taxed in China and in their home countries.

- Optimization of job arrangement: For some foreign employees who are employed by a domestic employer and overseas employer at the same time, or who are employed by an overseas employer only, but provide work in China and overseas within the same period, their IIT in China can be optimized by planning the days stayed in the country so that the amount of their income liable to Chinese IIT may be assessed in advance.

- Avoid worldwide taxation liabilities in China: According to the IIT Law, foreigners who have no domicile in China won’t be subject to paying IIT on their worldwide income until their number of consecutive years residing in China for 183 days or more is over six years. This is the so-called “six-year rule.” The count of the six years can be reset by living in China for less than 183 days in a tax year, or by leaving China for more than 30 days continuously where their days of residence in China have reached 183 days in a tax year. The six-year rule counts starting from 1 January 2019. Thus, the number of years before 2019 are not included in the count of the six years, and individuals who have no domicile in China won’t be subject to worldwide income before 2024. Companies with foreign employees are suggested to arrange their clock-reset trip before reaching six years to avoid being taxed on their global income in China.

The knowledge involved in IIT planning for foreign employees is relatively professional, and there are local variances in different cities. To avoid tax risks for enterprises and employees, it is recommended that the company HR seek assistance from a professional tax consultant in advance.