Panama, officially the Republic of Panama (República de Panamá), is a transcontinental country with a population of more than four million spanning the southern part of North America and the northern part of South America. The capital and largest city is Panama City where more than a half of the population lives.

Because of its key geographic location, Panama's economy is mainly based on a well-developed service sector, especially commerce, tourism, and trading.

The Panama Canal is one of the two most strategic artificial waterways critical to global maritime trade. The Panama Canal is a narrow isthmus approximately 65 km between the Caribbean Sea and the Pacific Ocean. Its expansion doubled the capacity by adding a new lane of traffic allowing for a larger number of ships and increasing the width and depth of the lanes and locks allowing larger ships to pass.

The Panama Canal is one of the two most strategic artificial waterways critical to global maritime trade. The Panama Canal is a narrow isthmus approximately 65 km between the Caribbean Sea and the Pacific Ocean. Its expansion doubled the capacity by adding a new lane of traffic allowing for a larger number of ships and increasing the width and depth of the lanes and locks allowing larger ships to pass.

Panama also signed the Panama–United States Trade Promotion Agreement which eliminates tariffs to U.S. services.

Panama is regarded as a high-income country. However, it remains a country of stark contrasts perpetuated by dramatic educational disparities.

Labor Code

Employment relationships are mainly regulated by the Constitution of the Republic of Panama and the Labor Code. The Constitution provides for the core inalienable rights relating to employment relationships, and the Labor Code regulates in detail such relationships.

According to the Ministry of Labor and Labor Development (MITRADEL), all labor contracts must meet the requirements established by the Labor Code of Panama.

All Panama labor contracts must be done in triplicate. You will need one copy for the Ministry of Labor, one for the employer, and one for the employee. There are also three types of labor contracts that can be signed, according to law:

-

A 90-day probational contract

-

A fixed-term contract, the duration of which can last up to one year

-

An indefinite-term contract

The employer must notify the worker in writing outlining the cause and the date that the termination was given.

For employees working less than two years on open-ended contracts, employers must give 30 days’ notice. Employees must give 15 days’ notice (specific rules apply for technical positions) to their employer when they decide to resign. There is no notice period for fixed-term contracts.

Employees are entitled to severance payment when their contract is terminated. It is equivalent to the following:

Working Hours, Pay

The standard workday is eight hours, and a full-time workweek is up to 48 hours. After eight weeks of shift work, each team works the eight-hour weekday shift for two weeks.

This pattern repeats for about 40 weeks. The weekday shifts help employees catch up on administrative tasks and are useful for employee training programs.

Normal daytime workdays run from 6:00 a.m. to 6:00 p.m. Sunday is usually the weekly day of rest.

Overtime Pay

Working on a national public holiday is paid at double the normal pay rate by the employer. Employees cannot work more than three hours of overtime per day or a total of nine hours per week.

The payroll cycle can be monthly, every two weeks, weekly, daily, or even hourly. The 13th salary is paid out in three installments in April, August, and December.

It is highly recommended that employers maintain employees’ payroll, tax, and social security records for at least 20 years.

Paying employees in Panama is not the same as paying workers in your own country. Employees must be paid using Panama’s employment and payroll standards.

Minimum Wage

Panama has a government-mandated minimum wage. The Panama minimum wage rate ranges from US$326.56 and US$971.35 per month, depending on the region and sector.

Taxes

The tax year in Panama runs from 1 January through 31 December.

Both residents and nonresidents are required to file tax returns in Panama. But unlike some other countries, both residents and nonresidents are only taxed on their Panama-earned income. Foreign-earned income is not taxed in Panama. There are no local taxes on income.

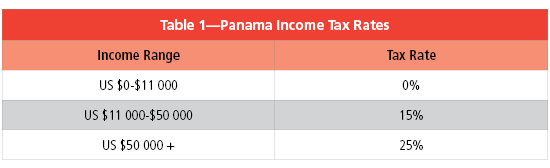

Rates, Thresholds

Tax rates for residents are progressive and based on total income, ranging from 0% to 25%. Nonresidents are taxed at 15%, plus the educational tax rate of 2.75%.

How Withholding Works

Employment income is taxed by withholding. Individuals with only one salary are not required to file an income tax return. Individuals with more than one salary, or who derive other taxable income not subject to income tax withholding, must file a tax return.

Returns, Tax Credits

Individuals who are required to file a tax return must do so by 15 March following the end of the tax year, but this deadline may be extended by one month upon request. Joint tax returns are permitted.

Income Tax

See Table 1 for the income tax rates.

Table 1—Panama Income Tax Rates

Social Insurance Contributions

Social Insurance Contributions

Employee contributions are 9.75% and employer contributions are 12.25% of the total remuneration of the employee.

Payroll Taxes

In addition to social security tax, the following payroll taxes are applicable:

- Educational Insurance Tax—Assessed at the rate of 1.25% for employees and 1.5% for employers on salaries and wages paid. There is no maximum limit on the taxable amount.

- Professional risk tax—This is an additional tax applicable to employers at 0.33% to 6.25% according to the type of industry

- Corporate income tax—The standard tax rate is 25%

- Branch remittance tax—The tax rate is the corporate income tax rate, plus 10%

- Capital gains tax—The tax rate is 10%

- Value added tax—The standard rate in Panama is 7%. Alcoholic beverages and hotel accommodation are taxed at 10%, and tobacco and tobacco-derived products are taxed at 15%.

- Dividends—For resident companies and individuals, the dividend taxes are 5%/10%/20% and for nonresident companies and individuals, the dividend taxes are 5%/10%/20%/40%.

- Interest, royalties, and fees for technical services—For resident companies and individuals, there is 0% tax. For nonresident companies and individuals, the tax rate is 12.5%.

Time Off

Employees are entitled to 30 days of paid annual leave following the commencement of 12 months of employment. They are also entitled to 18 days of paid sick leave.

Maternity leave is 14 weeks in total and starts six weeks before the expected date of delivery and ends eight weeks after delivery. Adoptive parents are entitled to 28 days of paid leave.

Fathers are entitled to three days of paid leave.

In case of termination of employment, employees should receive a payment for the vacation period not taken in cash at the rate of one day for every 11 days of work.

National Holidays

These are 14 national holidays in Panama in 2023, which include Good Friday and the Uprising of Los Santos (see Table 2).Foreign Hires

Foreign Hires

Foreigners who intend to stay in Panama for up to 90 days can obtain a tourist visa, but this visa does not allow the holder to work. To live and work in Panama, foreign employees will need to get an immigration visa and establish residence before applying for a work permit. In Panama, it’s the employer’s responsibility to obtain a work permit on behalf of any foreign employees. However, the employee cannot get a work permit until the National Immigration Service grants them permanent residence status.

Nonresidents are taxed only on income from Panamanian sources, and the tax on any type of income paid to a nonresident must be withheld by the payer. Nonresidents are taxed at 15%, plus the educational tax rate of 2.75%.

Culture

Panama's culture is a blend of African, American Indian, North American, and Spanish influences, which are expressed in its traditional arts and crafts, music, religion, sports, and cuisine. Panamanian music is popular throughout Latin America, and the country is known as well for its many festivals.