The Republic of Bulgaria is located in Southeast Europe and is bordered by Romania, Serbia, Greece, and Turkey.

Since transitioning into democracy in 1991, Bulgaria has been a unitary parliamentary republic. The largest and capital city, Sofia, is home to more than 1.2 million of the country’s seven million population.

Bulgaria is a member of the European Union (EU), NATO, and the Council of Europe. It is also a founding state of the Organization for Security and Co-operation in Europe (OSCE).

Applicable Law on Payroll Fees

The general provisions regarding the Bulgarian payroll system are settled in accordance with the Bulgarian Labour Code and Bulgarian Social Insurance Code.

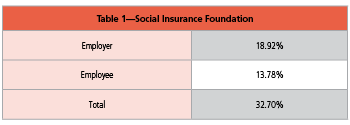

Social Insurance Foundation

Social insurance contributions are paid on a monthly basis. The percentage of social insurances depends on the activity of the employer. The most common scenario is as follows in Table 1.

The employer is obligated to pay the social insurance contributions each month by transferring the relevant amount to the bank accounts of the National Revenue Agency. When the payments are completed, the employer submits the necessary declarations for the accrued social insurances and the paid social contributions to the relevant authorities.

The employer is obligated to pay the social insurance contributions each month by transferring the relevant amount to the bank accounts of the National Revenue Agency. When the payments are completed, the employer submits the necessary declarations for the accrued social insurances and the paid social contributions to the relevant authorities.

Tax Deductions

The personal income of individuals is taxed at a flat rate of 10% of the net salary. Income tax is payable by the employer on behalf of the employee together with the payment of social insurances.

Every additional payment (including bonuses) is subject to social insurance and taxes.

At the end of the year, every employer provides to its employees a certificate for the total amount that has been paid on their behalf including social insurance contributions and income tax.

Depending on the employer’s trade activities and the position held by the employee, there are set minimum social insurance bases. The maximum social insurance base is BGN 3,000.00.

Employment Procedure

The employer has the obligation to register employment contracts no later than three days after their signing, but not later than the starting date of the employee and no later than seven days after their termination. The statutory number of working hours per week is 40 hours. A separate procedure needs to be followed in cases when a company is hiring a specialist from a non-EU country.

Protection of Employment

Holidays: According to the Bulgarian Labour Code, every employee is entitled to not less than 20 days of paid annual leave. If there is an additional agreement between the employer and the employee, this period can be longer, but not shorter. There are some categories (such as university students) that have additional paid days off. If the employment contract is terminated and the employee has unused days off, these days should be paid by the employer as compensation.

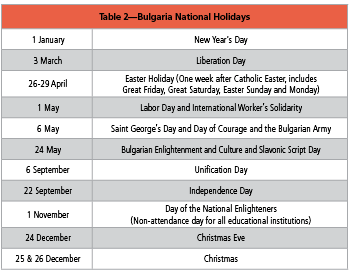

In addition to the 20 paid leave days, every employee is entitled to approximately 15 national holidays.

Illness: The compensation is payable by the government, except for the first three days, which are paid by the employer. The amount of the compensation for the first three days is 70% of the gross salary of the employee. For the days after that, the employee receives 80% of the average income in the past 18 months, which is payable by the state. In case of a work accident, this percentage is 90%. The employee should have not less than six months of work experience to have the right to receive compensation from the state. The doctor has the obligation to submit the sick-leave list of the employees to the authorities electronically, and the employer submits the other relevant documents. The government pays compensation within 14 days of their presentation.

Maternity: Compensation is payable by the government and is set at 90% of the individual’s income for the last 24 months of employment. It is payable for a duration of 410 days. The only obligation of the employer in such cases is to provide the maternity leave list to the government institutions.

Payroll Calculation Procedure

The monthly payroll calculation procedure consists of the following steps: Employees’ monthly working and sick days are calculated and compared in case there are additional leave applications and contracts. Bonuses or any other benefits are added to the gross salary. After the necessary calculations and deductions are made, the necessary printouts are generated. The payroll file, social insurance payment orders, as well as salary payment orders (if necessary) are sent to the employer. When the payroll calculations are completed, two extra declarations are prepared and submitted to the National Revenue Agency. In case of illness and after the declarations have been submitted, the sick leave list must be prepared and submitted no later than the 10th of the following month.

Termination of Employment

Employment termination may occur with a notice of one, three, or six months based on the employment contract. After the termination of the contract, the employer is obliged to provide to the employee all of the relevant documents, including a certificate for paid social insurances and income tax and a filled-in labor book.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Eurofast is a regional business advisory organisation employing local advisors in over 22 cities in South East Europe and Middle East (SEEME). The organisation is uniquely positioned as a one-stop shop for investors and companies looking for professional services in SEEME. It has over 40 years of history, working with many global brands and leading institutions, operating in the manufacturing, retail, airlines, and professional services sector.

Eurofast’s payroll team is committed to processing payroll accurately and on time. It focuses on ensuring employers are fully compliant in the countries where it services them. Eurofast also aims to add value to employers by safeguarding the confidentiality of their employee sensitive data, keeping them updated with employment legislation, reducing paperwork and cost while they focus on their core service or products. Its aim is to create client enthusiasm by giving more value to clients, whether measured by price, performance, quality, or service.