A smart contract is any contract that is digitally equipped and that automatically executes the terms of an agreement by itself. The “term” describes computer program code that can facilitate, execute, and enforce the negotiation or performance of an agreement using blockchain technology.

To explain in layman’s terms, the smart contract is a tiny computer program that stores the terms and conditions of a contract inside a blockchain. This purely digital type of contract runs on blockchain nodes that cannot be changed. So, basically any contract is a smart contract if they store rules, verify rules, are self-executing, and run in a decentralized manner.

The essential characteristics of a smart contract are as follows:

- No physical submission of documents required for the completion of the transaction

- The details of the transactions are recorded on the decentralized ledger wherein the details are protected, and user identity is anonymous

- It is not possible for anyone to alter the terms and conditions of the contract once the transaction is complete

- Transactions under smart contracts are irreversible in nature

Section 10 of the Indian Contract Act, 1872 states that a contract must satisfy basic elements—an offer, acceptance, intention, and consideration. Thus, smart contracts can be considered proper and valid contracts under Indian law.

Do Smart Contracts Hold Up Under Indian Laws?

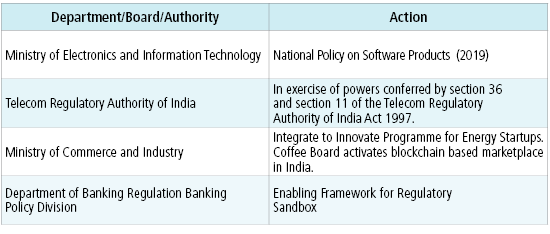

While India does not have specific laws/statutes/regulations related to smart contracts, there are provisions under the Contract Act, Evidence Act, and the IT Act, which can be applied to smart contracts. Yet, these create limitations for the use of smart contracts, as the legislation has not been updated to reflect technological developments (see Table 1).

Section 10 of the Indian Contract Act, 1872 speaks about the essential nature of a contract—"all agreements are contracts if they hold the free consent of parties willing to contract, for a lawfully accepted consideration and with an object.” When the same is applied to smart contracts, we see that there is offer and acceptance, hence, it could be said that smart contracts are validated and enforceable under Indian law.

But offer and acceptance are basic in nature and can be proved easily. However, the consideration must be a legal one—for example, are such contracts specifically recognized under the law.

The IT Act provides “that digital contracts are valid contracts and enforceable in the court. However, they should have the Digital or Electronic Signature by the Certified Authority authorized by the government.” Here, smart contracts contradict this clause as it is decentralized in nature and there is no involvement of a government-controlled authority.

The Evidence Act provides in section 65B, “electronic contracts are admissible in a court of law.” However, there is a condition that these contracts must have a valid digital signature from the certified authority to prove their authenticity, which is mentioned in section 85B of the Indian Evidence Act. This again contradicts the requisites for a smart contract.

What Is the Procedure to Execute a Smart Contract?

Smart contracts work by following a simple “if/when…then…” statements that are written into code on a blockchain. We can briefly divide the process into three steps as stated below:

- Coding—These contracts are mostly written in a programming language, Solidity (invented by Ethereum’s core contributors). It is imperative that they do precisely what the parties want them to do. The code behaves in predefined ways and doesn’t have the linguistic nuances of human languages. These codes are stored, verified, and executed on a blockchain.

- Transaction—As the transaction happens, a copy of the transaction is distributed to all the participants, say A, B and C, who validate the transaction in real time.

- Execution—Here A, B, and C are a network of computers executing the actions by verifying them. The actions here could be anything related to sending notice, registering a plot, releasing funds, buying non-fungible tokens (NFTs), etc. This network of parties updates the blockchain after this transaction gets completed, which means that the transaction cannot be reversed or changed.

Parties to the contract can add their own terms and satisfy their conditions before the transaction gets actioned. The parties must agree at the “if/when…then…” stage and explore all the possible exceptions and define a framework for resolving disputes. All this information is written on the blocks of a blockchain making the process fool-proof and secure.

Then this smart contract can be programmed by a developer—although increasingly, organizations that use blockchain for business provide templates, web interfaces, and other online tools to simplify structuring smart contracts.

What Are Benefits of Smart Contracts?

The benefits to smart contracts include the following:

- No interference—Unlike traditional contracts, no intermediary, no broker, no third party, not even a lawyer, is required for smart contracts to be created or enforced

- Self-executing—Due to its automated nature, smart contracts have the potential to solve problems by themselves

- Trust—Because of their decentralized nature, smart contracts have the tendency to facilitate trust. For example, in an international transaction between A and B, wherein A is in London and B is in Bengaluru, such contracts would be easier to use due to their automated and digital nature and encrypted records of transaction.

- Speed, efficiency, and accuracy—As the contract is executed, immediately after the transaction is done, there is no paperwork to process and it is done within minutes, providing a quick solution to manually filling in the documents in a traditional contract

- Transparency—As these contracts are coded, and cannot be altered, it creates transparency among the transacting parties

- Security—Due to the decentralized chain of transaction in the blockchain, wherein the records are encrypted, it is very hard to hack the contracts or personal information in the contract. A restrictive access is given to the parties only.

- Savings—Unlike traditional contracts, smart contracts remove the need for intermediaries to handle transactions and, by extension, their associated time delays, and fees

What Is the Future for Smart Contracts in India?

According to the Global Opportunity Analysis and Industry Forecast, 2021-2026, the market size for smart contracts was 106.7 million in 2019 and is estimated to reach 345.4 million by 2026.

Besides contract enforcement, technology can revolutionize the way contracts are performed. It is thus becoming more important for the Indian government to act and frame the statutory guidelines for the use of blockchain technology and smart contracts.

Once appropriate regulation is in place, technology solutions and innovation can develop to provide highly functional and cost-effective outcomes and/or offer maximum utility—all while being secure and trustworthy and without contracting parties having to worry about legal liabilities.

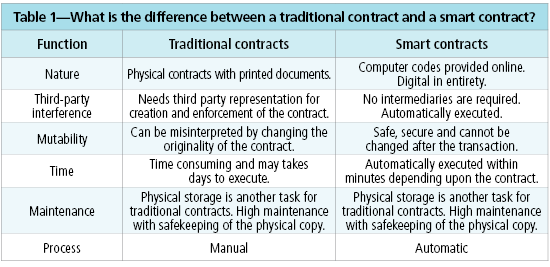

For now, regulators and bureaucratic bodies within the Indian government have made some initial efforts to understand and enable the design and application of new technologies. Some of these are reflected in Table 2.