India, officially the Republic of India, is the seventh largest country in the world with the second highest population of 1.2 billion people, trailing only China. The country, with its 28 states and eight union territories, boasts a rich culture and history dating back more than 5,000 years. It celebrates diversity in several aspects, including a terrain featuring the mighty Himalayan peaks in the north to the coastline of the Indian Ocean in the south—and from the Thar Desert in the west to Mawsynram in the east, which enjoys the highest rainfall in the world.

India, officially the Republic of India, is the seventh largest country in the world with the second highest population of 1.2 billion people, trailing only China. The country, with its 28 states and eight union territories, boasts a rich culture and history dating back more than 5,000 years. It celebrates diversity in several aspects, including a terrain featuring the mighty Himalayan peaks in the north to the coastline of the Indian Ocean in the south—and from the Thar Desert in the west to Mawsynram in the east, which enjoys the highest rainfall in the world.

Indian culture is the heritage of social norms, ethical values, traditional customs, belief systems, political systems, artifacts, and technologies that originated in, or are associated with, the ethno-linguistically diverse Indian subcontinent. The term also applies to countries and cultures whose histories are strongly connected to India by immigration, colonization, or influence. India's languages, religions, dance, music, architecture, food, and customs differ by region.

Employment Contracts

Employment contracts should be written, but this is not the legal requirement. A written contract should include all the terms of the employment, such as salary, annual leave, work hours, and workplace location as well as the conditions for termination, notice period, probation period, dispute resolutions, and any overtime. The contract must be signed by both the employer and the employee, and the contract generally is unlimited.

Probation periods generally differ based on the employee’s role and seniority, generally being between three and six months. The notice period is 15 days during probation and 30 days after that.

Employees can terminate their employment in writing by providing 30 days' notice and employment can be terminated if both parties agree.

Employers can terminate an employee for misconduct, being medically unfit, incompetent, and without cause if there is two months of notice or salary in lieu.

When dismissing an employee for cause, the employer must have an enquiry before the dismissal.

Employees with five years of service receive compensation if they are terminated. They receive 15 days of pay for each year of service, or seven days if they work in a seasonal profession.

Termination

The termination process is standard, with notice periods required unless an employer can provide sufficient cause for dismissal without notice due to misconduct, disobedience, lack of skill, neglect of duties, or absence without permission. The notice period required is at least 30 days.

Severance Pay

Severance pay depends on several factors, including the terms of the employment contract, the position and role of the employee, and the reason for termination.

Business and Employment Visas

There are two main types of visas: a business visa (visits to India of up to six months to conduct business for a non-Indian company) and an employment visa. Visa applications must be made in the applicant’s country of residence.

An employment visa is required for foreigners going to India for employment. The maximum length for this type of visa is five years; however, if the employment contract is longer than five years, then an extension is needed before the end of the visa. This visa also offers the possibility to live and work in India on a more permanent basis.

The estimated timeline for the employment visa process is as follows:

- Step 1: Employment visa application is one week, with an estimated time from start of two weeks

- Step 2: Entry to India is one day, with an estimated time from start of three weeks

- Step 3: Foreigners Regional Registration Office (FRRO) registration is one week, with an estimated time from start of one month

Minimum Wage

The national minimum wage is fixed by the respective state governments. It uses a complex method of setting minimum wages that defines thousands of different jobs for unskilled workers and over 400 categories of employment, with a minimum daily wage for each type of job.

Wages, Bonuses, Other Remuneration

Employers are required to pay their employees’ wages directly in cash or by electronic transfer to the employee’s bank account. Under the 2019 Code on Wages, wages are defined as all remuneration, including salary, allowances, or other value paid for work done.

The following are not wages:

- Bonuses that are not remuneration under the employment contract

- Housing, utilities such as electricity and water, or medical service allowances

- The employer’s contributions to any pension or provident fund

- Payments in connection with travel or other employment-related expenses

- Overtime allowances

- Commissions

- Awards or settlement payments

- Termination gratuities or retirement benefits

Employers in India are required to pay wages on a fixed schedule. Pay periods cannot extend beyond one month. Monthly wages are required to be paid before the end of the seventh day after the last day of the pay period. The deadline is less for shorter pay periods.

Bonuses are mandatory in India. Employers that have 20 or more employees must pay every employee who has worked at least 30 days a year and whose monthly wages do not exceed a ceiling set by the government of India an annual minimum bonus of 8.33% of the wages earned by the employee during the year, or INR 100, whichever is higher.

Employers also may pay bonuses for productivity out of profits. Such discretionary bonuses are usually stated in the employment contract. Discretionary bonuses may not exceed 20% of the wages earned by the employee in the accounting year.

Payroll Cycle

The payroll cycle is generally monthly, with wages paid on or after the 28th of each month.

The 13th salary is usually mandatory, paid as a percentage of the annual salary and within eight months of the end of the financial year.

Working Hours

The standard workweek is 48 hours, nine hours per day.

All work in excess of the standard 48 hours a week is to be paid as overtime and is regulated by employment contracts, generally calculated at 200% of the regular pay rate.

Retirement Age

Retirement age in India is 60 years old. Early retirement is possible at age 50 with at least 10 years of contributions. Pension payments are reduced by 4% for each year the pension is claimed early. An employee can withdraw their EPF account entirely when the employee retires or is unemployed for more than two months.

Public Holidays

Holidays in India vary by state, local cultures, or festivals. In India, there are 25 officially observed public holidays (see Table 1). The government also introduces other public holidays which vary every year.

Annual Leave

Employees receive one day of paid leave for every month of service, and this can be carried over up to a limit of 30 days. If the employment contract expires before a worker can take annual leave, compensation for leave is made in proportion to the number of months and number of hours worked in a week.

Paid Time Off

The regulations regarding paid leave are set in the employment contract as a minimum of 15 days of paid holiday a year (following completion of 240 days of employment). However, it is common practice for additional leave days to be included in the contract, together with rules on how many days can be carried over to the following year.

All paid time off requests must be applied for at least 15 days prior to the start of the leave and approved by the employer, works committee, and the manager to ensure continuity of work.

Sick Days

Employees who have been continuously employed for at least three months are entitled to 15 days of paid sick leave per year and must provide a medical certificate within 48 hours of the first day of sickness. The sick pay is calculated at 70% of the regular daily salary rate.

.

Maternity, Paternity, Other Leave

Eligible expectant mothers are entitled to 100% of their regular salary rate for 26 weeks for their first two children, decreasing to 12 weeks for any subsequent children. To be eligible, the employee must have been employed for at least 80 days of the preceding 12 months before the expected due date.

While government employees are entitled to 15 days of paternity leave, there are no statutory paternity leave laws for the private sector.

Each state generally sets other leave entitlements and policies.

Healthcare

India has a mix of public and private insurance, and some candidates request an allowance for supplementary medical coverage.

Those working in a factory or businesses with more than 10 employees qualify for the government’s Employees’ State Insurance (ESI) program. This covers medical expenses for those earning up to 21,000 ($276.46 USD) rupees a month or if they have a work-related illness.

The ESI provides medical care to employees and their families and provides cash benefits during sickness and maternity leave.

It also provides monthly payments for work-related disabilities or a death that occurs at a factory with 10 or more employees (this is under the Employee Compensation Act). The employee receives 70% of their basic wage for 91 days and is independent of sick leave. If an employee dies at work, the employer must pay compensation of 80,000 rupees or half the monthly wage multiplied by their age, whichever is greater. For a permanent disability, the compensation is 60% of the monthly wage multiplied by the age or 90,000 rupees, whichever is greater.

Social Security, Payroll Taxes

India’s social security programs cover pensions, disability, maternity benefits, and health insurance. There is no government fund for unemployment, but employers with 10 or more employees must pay their employees with at least five years of service a gratuity at the end of employment. The severance gratuity is equal to 15 days’ wages for each year of the employee’s service.

The Employees’ Provident Fund Organization (EPFO), under the Ministry of Labor and Employment, provides pension benefits to workers and their families who have made contributions. Employers with 20 or more employees are required to contribute to the Employees’ Provident Fund (EPF). Employers with fewer than 20 employees may choose to contribute to the EPF for their employees.

The EPFO manages three programs:

- EPF—A superannuation fund which holds an account for each employee covered by the program

- Employees’ Pension Scheme (EPS)—Pensions and social insurance

- Employees’ Deposit Linked Insurance (EDLI)—Life insurance

Employer Contribution Rates

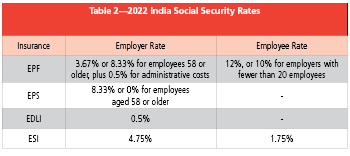

Employers pay the rates for their employees’ social security. Employers pay 17.75% and employees pay 13.75% for social security, as detailed in Table 2.

Employers pay the rates for their employees’ social security. Employers pay 17.75% and employees pay 13.75% for social security, as detailed in Table 2.

Thus, employers pay 17.75% of salary for social security of employees under age 58 or 14.08% for employees aged 58 or older and employees pay 13.75% or 11.75% for their social security, depending on whether their organization has 20 or more employees.

Employees may, but are not required to, make additional contributions to their EPF account.

The employer is required to deposit both the employer’s and the employee’s EPF contributions to the EPFO electronically by the 15th day of the month for the prior month. The EPFO allocates EPF contributions to each employee’s account.

The employer pays ESI contributions via the Employees’ State Insurance Corporation website using the e-challan system. There are two contribution periods per year:

- 1 April 1 through 30 September

- 1 October through 31 March

Payments are due by the 15th of the month following the end of the contribution period, that is, on 15 October and 15 April each year.

Minimum, Maximum Contribution Bases

The salary ceiling for EPF contributions is Indian rupees (INR) 15,000 per month ($196.64 USD). This wage ceiling is set by law and has been in place since 2014. The salary ceiling does not apply to international workers. The salary ceiling for EDLI also is INR 15,000 per month.

Employees earning less than INR 137 per day do not contribute to ESI, but employers pay ESI on all an employee’s wages. The salary ceiling for ESI contributions is INR 21,000 per month ($275.29 USD).

Employees earning less than INR 176 per day do not contribute to EDLI. The salary ceiling for EDLI contributions is INR 15,000 per month.

Income Taxes

Employers in India are required to withhold employees’ income taxes from their wages. Employers complete Tax Deducted at Source (TDS) returns quarterly. Because the financial year in India runs from 1 April to 31 March each year, the financial quarters are as follows:

- April through June

- July through September

- October through December

- January through March

TDS returns for each quarter are due by the 7th day of the following month for the prior quarter, except for the fourth quarter, when the due date is 30 April.