Tax and immigration authorities’ increased focus on the growing mobile workforce is prompting companies to move short-term business travel (STBT) compliance and risk to the forefront. Companies need to determine the best practice for managing their business travelers. This is by no means a small- scale project. Analysis includes the type of travel, business being conducted, workdays, and the immigration and tax laws of each of the countries. Perhaps the greatest challenge for most companies is to determine the best mechanism for identifying a trip has occurred.

Tax and immigration authorities’ increased focus on the growing mobile workforce is prompting companies to move short-term business travel (STBT) compliance and risk to the forefront. Companies need to determine the best practice for managing their business travelers. This is by no means a small- scale project. Analysis includes the type of travel, business being conducted, workdays, and the immigration and tax laws of each of the countries. Perhaps the greatest challenge for most companies is to determine the best mechanism for identifying a trip has occurred.

Short-term business travel has an impact not only on payroll but upon corporate travel, global mobility/immigration, and corporate tax. Forming business partnerships and identifying solutions and tools that will benefit all areas will be valuable to the success of managing compliance and risk.

Define and Establish Partnerships

Establishing business partnerships is the first step in managing business travel. Identify partners who have a stake in the company’s compliance with tax and immigration rules in this area and are close to the process.

If you have a travel expense agency that sets up your employee travel, you may want to consult with the group that handles this vendor relationship. In most organizations, corporate travel manages this. It can request any enhancements to the reporting received from these vendors if needed and explain how to use the reports.

Global mobility/immigration are key groups with whom you would want to establish a relationship. In some organizations, these may be separate groups in which case you would connect with all applicable stakeholders. These individuals are usually the first contact with the team members who are traveling. They can provide insight into type of business travel (frequent traveler, on assignment, occasional trip) as well as details on the visa (if applicable) obtained by the traveler.

Corporate tax is often faced with audits from tax authorities on travelers and their in-country presence. Audits are increasing around permanent establishment (PE) in host jurisdictions due to the need for countries to collect revenue to fund fiscal deficits. There can also be value-added-tax exposure. The knowledge corporate tax has of the risks is beneficial to the development of a strategy to ensure the company’s compliance with tax and immigration authorities.

Once you establish the partnerships, set up forums to discuss the risks and work together to design a strategy to manage business travel risk and compliance.

Identifying, Managing Risks

Identifying, Managing Risks

The risks associated with short-term business travelers are growing, and more tax and immigration authorities are taking action. Risks exist in all areas of business. It is important to understand the risks and identify the separate significance.

As noted in Figure 1, companies risk penalties and fines or even prosecution for their failure to report income and taxes to the host countries and to meet immigration requirements. China, Singapore, and India have created information-sharing links between immigration and tax authorities.

India has introduced recent legislation to require all nonresident companies to disclose foreign nationals (including STBT) working in India, and in Singapore employers are required to file paperwork for STBTs exceeding 60 days within a year within two months of departure. Her Majesty’s Revenue and Customs (HMRC), U.K.’s tax authority, and Canada also have been more focused on business travelers. In the 2015-16 tax year, the U.K. added a simplified arrangement to be filed for travel between non-DTA countries (countries without a double treaty taxation agreement with the U.K.) and the U.K.; and Canada passed a provision of relief from payroll withholding obligations for qualifying business travelers.

Permanent establishment is also a key concern when entities are not set up in the countries in which the employee is conducting business. This creates an exposure for the company to costs incurred by the employees as well as indirect taxes including goods and services tax, value-added tax, sales and use tax, and custom duties.

The business partner forum/stakeholders should evaluate the risks and design a compliance checklist as a basis for determining a roadmap for managing the business traveler population. In addition, it is beneficial to consult with subject matter experts in tax, employment, and immigration both internally and externally.

The business partner forum/stakeholders should evaluate the risks and design a compliance checklist as a basis for determining a roadmap for managing the business traveler population. In addition, it is beneficial to consult with subject matter experts in tax, employment, and immigration both internally and externally.

The components needed to evaluate the risks will include determining a source for the data and obtaining the travel volume, frequency, destinations, regulatory guidance on nonresident taxation and double taxation treaty agreements, and totalization agreements (social security). Once it has compiled these, the company can evaluate the compliance and risk exposure and design a strategic plan/business case that includes new business travel policies.

The development of pre-travel checklists also can be beneficial in evaluating the risk. This can be done through a questionnaire employees complete prior to travel. It addresses the number of days, destination, type of business activities, etc., or creates an approval process for trips that include this information. This allows you to evaluate high-risk countries prior to travel and allows immigration to look at any potential visa issues.

Managing the Data

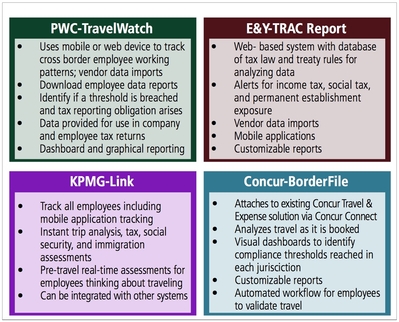

You have formed the partnerships and determined the risks, but now you face the greatest challenge: how to identify the travelers and track the trips. A variety of vendors offer travel management tools and mobile applications. A few of the offered applications are represented in Figure 2, but you shouldalso consult current vendors working with your organization as well as your internal technology team for options.

Analyze all options to determine cost/benefit and select the tool that best fits your business’ needs. It is important to understand what tools can offer. Do you want automated tracking that pulls from existing travel records? In other words, are you looking for a tool that links with a current travel and/or expense system, or one that requires the employees to input data into a web or mobile application?

Request a demo of the products and check for integration with existing tools and devices to help in the decision-making process.

Defining the Strategy

Defining the Strategy

You have set up business partnerships, identified the risks, and determined a tool for tracking and reporting. Now it is time to determine a strategy and set policies. Key elements in the strategy should include collaboration with global mobility on length of stay for the travelers, developing policies, and determining the road map for implementation.

Typically, a business trip can be up to six months, but depending on the type of work performed and visa requirements, it may be considered a short-term assignment. Understand the nature of the trip and be mindful of triggers for taxable presence. In most countries, any stay over 183 days will trigger tax residency. However, countries that do not have double taxation treaties may trigger a tax presence within 90 days or less, or even within a day. Some countries use a cumulative stay formula to calculate the days. This means you must be aware of frequent travelers.

With this in mind, establish a reporting workflow with global mobility to provide you notification of employees sent for six months or less to evaluate for potential business travel reporting. Corporate tax should provide a list of locations in which your company has established permanent establishment so that you can evaluate if the employee is traveling to a country that has risk exposure.

As global business travel is complex, many companies take the approach of a rolling implementation. Potential phases might include identifying countries with the highest risk of compliance exposure and making them a priority and then rolling out down the line or implementing based on global regions. The method should be based on the scale of your organization, employee population, and any trends you see in business travel.

One final note on strategy, and an important element to remember, is communication. As you develop policies and start tracking and reporting, you need to communicate with employees by announcing new policies in alert notifications and/or through the HR representatives who have direct contact.

One final note on strategy, and an important element to remember, is communication. As you develop policies and start tracking and reporting, you need to communicate with employees by announcing new policies in alert notifications and/or through the HR representatives who have direct contact.

Path Forward

Global mobility will continue to be an issue as the trend toward mobile workforces grows and tax authorities and immigration work together to identify potential noncompliance.

There is no immediate solution, but through coordination with business partners and establishing a workflow and process, you can take steps toward managing the process. It may take time to build out a defined global strategy, but each step you move forward and every phase that rolls out brings you closer to global compliance.