Editor’s note: Part I of this article in the August/September issue of Global Payroll explored worker welfare in Brazil, the formal work relationship regulated by labor code compared with the informal work relationship not regulated by labor code, and provided an overview of Brazilian labor law, payroll, and social security.

The fact that Brazil has one of the oldest and most protectionist labor laws in the world poses some challenges to workers’ welfare. In 1988, Brazil adopted a new Constitution, which revised labor regulations that had been in place since the 1940s. The revised regulations aimed at improving employees’ welfare and offering them more protection and better working conditions.

Let’s explore Brazil’s eSocial platform, present global payroll highlights for companies operating in Brazil, and provide an overview of the complex Brazilian payroll, labor, and accessory obligation scenario.

Social Digital Tax Bookkeeping—eSocial

Digital Tax Bookkeeping (SPED) is a government project that intends to gather in a digital environment all the information regarding federal taxes, company accounting, labor relations, and social security information. The eSocial platform is, therefore, one of the SPEDs currently under implementation. It refers to all labor, social security, and tax issues relating to labor relationships, as detailed in Part I of this article. It also has the purpose to unify all accessory obligations that are related to the payroll procedures mentioned before. The expected date for eSocial (as of the release of this article) is January 2018 for companies with gross revenue of BRL 78 million or higher.

Digital Tax Bookkeeping (SPED) is a government project that intends to gather in a digital environment all the information regarding federal taxes, company accounting, labor relations, and social security information. The eSocial platform is, therefore, one of the SPEDs currently under implementation. It refers to all labor, social security, and tax issues relating to labor relationships, as detailed in Part I of this article. It also has the purpose to unify all accessory obligations that are related to the payroll procedures mentioned before. The expected date for eSocial (as of the release of this article) is January 2018 for companies with gross revenue of BRL 78 million or higher.

It is important to mention that eSocial is a project intended to comply with the requirements of Brazil’s Internal Revenue Service (RFB), the Ministry of Labor and Employment (MTE), the National Social Security Institute (INSS), the Federal Savings and Loan Bank (CEF), the Board of Trustees of the Unemployment Compensation Fund (FGTS), as well as with the Labor Court, particularly regarding the module on labor claims. This means that, with the implementation of eSocial, all Brazilian labor and social security authorities will have access to the same data and will be able to crosscheck information from across these different sources, resulting in the possibility of assessments when companies fail to comply with Brazilian law.

Together with the eSocial program, the Government will release another system that complements eSocial in certain ways, known as EFDreinf. This other pillar of SPED was originally born together with eSocial, but during its journey was pulled out to become a separate program. EFDreinf was created to gather all the information regarding withholding taxes and social contribution. One of the largest parts of the EFDreinf comprises information regarding contractors that render services to companies. Those contractors supply manpower to the companies; as a consequence, those who hire their services must withhold 11% (as a general rule) of each invoice. This is very common in security and cleaning services.

Nowadays, the government has limited access to the information that surrounds those contracts between the third-party contractor and the company. With the EFDreinf program, the government will have online access to the precise information regarding all the details of this relationship, which facilitates crosschecking and audit procedures.

Global Payroll Highlights for Companies Operating in Brazil

Many global companies have their payroll procedures centralized in their headquarters or regionally, depending on their strategy. This is a practice that aims to better control payroll costs and quickly manage their workforces.

However, there are some challenges we want to highlight. According to an EY study called Managing Global Compensation (2014), the main challenges of managing a global payroll are:

- Ensuring compliance with country payroll reporting and withholding obligations

- Establishing effective global processes and controls

- Accessing total program cost management information

- Reducing or eliminating unnecessary costs

- Improving assignee satisfaction through accurate and clear global statements

- Determining taxability or calculating local gross-up

The first challenge reported in the EY study (ensuring compliance with country payroll reporting and withholding obligations) fits perfectly into Brazilian payroll procedures.

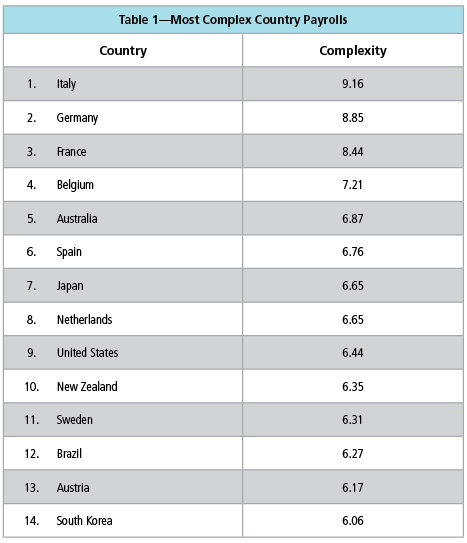

Brazil has one of the most complex payroll procedures among the developing countries. It is also considered the most complex in South America, according to the Payroll Complexity Guide of NGA Human Resources, 2014 (see Table 1).

According to the NGA research, two criteria were used to rank these nations: government reporting/returns, and management of payroll data. These criteria are, in turn, subdivided into the following key findings: payroll number of parameters, number of benefits, number of data items, reporting frequency, reporting complexity, and government instances.

Findings indicate that the NGA research reflects the Brazilian scenario before the eSocial project. We believe that in a short-term perspective, the implementation of eSocial will increase the level of difficulty of payroll procedures as well as the possibility of assessments. We believe this is the case due to the following: Today, companies have to send (on a monthly basis), through GFIP, information on approximately eight pieces of data per worker, including employees’ and independent contractors’ compensation, INSS (Instituto Nacional do Seguro Social or National Institute for Social Security) and FGTS (Fundo de Garantia do Tempo e Servico, or Severance Indemnity Fund) calculation basis, withholding INSS on payroll, among other significant data on FGTS and INSS. Just to illustrate the complexity of eSocial, companies will have to send more than 200 pieces of data on a monthly basis to comply with the new federal tax obligation.

Furthermore, because the eSocial project is still not in place, it is possible that for a brief period of time, companies will be required to deliver monthly both eSocial and the accessory obligations previously mentioned, which will further complicate the whole process. This will dramatically change the Brazilian payroll situation and eventually increase the need for local support on Brazilian payroll procedures.

Overview of Brazilian Complex Payroll, Labor, and Accessory Obligation Scenario

The Brazilian labor law and social security reality can place an overwhelming burden on companies, with the filing of numerous accessory obligations, the high complexity of taxes, the calculation of rates, and the existence of protectionist labor legislation.

As an outcome of the eSocial project, the accessory obligation scenario will be significantly more challenging. It will certainly demand paying special attention to Brazilian labor and social security compliance. The difficulties in managing payroll that companies in Brazil already had will be greatly increased by eSocial, which will, in turn, make it easier for Brazilian labor and social security authorities to conduct focused assessments regarding labor and social security law compliance.

It is important to note that the eSocial project was also designed based on the premise that it would not change any labor or social security laws or rules. According to Roberto Dias Duarte, quoting the president of The National Association of Federal Tax Auditors of Brazil, in his book, Big Brother Tax, eSocial was created to “contribute to the financial health of the social security system, besides benefiting workers in other respects.” According to Duarte, “‘Fragile’ professionals, from a social security standpoint, will be greatly advantaged.”

Based on this statement, and recalling the initial discussion of this article, eSocial also has no intention to harm workers—on the contrary, it’s designed to benefit them. But what if eSocial, empirically speaking, can really harm workers?

The analysis of the research conducted by the National Confederation of Industries (CNI) in 2016 exemplifies key concerns for Brazilian workers. The results are:

- 71% of Brazilian workers want more flexible rules for working time

- 73% want to work from home

- 53% would like to split vacation days

- 58% would like to reduce their lunch breaks in order to leave work sooner

- 63% would like to work more hours during the week to take different days off

The results express desires of workers, all of which are currently forbidden according to Brazilian labor legislation. For example, according to labor regulations, split vacation can only be taken in exceptional conditions (conditions which are not specified by the law). However, this practice is widely used and accepted by most companies in Brazil. Now, after the implementation of eSocial, all companies will be required to send this type of information to the authorities, which could cause audit assessments and fines regarding this matter. So, in companies that do not wish to operate with a high compliance risk, split vacation prohibition will probably be effectively enforced, adversely affecting workers.

If it is true that eSocial intends to benefit workers, would it not be better to make a massive reform in labor legislation before the project implementation? We believe so, but it is not that simple to make a labor change in Brazil, because of one fundamental principle embedded in Brazilian legislation culture: all workers are considered to be in a disadvantaged situation, compared to the employer — a concept called the “hipossuficiência” (“hyposufficiency”) principle in Portuguese.

According to José Pastore in his article published in 2013: “The concept of ‘hipossuficiência’ is similar to the legal concept of interdiction. We interdict a person when his or her ability to reason stops. Brazilian workers—all of them—are treated the same way by the Labor Code (CLT). Even when they are represented by their union, workers do not have the right to make choices.”

Furthermore, the Brazilian labor code also intends to guarantee all rights to workers, which inhibits the private negotiation between employer and employee. Besides salary and annual bonus, all other rights are established under the labor legislation. They are neither negotiable nor flexible and do not reflect the current scenario of 2017. (Maybe in 1943, when the CLT was created, this kind of non-flexible legislation would be sufficient to fulfill the needs of labor relationships).

Definitely and unfortunately, Leandro Narloch’s comparison of stricter and more flexible labor legislations across developed and developing countries does make sense for all that surrounds this complex scenario of labor law and payroll procedures. This is even more accurate now, as Brazilian authorities are again reinforcing the “cigarette tax raise” phenomenon by creating a strict digital scenario for accessory obligations and payroll reporting, without changing the legislation to really benefit all workers.

In summary, while Brazil is not willing to confront the several necessary changes in its labor and payroll legislation, workers will have to live with this complex and bureaucratic scenario and only hope for a realistic future that will be able to encourage flexibility and that will also be concerned with their productivity level. Until then, one can only hope that the Brazilian economic scenario will not succumb due to low levels of CLT workers’ employment relationship. It is our sincere wish that Brazil finds a cure for the “labor and payroll disease,” doing the exact opposite of the anti-smoking campaigns: fostering CLT work relationship by simplifying accessory obligations, thus creating more flexible rules for employers and employees in order to increase, as a natural consequence, the levels of productivity.

The views reflected in this article are the views of the authors and do not necessarily reflect the views of the global EY organization or its member firms.

Ricardo Winter is a manager of EY’s People Advisory Services in Brazil with nine years of work experience in labor law and social security areas. He has experience in a wide range of HR and payroll projects in different industries where his focus is on reviewing processes, gap analysis, internal controls, business compliance, risk assessment, corporate policies, and procedures regarding compliance with labor and social security legislation. He also has international experience in several global employment tax projects in EY Chile.

Ricardo Winter is a manager of EY’s People Advisory Services in Brazil with nine years of work experience in labor law and social security areas. He has experience in a wide range of HR and payroll projects in different industries where his focus is on reviewing processes, gap analysis, internal controls, business compliance, risk assessment, corporate policies, and procedures regarding compliance with labor and social security legislation. He also has international experience in several global employment tax projects in EY Chile.

Paula Abreu works in Labor and Social Security Law at EY’s Rio de Janeiro office. She has been working with labor and social security projects and analysis for more than six years and has experience in audit and consulting for companies from different industries. Abreu works with labor and social security procedures for the purposes of compliance, advisory, and mergers and acquisitions for national and multinational clients. She also participates on projects helping companies adapt to eSocial (new Brazilian ancillary obligation).

Paula Abreu works in Labor and Social Security Law at EY’s Rio de Janeiro office. She has been working with labor and social security projects and analysis for more than six years and has experience in audit and consulting for companies from different industries. Abreu works with labor and social security procedures for the purposes of compliance, advisory, and mergers and acquisitions for national and multinational clients. She also participates on projects helping companies adapt to eSocial (new Brazilian ancillary obligation).