Finding the right global payroll provider can be tremendously ambitious and, at the same time, a laborious task for international business leaders who must carefully weigh the qualities of provider solutions and service levels.

Finding the right global payroll provider can be tremendously ambitious and, at the same time, a laborious task for international business leaders who must carefully weigh the qualities of provider solutions and service levels.

Meanwhile, global service providers must ensure their services appeal to business leaders. So, how do service providers ensure their offerings are compelling and that they can meet the needs of their customer base?

This process is comparable to the classic tango where each entity looks for just the right partner who can perform flawlessly. However, this calls for an analysis from both perspectives to make the right connection.

Global Payroll Provider Strategies

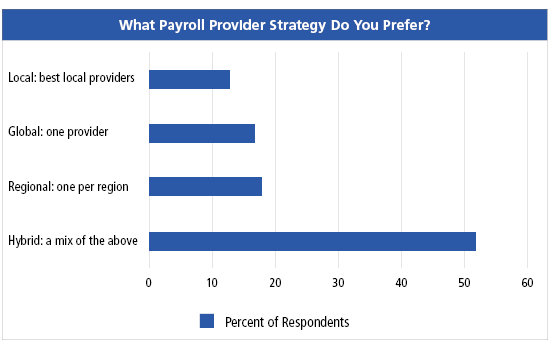

To gain an understanding of global payroll providers’ strategies, I asked whether people preferred a global, regional, local, or hybrid payroll provider strategy. More than half of respondents said they used a hybrid one (see the Chart):

- 17% global (one provider)

- 18% regional (one per region)

- 13% local (best local providers)

- 52% hybrid (a mix of the above)

Payroll Provider Strategies

When designing your global payroll service delivery model, hybrid is the only one-size-fits-all approach.

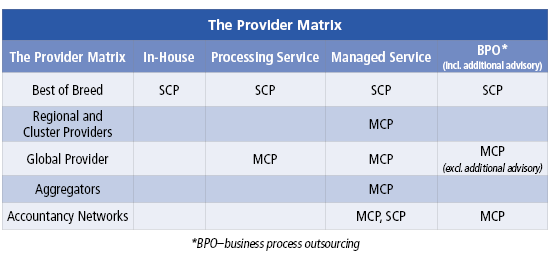

If you operate a hybrid global payroll provider strategy, you will end up with a mix of providers. Those can be divided into two provider profiles: single-country providers (SCP) and multi-country providers (MCP).

From those providers, you then have different provider profiles and service levels (see the Table).

The Provider Matrix

*BPO=business process outsourcing

Let’s look at each of those service levels.

Single-Country Payroll Providers

An SCP offers their services for a specific country, often characterized as a best of breed option. They are specialized in all payroll and employment tax-related matters in that country. These SCPs could be technology-only providers that develop and maintain a locally compliant payroll engine (e.g., Nmbrs in the Netherlands, Sage Payroll in the U.K., greytHR in India, and DATEV in Germany). Often, they do not provide any payroll processing services and are restricted to technical support.

On the other hand, there are full-service providers that license a local payroll engine to deliver their services with a team of specialized and certified payroll professionals. Coincidentally, these service providers are often subcontractors of MCPs.

To understand what businesses prioritize as the most important criteria when they select an SCP, I asked 200 global payroll managers, regional payroll managers, and specialists, and had the following results:

- 42% service levels

- 45% technology platform

- 10% cost

- 3% contact person

Customers looking for an SCP prioritize the best combination of service levels and a technology platform to deliver those services and interact with them. Let’s explore what that means for a service provider and a customer.

The services the SCP delivers should meet the highest standards, which customers can recall with a simple acronym: ACT (accurate, compliant, and timely). This is often underpinned by service level agreements (SLAs) that need to agree on the following key items:

- Uptime of the technology used to deliver the service

- Processing times from submission to approval

- First-time right percentages (i.e., when a trial run is approved)

- Timeliness of delivering results and outputs (i.e., filings, bank files)

- Response time when the customer has service requests

- Change request procedures

Think about this from the perspective of the SCP that will likely operate a range of SLAs and need to work with a range of technology platforms provided by the MCPs to diligently meet customer demands. SCPs have customers who agree on services directly or indirectly through an MCP that subcontracts the SCP to deliver on their country coverage promise.

The technology platform consists of two main categories linked to different capabilities. These categories include the following:

- Local payroll engine: Licensed to deliver a compliant local payroll. Often, this is not a platform that is meant to be customer-facing (aside from some employee self-service (ESS) and manager self-service (MSS) capabilities).

- Bureau management platform: Licensed to connect the local payroll engine and manage the internal and external workflow, data flows, and processes.

The local payroll engine often lacks the capabilities to manage both internal and external operations. The gap for SCPs sits in the capabilities of the bureau management platform.

When looking at the interoperability of the local payroll engine with all the imposed platforms of the MCPs, there are also gaps. This will generate a one-to-many connection while you would ideally have a one-to-one-to-many (engine to bureau platform to customers/MCP).

Customers searching for services in a particular country look to providers to offer integrations with their human capital management (HCM) systems (e.g., Workday, SAP SuccessFactors, HiBob, BambooHR, etc.), digitized workflows to submit data and interact (no email), and integrations in terms of payroll journals to their finance ERPs (e.g., Workday, SAP, Oracle NetSuite, etc.).

A bureau management platform steps in when these requirements cannot be met by the local payroll engines. Helping providers improve their service offering tech stack makes it easier to win and retain customers by delivering a much better experience.

The cost wasn’t as high a priority for global payroll managers choosing an SCP. The SCP, if contracted directly, offers a great mix of service levels and compelling fees. These fees often include one-time setup, per employee per month (PEPM), and ad-hoc advisory fees.

Although cost might not rank as highly in the poll, it’s always a consideration regarding budget and provider comparison. So, ensure you have efficient operations (i.e., payroll full-time equivalent (FTE) to clients/employees processed ratio) to drive down costs and maintain good margins with competitive fees.

A contact person often makes the difference in being satisfied with a provider. Having a very knowledgeable, responsive, and kind contact person makes for excellent service. When there are issues, you know they will be resolved.

Although this aspect doesn’t make a customer choose a provider, it does make the customer stay; aspire to be that contact person if you work on the provider side.

Multi-Country Payroll Providers

Now, let’s bring in the multi-country scope. First, to understand what customers perceive as the most important criteria when they select an MCP, I ran a follow-up poll with these results:

- 36% service levels

- 36% technology platform

- 20% country coverage

- 8% cost

If we compare this to the SCP, it’s clear that both service levels and a technology platform are most important for customers selecting an MCP. With multiple countries in the mix, I changed the “contact person” option for a “country coverage” option, and 20% voted for country coverage as the most important selection criteria.

As outlined in the table above, there are several different types of MCPs. These MCPs include the following:

- Regional and Cluster Providers: These are providers that connect partners and/or own offices to service a specific cluster of countries or even a whole region. Clear cluster examples are the Nordics (Finland, Denmark, Iceland, Norway, and Sweden) and DACH (Austria, Germany, and Switzerland). Clear regional examples are LATAM (Latin America) and APAC (Asia-Pacific).

- Global Provider: These providers have a diverse, but more rigid, service offering. They have a whole network of best of breed providers (to license payroll engines), local service providers, cluster providers, and their own local service providers (sometimes even a homegrown local payroll engine). While you get one company and logo, the actual service offering is often a mix of the other options listed here.

- Aggregators: These are usually part of a global provider or focus on aggregation and consolidation only. Often, they have a closed platform in which they “connect” their country coverage (through their own services and via partners). The customer interacts through the platform with the subcontractors of their aggregator. They cannot use it for other purposes. Often has restricted services (managed services) with a middle group coordinating it, either allowing direct local contact or not.

- Accountancy Networks: Accountancy networks can function as SCPs and MCPs, depending on the coverage their clients need. Depending on the geographic footprint of the network, they can fit into the local, cluster, or global provider category. They often have very rich service offerings, from managed payroll services to additional advisory services such as HR, legal, employment tax, company secretarial, etc.

Now, let’s see what those selection criteria mean for an MCP, and what a customer would expect the MCP to deliver.

Whereas with an SCP you have access to all the service levels you need, this offering is restricted to one country. The customer, of course, always has the choice to find an SCP for their entire scope. Based on our experience, organizations do this for up to around 20 countries (whether that is their entire scope or a sub-scope) and beyond that, customers usually seek some sort of consolidation. That is where an MCP comes in with their country coverage.

You may ask, “But what about the service levels?”

This is where it becomes very tricky, underpinned by the poll results prioritizing service levels so highly. With the different provider options and inherent multi-country scope, we often see MCPs struggling to offer the best service levels while also fitting them into their overall operational model.

You may also be asking, “How can you cover all the countries while diversifying the service levels across that scope, and coordinate the end-to-end services?”

Here is a summary of our advice to both providers and customers:

- Providers: You can operate a restricted set of service levels (usually managed [payroll] services with some additional scope) and then manage and coordinate that specific scope for the customer. You allow the customer to go through you with change requests or additional services, or directly with your partner (and this can be scary!). Let’s face it: aggregators don’t do well in this dynamic. Accountancy networks and specialized expansion providers are particularly strong here, offering both coordinated payroll services and direct contact with local teams within the network for specific (advisory) services.

- Customers: Perform a detailed discovery of your landscape in scope for a potential MCP down to the actual full services of the local countries. Look beyond the payroll processing, to all the services that payroll, HR, finance, and tax procure from that provider. When reviewing an MCP, take all those services into account and focus on that operationally.

Focus on the strength of your network and expose the weaknesses. You are as strong as your weakest provider, as those (along with a below-par platform) make customers move away. Be flexible and open in choosing your best of breeds and perhaps give options to customers. Difficult to operationalize, but worth it!

With modern global payroll management platforms, customers do not have to choose just an MCP or SCP. You can choose both, and mix-and-match the best service levels while still digitizing, automating, and standardizing your workflows, processes, and data flows. You can have standardization and the flexibility to choose your providers.

This brings us to the technology platform side of the MCP business. If you are an MCP with extensive large country coverage, your own offices and partners will either use a best of breed for the local payroll engine or become one. So, this is where both come together. But with a lot of local payroll engines, you will not truly offer connected, coordinated, and digitized multi-country services.

While many aggregators have their own (or licensed) aggregation platform, many providers still manage the service and data through email, or at best, a file-share type of portal. That’s why using a platform designed for self-service adds the much-needed and customer-demanded open management capability. This enables more efficient operations, lower cost of operations, and higher margins while attracting new, upmarket customers.

According to the poll results, cost itself isn’t the true driver for making a strategic provider decision. Of course, cost always plays a role, just as with SCPs. If you compare a country's PEPM from an SCP and an MCP, the MCP will likely be higher. This is because you also get coordinated services, and sometimes a central platform.

One cost in the MCP space, which is often overlooked, is the cost of making portfolio changes. What if you exit a country and you no longer have service requirements? What if you decrease headcount significantly? There are many possible situations, which is why customers should plan for the worst-case scenarios and allow for flexibility in cost and related contract terms. And providers must find a balance between internal and external push and pull.

If you see a provider starting to serve more than 165 countries, that means they cover roughly 85% of the world, which is very impressive. However, it’s always good to review this down to the local level: local best of breed partners (either subcontractors or own office), the available service levels, actual live customers and their profiles (e.g., industry, employee size), and lastly the contact person profiles and attrition rates. This will paint a more transparent picture of how the actual coverage works. For providers reading this article, be as transparent as possible.

The question remains: Who needs to tango who in global payroll? The answer is elegant and simple in the following:

- The service levels need the technology platform to dance. While service is great and pivotal to the success of any (global) payroll, providers and customers need a platform to manage operations, data, processes, and self-service configuration and reports.

- The technology platform needs the service levels to dance. Of course, having an open global payroll platform is great; you still need local and/or multi-country services to deliver payroll results.

- The provider (SCP and MCP) need the customer to tango. Great to start a business, but you need customers to deliver services to, and those customers need to get the best possible customer service and experience you can offer to outcompete the competition.

- The customers need the providers (SCP and MCP) to dance. When you manage payroll for a business, you will need to find the best set of payroll providers to allow for a hybrid approach. Once you are working with this carefully selected set of partners, you may also need an open platform to manage them all in one central place.

As stated before, international businesses have a challenging task when it comes to identifying the perfect global payroll provider to partner with. It may not be as simple as choosing a dance partner who can dance in step with you, but it certainly brings peace of mind when international business leaders know their global payroll provider can follow their lead.