Brazil is the largest country in South America known for its diverse population, vibrant culture, and significant economic presence. Brazil is characterized by its expansive geography, including the Amazon Rainforest.

With a democratic government, Brazil faces challenges such as economic inequality and environmental concerns. It is a major player in the global economy, particularly in the export of commodities.

Tourists are drawn to Brazil for its natural beauty and iconic festivals like Rio de Janiero Carnival, or Carnival.

Labor Code

Brazil's labor code, known as the Consolidation of Labor Laws (CLT), governs employment relationships and worker rights. Enacted in 1943, it covers various aspects including: employment contracts, working hours, wages, vacation, health and safety, collective bargaining, termination procedures, and worker rights. The code ensures social security provisions and outlines the rights of employees to organize and engage in collective negotiations through labor unions.

Minimum Wage

As of 1 January 2024, Brazil has adjusted the minimum wage, raising it from R$1,320.00 to R$1,412.00 ($268.44 USD to $285.22 USD) per month. It's important to note that the increase in minimum wage may not necessarily account for inflationary trends.

Working Hours, Conditions

The regular workweek for employees in Brazil is 40 hours, with a maximum limit of 44 hours per week.

Overtime Pay

Overtime in Brazil is calculated daily rather than weekly. If an employee works more than 8 hours a day, the additional hours are compensated at a rate of 1.5 times their regular pay.

One unique benefit to Brazilian employees is the 13th month salary. After a full year of work, employees are entitled to an extra full month’s salary. It works much like a mandatory bonus. Employees also receive overtime pay, paid sick leave, and vacation days.

Termination procedures, collective bargaining, health and safety regulations, and social security provisions are all specified. Workers have rights to organize and participate in collective negotiations. Legal protections exist for young workers, and there are efforts to promote diversity and inclusion in the workplace.

Taxes

In Brazil, only the federal government requires taxes. States, cities, and municipalities do not require income taxes from their employees.

Recent legislation (Law 14,754/2023), passed on 12 December 2023, and in effect 1 January 2024, specifically addresses investments held overseas by individuals domiciled in Brazil. These investments include financial assets, controlled companies, trusts, and closed-end funds within Brazil.

The recent tax legislation expands the scope of taxing foreign financial investments, subjecting them to a 15% tax rate when reported in annual income tax returns. Additionally, the law eliminates tax deferrals for controlled entities abroad, requiring annual taxation based on accounting profits, irrespective of distribution.

Trusts are now subject to taxation; with the assets and rights they comprise considered as the settlor's property. Transfers will be categorized as either donations or inheritances.

Finally, the law provides an option to adjust the value of assets and rights held abroad, taxing any appreciation at a rate of 8%, while also discontinuing two significant tax exemptions (a tax exemption on capital gains income earned on the sale of assets and rights acquired during the period of non-tax residence in Brazil and an exemption for tax on the exchange variation computed in the sale of assets originally acquired in foreign currency).

Income Tax

The determination of income source is based on the taxpayer's location, regardless of where the work is performed. The progressive tax rate table for income received abroad ranges from 0% to 27.5%.

According to Brazilian legislation, the following individuals are classified as tax residents:

- Naturalized foreigners

- Foreigners holding a permanent visa or a temporary visa with a local employment contract from their arrival date

- Brazilian residents living abroad for the initial 12 months after departure when no exit process is initiated

- Citizens of Argentina, Paraguay, Uruguay, Bolivia, Chile, Colombia, and Peru claiming temporary residence either on the date the working relationship is established or when permanent residence is attained

- Individuals entering the country under a temporary visa to work as a doctor in the 'Mais Médicos' program on the arrival date

- Naturalized foreigners residing in the country

- Foreigners holding a temporary visa without a local employment contract, but completing 183 days of residence in Brazil within any 12-month period

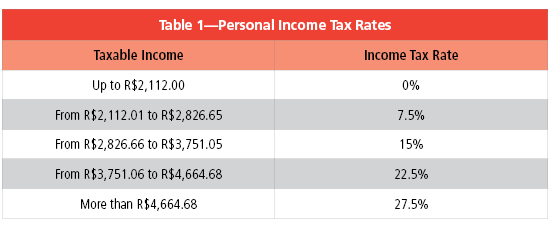

Regarding the individual income tax brackets and rates, Law No. 14,663 converts the brackets and rates established by Provisional Measure No. 1.171 of 30 April 2023 into law as in Table 1.

The brackets and rates are effective from May 2023.

Corporate Tax

The corporate tax rate in Brazil is 34%.

It comprises a 15% basic rate, a 10% surtax on income exceeding R$240,000 annually, and a 9% social contribution on pre-tax profits.

Dividends, Interest Received Abroad

The dividends and interest received abroad are taxed according to the following:

- Taxable income tax event continues to be the moment of effective availability of income

- Tax due must be calculated monthly

- Payment of income tax has a single 15% rate to be made annually with the income tax return

- A new law provides for compensation of losses incurred abroad with the income earned

Capital Gains on Sale of Assets, Rights Abroad

This includes the capital gains on the sale of assets and rights abroad acquired during the period of nontax residence.

For taxable capital gain, the nature of the asset governs which rules apply.

The sale of financial investments abroad originally acquired in national or foreign currency are taxed according to the following:

- Capital gain income, including exchange-rate variation, earned on the sale is subject to a single 15% rate, paid annually through the income tax return

- A new law provides for compensation of losses in relation to the gains obtained

- It is possible to claim income tax paid abroad as a tax credit in Brazil (if in compliance with the legal requirements)

Controlled Entities Offshore

Controlled entities offshore are taxed according to the following:

- End of deferral, with profits and dividends taxed at 15%, whether distributed to individuals residing in Brazil, on 31 December each year

- Legal provision for optional tax treatment of assets and rights held by a controlled entity, as if held directly by the individual

Trust

Assets and rights subject to trust generally considered owned by the settlor and income earned will be taxed at 15% (tax transparency).

Transfer of assets and rights to a beneficiary (change of ownership) are considered a donation if done during the life of the settlor, or an inheritance if the settlor dies.

Sales Tax

The sales tax rate in Brazil is 17%.

Time Off

In Brazil, employees are entitled to various types of leave, including the following:

- Vacation Leave: Employees in Brazil are entitled to paid vacation leave. The standard duration is 30 calendar days, which can be taken all at once or split into two periods.

- Maternity Leave: Pregnant employees are entitled to maternity leave, which lasts for 120 days. During this period, the employer must maintain the employee's salary.

- Paternity Leave: Paternity leave is granted for up to five days for new fathers. During this time, the employer must also maintain the employee's salary.

- Sick Leave: Employees who are unable to work due to illness are entitled to sick leave. The duration and compensation depend on the length of service and the specific circumstances.

- Adoption Leave: Adoptive parents are entitled to leave, like maternity leave, for a period of 120 days. The employer is required to maintain the employee's salary during this time.

- Leave for Marriage: Employees are entitled to paid leave for marriage, typically for up to three days

- Leave for Examinations: Employees are allowed leave to attend professional or academic examinations. The duration of the leave is typically determined by the employer.

- Leave for Jury Duty: Employees called for jury duty are entitled to leave with continued payment of salary

- Leave for Death of Family Member: Employees are entitled to leave in the event of the death of a family member. The duration and compensation depend on the relationship to the deceased.

National Holidays

There are 11 national holidays in Brazil (see Table 2). Many of these holidays are either national or religious observances. Most businesses are closed and provide paid leave to their employees.

Additionally, there may be regional or local holidays. It's advisable to check with official sources for the latest information on holiday schedules.

Foreign Hires

Foreign employees intending to work in Brazil are required to obtain the relevant work visa. For short business trips or brief work visits, a three-month business trip work visa is available. Those in need of a temporary work visa for an extended period can apply for a Visto Temporario V, allowing them to stay with the same employer for two years. An additional renewal is possible, extending the total stay to four years. If a foreign employee who has exhausted the four-year limit and wishes to continue working in Brazil, must apply for a permanent work visa, known as Visto Permanente.

Visas

Brazil offers various working visas for foreign nationals based on different purposes. The Temporary Work Visa is suitable for employed individuals, allowing a stay of up to two years with renewal options. After reaching the maximum duration, individuals may apply for a Permanent Work Visa. Other types include the Investor Visa for significant investments, Technical Assistance Visa for professionals providing training, Intern Visa for students, Artist or Sportsman Visa for performers or athletes, and Specialized Technical Services Visa for professionals offering specialized services.

The profits of entities controlled abroad that: are domiciled in a tax haven/privileged tax regime, or have their own active income lower than 60%, calculated from 1 January 2024, regardless of distribution, will also be subject to a 15% income tax rate.

Alternatively, the individual may choose to declare the assets and rights held by the controlled entity, directly or indirectly, abroad as if they were held directly by the individual, with taxation occurring when income is in fact received.

Taxes

Nonresidents in Brazil are subject to taxation solely on income earned within the country. The applicable flat rate for this income is 25%, with no deductions allowed. Rental income derived from a property located in Brazil is taxed at 15%. However, income received from sources outside Brazil by nonresidents is exempt from taxation.

Culture

Brazilian culture is a vibrant blend of indigenous, African, and European influences. It is characterized by lively music genres like samba and bossa nova, with the annual Carnival being a globally recognized celebration. The unique martial art Capoeira, religious diversity, and festivals like Festas Juninas (June Festival) also contribute to the cultural tapestry.

Brazilian cuisine is diverse, featuring dishes like feijoada and churrasco. The country has a rich literary and artistic tradition, and sports, particularly football, hold a special place in the national identity. The Portuguese language is central to communication, and Brazilians are known for their warm and expressive communication style. Regional variations add complexity to this dynamic and evolving cultural landscape.