China, officially referred to as the People's Republic of China, is situated in East Asia and holds a significant position in global affairs. With borders shared with 14 countries, it boasts diverse geographical features, ranging from mountains and plateaus to plains and coastlines.

China, officially referred to as the People's Republic of China, is situated in East Asia and holds a significant position in global affairs. With borders shared with 14 countries, it boasts diverse geographical features, ranging from mountains and plateaus to plains and coastlines.

As the world's second-largest economy, China possesses a profound cultural heritage spanning millennia. The nation has emerged as a global leader in technology and innovation. Hosting major tech corporations, the government has committed substantial investments to advance areas such as artificial intelligence, 5G technology, and renewable energy.

Labor Code

There are two types of employment contracts In China. These include fixed-term contracts, which have a specified duration and can be renewed with limitations, and open-ended contracts, which have no predetermined expiration date. Additionally, there are project-based contracts for specific tasks or projects, part-time contracts for reduced working hours, and dispatched worker contracts where employees are hired through labor dispatch agencies. All contracts must comply with relevant labor laws, and the terms and conditions should be clearly outlined, covering aspects like wages, working hours, and benefits.

Workers must receive their wages in legal tender, monthly, and in person. Additionally, numerous companies in China have implemented a practice of providing a 13th-month salary payment.

China's labor code encompasses various regulations, including a standard eight-hour workday, minimum wage requirements varying by region, mandatory employment contracts, and provisions for working conditions and leave entitlements. Social insurance contributions are mandatory for employers and employees. The code addresses termination procedures, severance pay, and collective bargaining, with specific regulations for foreign employees. Dispute resolution mechanisms, such as mediation and arbitration, are in place.

Minimum Wage

In China, minimum wage levels are determined at the provincial, autonomous area, and municipal levels. As of 2023, the monthly minimum wage in Shanghai stood at RMB 2,690. Notably, 12 provinces, including Anhui, Beijing, Guangxi, Guizhou, Hebei, Qinghai, Shaanxi, Shandong, Shanghai, Shanxi, Tianjin, and Yunnan, increased their minimum wage standards in the same year.

Working Hours, Conditions

The standard working hours are typically 8 hours per day, 40 hours per week.

Overtime Pay

Overtime work is subject to specific regulations, and employees are entitled to overtime pay. Employers must obtain employee consent for overtime assignments, as there are legal limits on the total number of overtime hours.

Taxes

In China, individuals and businesses follow an annual tax cycle, reporting income and paying various taxes such as individual income tax, corporate income tax, and value-added tax (VAT). Payroll and taxation rules vary for foreign and local employees. Key considerations for foreign companies include individual income tax (IIT), social security costs, payroll tax, sales tax, withholding tax, and business tax. Foreign workers are taxed separately, contribute to social insurance, and have exemptions from certain labor requirements. Multinational employers handling dispatched employee salary through home country payrolls may fall under China's corporate tax laws. Tax records typically need to be maintained for three to five years.

Income Tax

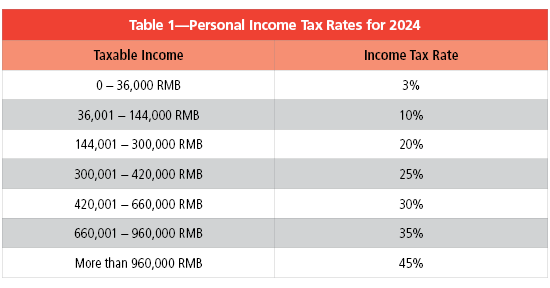

Progressive tax rates apply to comprehensive income for individuals in China, ranging from 3% to 45% (see Table 1).

Tax residency is determined by domicile or residence exceeding 183 days in a calendar year.

Tax residents must declare global income, including wages and other sources, starting from RMB 5,000.

Expatriates can offset taxable income with relevant business expenses.

Foreign employees are considered tax residents after residing in China for 183 days.

A flat rate of 20% is applied on the remaining categories of income, including incidental income, rental income, interest income, dividends, and capital gains, unless specifically reduced by the State Council.

Corporate Tax

The standard tax rate is 25%, but eligible enterprises in government-supported industries may benefit from a reduced rate of 15%.

Withholding Tax

Nonresident individuals and foreign corporations face a 20% national withholding tax on dividends, interest, and royalties.

A 15% rate applies to interest on bank deposits and specific financial instruments.

Sales Tax

The sales tax rate in China is 13%.

Payroll Tax

The payroll tax is paid by employers to provinces and territories and deducted from employees' salaries.

PAYG tax, covering Medicare levies and insurances, is withheld by the Chinese Government.

Social Taxes

Employee Social Security: 10.50% contribution covering pension, health insurance, maternity insurance, work-related injury insurance, and unemployment insurance.

Employer Social Security: 28.52% contribution covering the same insurances, with a limit on employer contributions.

Employers must provide five types of social insurance benefits, and both employers and employees contribute to provincial housing funds.

Time Off

Full-time employees in China are granted five days of paid annual leave per year, and this entitlement increases to 10 days after completing 10 years of service.

Sick pay is determined based on the length of service during a six-month sick leave period:

- Under 2 years of employment: 60% of regular wages

- 2-4 years: 70% of regular wages

- 4-6 years: 80% of regular wages

- 6-8 years: 90% of regular wages

- 8 or more years: 100% of regular wages

National Holidays

China observes several national holidays (see Table 2).

These holidays often involve traditional customs, family gatherings, and time off from work. Regional holidays may also be observed.

Foreign Hires

Foreign residents in China are mandated to register for tax with local authorities. Those working in multiple local tax jurisdictions can either file and pay taxes separately in each jurisdiction or opt for consolidated monthly payments at a single location upon approval from local tax authorities.

Multinational employers may be considered taxable establishments or permanent establishments (PE) in China if they conduct employee performance reviews and assume responsibilities and risks related to the employee's work. Foreign workers seconded to China, paid from their home country, may establish tax under certain conditions, including management or service fees from the Chinese host company exceeding the employee's total wages and expenses.

Visas

Visa categories include F visas for non-commercial purposes, M visas for business, and work visas (Z and R visas) for commercial performances or academic exchanges. Residency visas, including permanent resident visas (D visas), are required for lawful residence exceeding one year.

Taxes

Tax classification is based on residence duration. Residents (183 days or more in China) are subject to Chinese tax on worldwide income. Nonresidents (spend less than 183 days in China) are liable for onshore income tax. The "five-year rule" dictates that those residing for over five years pay taxes on both onshore and offshore income, while those within the first five years only pay tax on onshore and offshore income derived from onshore sources.

Culture

Chinese culture is diverse and deeply rooted in a history spanning thousands of years. Key elements include the use of characters in the Chinese language, traditional philosophies like Confucianism and Daoism, and a rich array of traditional arts such as calligraphy and painting. Chinese cuisine is renowned for its diversity, and tea culture is integral. Festivals, family values, and traditional clothing also play significant roles. China has embraced innovation, particularly in technology, and boasts a thriving modern entertainment industry. Despite embracing modern influences, traditional values persist, making Chinese culture a dynamic blend of ancient traditions and contemporary developments.