Labor Code

Much of the administration of labor-related requirements and benefits is the responsibility of the German Trade Union Federation and collective bargaining agreements.

- Minimum wage

Minimum wage remains unchanged from 2015 at €8.50 per hour. Fifteen trade branches have minimum wages in place that are often higher than the general minimum wage. Exceptions to the minimum wage include employees under 18 years old, interns, and long-term unemployed for the first six months in a new job. Employers that breach the law will pay a fine of €30,000 to €500,000.

- Workweek/Conditions

The workweek is limited by law to 48 hours; however, in most cases it does not exceed 40. Employees must be given at least 11 hours of uninterrupted rest between shifts. If this period is interrupted, it must be granted in full after the interruption. Employees must not work for more than six consecutive hours without a break. If they work from six to nine hours, a 30-minute break (or two 15-minute breaks) must be provided, and if employees work more than nine consecutive hours, a 45-minute break must be provided, but this may be split into periods of at least 15 minutes each.

- Overtime Work and Compensation

Employees can be required to perform overtime work only if there is a provision in the employment agreement or in a collective bargaining agreement. However, such overtime hours may not exceed 12 hours in a workweek. Wages for overtime hours worked are not required or regulated by law. Employers are allowed to include provisions for overtime work in the monthly wage agreement. Overtime must be paid if it occurs regularly and is necessary to fulfill the employee’s work assignment. However, if the overtime work is done for other reasons, the employee may be granted time off in lieu of payment.

- Pay Period

Pay dates depend primarily on employment agreements. If there is no agreement and a payment schedule is not established, wages must be paid upon completion. If the wage is calculated on a time basis (e.g., weekly or monthly), it has to be paid after the expiration of the period. In general, the wage payment interval may not exceed one month.

- Fringe Benefits

While labor law does not require other payments in addition to wages, German employers commonly provide various sorts of bonuses. These include gratuities/gifts, profit-sharing, use of a company car, supplemental pay, commissions, and piecework rates.

- Gratuities

Gratuities are special bonuses paid in addition to regular wages on special occasions (e.g., Christmas, anniversaries, and annual reports). The most common gratuity is the Christmas bonus. While this bonus is at the employer’s discretion, a legal claim can arise if the bonus has been granted at least three times previously.

- Profit-sharing

Employees may receive profit-sharing bonuses. Profit-sharing bonuses are mostly granted at or above executive officer level based on employment contract.

Time Off

The German Federal Leave Act mandates time off, such as vacation. Maternity, parental, and sick leave also are required.

Annual Leave

All employees are entitled to paid leave. The minimum in Germany is 24 working days, in addition to official holidays. Employees must complete six months of work in order to fully qualify.

- Maternity Leave

The Maternity Protection Act ensures that female employees suffer no financial disadvantages as a result of maternity. Employers must give pregnant employees six weeks of leave prior to the birth of her child and eight weeks after the birth of the child. During this period, employees are entitled to full pay from health insurance.

- Parental Leave

Employers are required to give mothers and fathers up to three years of unpaid leave. The first two years have to be taken immediately after the child’s birth, and the third year can be taken at any time up to the child’s eighth birthday. Both parents can claim parental benefits if they are on leave during the first 12 months after the child’s birthday. The benefit is calculated at 65% of the parent’s previous monthly salary.

- Sick Leave

Employers must give employees up to six weeks of sick leave at full remuneration. After six weeks, employees are entitled to receive a sickness allowance paid by their statutory health insurance plan in the amount of 70% of employees’ normal pay. The maximum period for this allowance payment is 78 weeks.

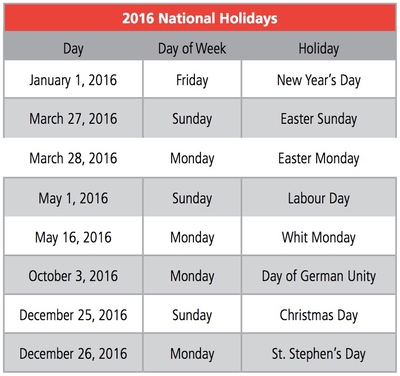

2016 National Holidays

In addition to several legally recognized holidays, Sundays also qualify as holidays in Germany. The official holidays vary by federal state; however, the ones in the table are universally recognized.

Types of Employees

Relations between German employers and employees are extensively regulated under German labor and employment laws. Employees must have written employment contracts that reflect the key aspects of the employment relationship. The contract must reflect the parties to the contract, work to be performed, gross salary and benefits, vacation, starting date of employment, place of performance, and notice periods. Although an employment contract unlimited in time is typical, it is possible to agree on an employment contract with a limited term.

Employers tend to increasingly make use of limited-term contracts, although they are subject to restrictions under labor and employment laws. An employer may always enter into, but not renew, a limited-term employment contract for a period of up to two years without restrictions.

Taxes

German employment tax laws cover federal income, plus an extensive array of social taxes to cover the country’s multifaceted social insurance scheme. Both employers and employees share the social tax responsibility. In addition, employers are obligated to withhold a mandatory “solidarity surcharge” of 5.5% of employee’s tax obligation.

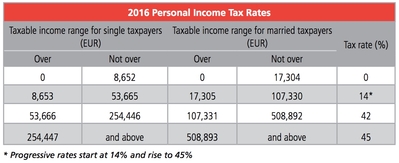

Income Taxes

Pay-as-you-go income taxes are classified as Lohnsteuern and are administered by the Federal Ministry

of Finance and payable to the local state tax office. Employers are responsible for withholding taxes from employees and paying the taxes to the federal government. Employers employing German citizens or residents in Germany are covered under federal tax laws. A resident employer is defined by having a residence, habitual abode, place of management, headquarters, permanent establishment, or permanent representative in Germany. Resident taxpayers—or those with a domicile or habitual abode in Germany—are subject to unlimited tax liability on all worldwide income. Income tax rates range progressively between 14% and 45%, as shown in the table on this page. Incomes lower than €8,652 are exempt from taxation.

Income Tax Registration

Employers are required to register their business with the local tax office, which issues an employer tax identification number. The registration period is generally a calendar month. All employees are issued wage-tax cards that lists exemptions and allowances.

Income Tax Reporting, Remittance

Employers are responsible for withholding employee payroll taxes each month and remitting them to their local tax office. Payment and reporting obligations vary according to the specifications of each employer, including whether they are German or foreign and the residency status of their employees. Monthly wage tax filings are due on the 10th day of the following month. Germany mandates the use of the online financial services tool ElsterOnline to process employee and employer tax filings. Employers are also required to submit their annual income tax forms through ElsterOnline no later than February 28 of the following year. Depending on the amount of wage tax, reports and payments can be made monthly, quarterly, or annually. Generally, most businesses do monthly filings.

Stock Plans

Stock plans offered to employees are taxable upon their exercise. Employers must withhold income tax based on the difference in price between the purchase price and the value of the stocks at exercise. Share plan amounts are subject to the same tax calculations as normal wage payments. The amounts also are subject to social tax withholding. Employers must remit the taxes in the same manner they would remit income tax withheld from employee salaries.

Social Insurance Programs

Germany has an elaborate social security system that ensures its citizens live comfortably even if  they’re sick, disabled, unemployed, or retired. Expatriates can also participate in the system to a large degree. People with jobs must, as a rule, make payments to four parts of the system, for health insurance, long-range nursing care, pensions, and unemployment. These payments usually amount to approximately 40% of gross income. Germany’s multifaceted social insurance system is financed jointly by employer and employee contributions. The employees’ portion, which amounts to approximately 20% of gross wages, is withheld at the source.

they’re sick, disabled, unemployed, or retired. Expatriates can also participate in the system to a large degree. People with jobs must, as a rule, make payments to four parts of the system, for health insurance, long-range nursing care, pensions, and unemployment. These payments usually amount to approximately 40% of gross income. Germany’s multifaceted social insurance system is financed jointly by employer and employee contributions. The employees’ portion, which amounts to approximately 20% of gross wages, is withheld at the source.

The social security system includes pension, health care, unemployment, care in old age, sick pay, maternity, and insolvency. Another pillar of the social security program is workers’ compensation insurance, which is an employer tax.

The maximum income upon which social security or wage taxes can be levied on any given taxpayer varies somewhat among federal states. The Eastern states of the former German Democratic Republic, except Berlin, have a lower maximum taxable amount than their Western counterparts. However, the tax liability as a percentage is uniform throughout the country. Employees and employers are liable for social insurance taxation on all wages earned in Germany, including benefits in kind.

Social Insurance Tax Registration and Reporting

Employers are responsible for registering their employees with the social insurance system. Payment and reporting obligations vary based on residency status. Monthly employment tax filings are due on the 10th day of the following month. Resident employees working for a foreign employer must report their wages to the tax office in their state after the end of the calendar year.

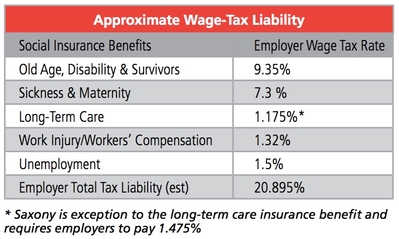

The table on this page indicates the employer's approximate social insurance tax liability.

Unemployment Insurance

Employers withhold 1.5% of employees’ total earnings monthly for unemployment insurance. Taxes are calculated on wages equal to or less than €74,400—or €64,800 for residents of the former East German states, except Berlin. Employers also must contribute 1.5% of total employee wages up to the base maximum.

Health Insurance Systems

Unlike financing for old age, disability, and survivors benefits, employees and employers do not share exactly the same tax burden as a percentage of wages for health insurance. Rates fluctuate based on total earnings. Employees are assessed only on wages totaling less than €50,850 per year, but wages can be voluntarily included. In contrast, employers contribute an average of 7.3% of total employee wages for health insurance, although this percentage is liable to fluctuations based on total income. The maximum annual wage upon which these taxes are calculated is €50,850.

Pension Fund

Beyond the statutory pension scheme required through the social tax system, employers provide company retirement plans to employees on a voluntary basis.

Retirement Pension Insurance

The maximum wage upon which taxes are assessed for social insurance is €74,400, or €64,800 for residents of former East German states, per year. Employers also must pay 9.35% of their total monthly payroll.

Long-Term-Care Benefits

Employees are responsible for paying 1.175% of earnings in most federal states, although employers should check with their local tax office to verify the requirements of the particular state. Employees over age 23 without children pay an extra 0.25% of all earnings. Employees are only mandatorily assessed on wages totaling less than €48,600 per year. Wages in excess of this are only voluntarily assessed.

Employers are responsible for paying 1.175% of wages to fund long-term-care benefits for employees. In Saxony, however, employers pay 1.475%.

Work Injury/Workers’ Compensation

Under this tax, employers contribute an average of 1.32% of all payroll wages, although percentages change corresponding with the assessment of risk, according to the official German Social Accident Insurance website. Workers do not contribute to this fund.

Other Taxes

Germany has other taxes unrelated to social insurance. These taxes are imposed on gross taxable wages for a variety of reasons and are collected by the employer through the ElsterOnline system.

Benefits Taxation

For some services provided to employees (e.g., canteen food, office outings, transportation of employees, accident insurance, and payments to retirement funds), employers have the option to pay income tax on account for employees. The tax is paid at a flat tax rate that varies depending on the service provided from 15% to 25% of the given value. These benefits are not taxable if the amount paid does not exceed €44 per calendar month.

Additionally, benefits in kind—like room, board, and/or the use of a company car—should be valued and added to the employee’s total wages as imputed income.

Solidarity Surcharge

A 5.5% solidarity surcharge is levied on all income, withholding, and corporate taxes—minus certain deductions. The surcharge is levied on the tax liability itself—not income—and is withheld by the employer at source. The solidarity surcharge finances the economic revitalization of the federal states in the former East Germany, which have higher levels of unemployment on average.

Church Tax

Employees who are official members of a religious entity are responsible for paying a church tax. A person’s membership with a church, or religious entity, is determined by that respective entity. The church tax is levied on total monthly taxable income. Like other wage-related taxes, this tax is withheld by the employer and remitted to the local tax office, which distributes funds to the religious entity. The church tax varies by federal state between 8% and 9%. The tax is levied on both total wages and non-traditional income, such as capital gains. An employee’s habitual abode is used to determine the church tax, as it shifts based on location.

Tax on Capital Assets

Taxes on income from capital assets are levied at a flat rate of 25% and must be withheld at source.

Terminations

The rights and duties regarding the employment relationship, including its termination, are in particular determined by the content of the employment agreement, agreements between the works council and the employer, collective bargaining agreements, labor laws, and the constitution, as well as European law.

For resolving conflicts in individual and collective labor disputes, the labor courts play a dominant role. The employment relationship may be terminated by mutual consent such as by separation agreement or by expiration of an employment agreement limited in time. However, the most common way to terminate an employment is by notice of termination.

The notice of termination, to be valid, must be in writing and signed by the competent person, usually the Managing Director or HR Director. If notice is given by other representatives of the employer whose authority to represent the employer is not commonly known to the employee, the original power of attorney must be attached to the notice of termination. The original signed notice of termination must be given directly to the employee. Termination via fax or email is null and void. The termination notice must be declared clearly and unambiguously and express the intention to terminate. It also must declare whether termination is intended to be an ordinary termination with a regular notice period, or an extraordinary termination, without notice period because of significant misconduct.

Termination Notice Period

If a collective bargaining agreement is applicable, the notice periods follow the provisions contained in it. If no collective bargaining agreement is applicable, the notice periods follow the individual employment agreement or the applicable statute, where the statutory notice periods are more favorable to the employee. The statutory notice periods are as follows:

- During probation (up to six months), the statutory notice period is two weeks

- The basic notice period is four weeks as per the 15th or the end of a calendar month

- After two years of service: one month to the end of a calendar month

- After five years of service: two months to the end of a calendar month

- After eight years of service: three months to the end of a calendar month

- After 10 years of service: four months to the end of a calendar month

- After 12 years of service: five months to the end of a calendar month

- After 15 years of service: six months to the end of a calendar month

- After 20 years of service: seven months to the end of a calendar month

General Culture

Germany is at the center of Europe, not only geographically but also in terms of politics and economics. The country is Europe’s second most populous after Russia, with more than 81 million people, according to the World Factbook. The German economy is the largest on the continent and the fifth largest in the world. While Germany exerts its influence on the countries that border it—Austria, Belgium, Czech Republic, Denmark, France, Luxembourg, the Netherlands, Switzerland, and Poland—all of these cultures have, in varying degrees, had a hand in shaping today’s Germany. According to the World Factbook, the population is 91.5% German, with Turkish being the second largest ethnic group at 2.4%. The remaining 6.1% is made up primarily of those of Greek, Russian, Italian, Polish, Serbo-Croatian, and Spanish descent.

Germans place a high priority on structure, privacy, and punctuality. The German people embrace the values of thriftiness, hard work, and industriousness and there is great emphasis on making sure that “the trains run on time.” Germans manage time carefully, and calendars, schedules, and agendas must be respected. Germans are stoic people who strive for perfection and precision in all aspects of their lives. They do not admit faults, even jokingly, and rarely hand out compliments. At first their attitudes may seem unfriendly, but there is a keen sense of community and social conscience and a desire to belong.

Germans love rich, hearty cuisine, though each area of Germany has its own definition of what a traditional meal looks like. Beer is the most popular alcoholic beverage, and the country is known as the birthplace of a number of beer varieties. Brandy and schnapps are also favorite German alcoholic beverages.

Business Culture

The desire for orderliness spills over into the business life of Germans. Everything is carefully planned out and decided upon, with changes rarely occurring after an agreement is made. Hands-on expertise is highly respected, and companies tend to be headed by technical experts rather than lawyers or those with a financial background. Workers at all levels are judged heavily on their competence and diligence rather than on interpersonal skills. Communication with co-workers as well as outsiders tends to be direct and not always diplomatic. Laws, rules, and procedures define and regulate most aspects of German living, and this is evident in all economic, political, and even social spheres. In German business culture, this is reflected in the adherence to prescribed business rules, resulting in a low degree of flexibility and spontaneity in attitudes and values. Germans do not like surprises. Sudden changes in business transactions, even if they may improve the outcome, are unwelcome. Business is viewed as being very serious, and Germans do not appreciate humor in a business context. In addition, counterparts do not need or expect to be complimented. Work and personal lives are rigidly divided, and Germans subscribe to the idea that there is a proper time and place for every activity. When doing business in Germany, it is essential that you appreciate that business etiquette is of great importance to your German counterpart. Unethical behavior will seriously diminish all future business negotiations.

Punctuality

Germans are most comfortable when they can organize and compartmentalize their world into controllable units. Trains arrive and leave on time to the minute, projects are carefully scheduled, and organizational charts are meticulously detailed. Germans are extremely punctual, and even a few minutes delay can offend. If you are going to be even slightly late, call ahead and explain your situation. Be five to 10 minutes early for important appointments.

Gift Giving

Gift giving among business associates is not common in Germany, with a recent trend toward concentrating more on the actual business at hand and less on formalities and rituals when traveling on business. However, for more social occasions, gift-giving is relatively customary. The following issues are important to note when considering giving a gift: A visitor thinking of giving a gift should choose one that is small and of good quality, but not overly expensive. Acceptable gifts at business meetings are items of office equipment, good quality pens with your company’s logo, or liquor. When invited to a German home, it is appropriate to bring a gift of flowers, wine, chocolates, or a small gift that represents your home country or region. Flowers should be given in uneven numbers and unwrapped (unless wrapped in cellophane). Avoid presenting 13 of any kind of flower. However, this rule does not apply to bouquets arranged and wrapped by a florist. Do not give red roses, as they symbolize romantic intentions. Do not give carnations, as they symbolize mourning. Do not give lilies or chrysanthemums, as they are used at funerals. Gifts are usually opened when received. Germany generally has the same traditions as most other European countries in terms of gift giving.

Business Dress Code

Germans take great pride in dressing well, regardless of where they are going or what position they hold. Appearance and presentation are particularly important with regard to business. Even when dressed informally, they are neat and conservative; their clothes are never ostentatious. Casual or sloppy attire is frowned upon. Businessmen should wear dark-colored, conservative business suits; solid, conservative ties, and white shirts. Women also dress conservatively, in dark suits and white blouses or conservative dresses. This form of dress is observed even in comparatively warm weather. Do not remove your jacket or tie before your German colleague does so. Women should refrain from wearing heavy makeup and ostentatious jewelry or accessories.

Web Resources

For more information, see the following web resources:

CIA The World Factbook

https://www.cia.gov/library/publications/the-world-factbook/

The Local—Parental Leave

www.thelocal.de/jobs/article/german-parental-leave-our-guide

PwC German Tax Summary

http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/Germany-Individual-Taxes-on-personal-income

How to Germany—Working in Germany

http://www.howtogermany.com/pages/working.html