After the principalities of Wallachia and Moldovia united, Romania gained independence from the Ottoman Empire in 1877. Located at the crossroads of Central, Eastern, and Southeastern Europe, this country is the 12th largest in the European Union (EU) and is home to almost 20 million people.

After the 1989 Romanian Revolution, the former socialist republic transitioned back toward a democratic system and market economy, which has been steadily growing. Romania’s economy is predominately based on services and producing and exporting machines and electric energy.

Romania has been a member of the United Nations since 1955 and joined NATO in 2004 and the EU in 2007.

Applicable Payroll Law

The general provisions regarding the Romanian payroll system are settled in accordance to the following: Romanian Labour Code; Health, Insurance and Unemployment Laws and Regulations; and the Romanian Tax Code.

Social Insurance Foundation

The contribution rates to the state social insurance funds are determined on an annual basis by the law on social insurance budget approval and the law on health insurance.

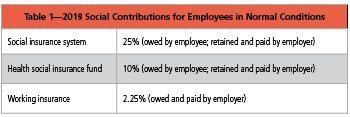

The social insurance contribution rates for 2019 are as follows:

- Employee’s contribution: 25%

- Employer’s contribution for hard work conditions: 4%

- Employer’s contribution for special work conditions: 8%

These rates apply to the employee’s monthly gross income.

The social insurance contribution is fully the liability of the employees. As for the other categories of insured persons, who are not employees or who do not work for a certain employer, the contribution is also entirely due by the insured and will be in proportion with the gross insured income.

The social insurance contribution cannot be lower than the social insurance contribution obtained by applying the above rate to the minimum gross salary available at the moment of the calculation, corresponding to the number of working days from the period. This provision does not apply to the following categories of employees:

- Students younger than age 26 who are currently enrolled in a school

- Apprentices up to 18 years old

- People having disabilities and those who have the right to work fewer than eight hours a day by law

- Retired individuals in the public pension system, except retired persons who benefit from special laws and the ones who combine public pensions with private pensions

- Individuals who—during the same month—receive salary incomes from two or more labor contracts and the combined monthly base of calculation is at least equal with the minimum gross salary available at the moment of calculation

The minimum gross salary for 2019 is as follows:

- 2,080 Romanian Leu (Ron) for a full-time job

- 2,350 Ron for a full-time job that requires university studies and for having at least one year seniority in a domain of university studies

The employer will calculate, withdraw, and pay the social insurance contribution to the social insurance fund on a monthly basis.

The health insurance contribution rate for 2019 is 10%.

This rate applies to the monthly gross income.

The health insurance contribution is fully the liability of the employees. As for the other categories of insured persons, who are not employees or who do not work for a certain employer, the contribution is also entirely due by the insured and will be in proportion with the gross insured income.

The employer will calculate, withdraw, and pay the social insurance contribution and the social insurance fund on a monthly basis.

The working insurance contribution rate for 2019 is 2.25%.

This rate applies to the monthly gross income.

The working insurance contribution is fully the liability of the employer.

The working insurance contribution is not owed for the amounts supported from the State’s Social Insurance Budget, Unemployment Insurance Budget, and from the Health Insurance Budget.

The working insurance contribution is not owed for the amounts supported from the State’s Social Insurance Budget, Unemployment Insurance Budget, and from the Health Insurance Budget.

Income Tax, Tax Deductions

The Romanian Tax Code provides that individuals are taxed 10% of their salary.

The personal deduction applicable for salaries up to 1,950 Ron is 510 Ron.

The personal deduction is digressive for taxpayers with monthly gross salary between 1,951 Ron and 3,600 Ron. The increase of salary results in a decrease of personal deductions.

Some supplementary deductions may be granted if the employee has dependents.

No personal deduction is applicable for monthly gross salaries higher than 3,600 Ron.

Employment Procedure

According to the Romanian Labour Code, the individual labour contract is concluded based on the parties’ mutual consent, recorded in writing in Romanian. The obligation to conclude individual labour contracts is incumbent on the employer. The employer is obliged to provide to the employee a copy of the employment contract before commencing work.

Before concluding or amending any individual labour contract, the employer must inform the applicant or the employee, as the case may be, on the general provisions it intends to insert/amend in the contract, such as: the parties’ identity, the workplace details, the employer’s residence or headquarters, risks of work, contract duration, position/occupation as per the Classification of Occupations in Romania, terms and conditions of the prior notice to be served by the contracting parties, the basic salary, the applicable collective labour agreement, etc.

Any amendments of the above-mentioned elements will involve execution of an addendum to the contract, which must be recorded at the Labour Chamber online by use of the Revisal program at least one day before the change. An exception is made for the change of the salary and bonuses, which must be recorded at the Labour Chamber via the Revisal program within the 20th day of the change.

The provisions of the individual labour contract may not be contrary to or grant employee rights below the minimum level established by the relevant legislation or by the collective labour agreement.

The Labour Code provides for the following types of individual labour contracts:

- Labour contract for a determined duration

- Temporary labour contract

- Part-time individual labour contract

- The individual labour contract for home work

- Apprenticeship contract

As a rule, the Labour Code provides the conclusion of an individual labour contract for an indefinite period.

Working hours: The normal working hours are eight hours a day or 40 hours a week on average.

For people under the age of 18, the normal work time is six hours a day and 30 hours a week.

Employees may opt for an irregular distribution of the working hours, but must strictly observe the total normal working hours of 40 hours a week.

The maximum legal working hours may not exceed 48 hours a week, including overtime work.

By exception, working hours (including overtime) may exceed 48 hours a week if the average of working hours calculated over a period of four months does not exceed 48 hours a week.

Protection of Employment

Holidays: For each employee, the annual holiday leave is a minimum of 20 working days.

The right to annual leave cannot be subject to any waiver, assignment, or limitation.

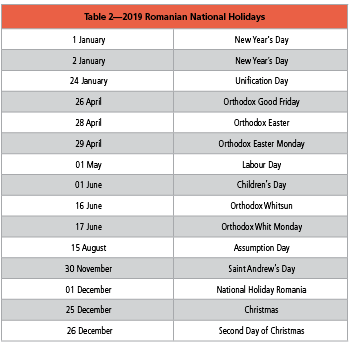

The official holidays, as well as the paid days off, stipulated in the applicable collective labour agreement are not included in the annual leave. See Table 2 for the list of holidays.

Additionally, according to the Labour Code, employees have the right to paid days off for certain family events or for other particular situations.

Illness: In the case of illness, the employer must pay the sick leave days, typically the working days from the first five calendar days of illness, depending on the illness category. The difference is paid by the FNUASS Fund. The payment rates are between 75-100% of the employee’s base salary.

Maternity: The total maternity leave amounts to 126 calendar days. One of the parents has the right to two years of leave for baby care, paid by the municipality with 85% of the average of the net salaries of the last 12 months, but not less than 1,250 Ron and not more than 8,500 Ron.

Payroll Calculation Procedure

The monthly payroll must be printed, stamped, and archived and include the calculation for all contributions of the employer and employee and the tax on income.

The due date for payment of all taxes related to the salaries is the 25th of the next month.

Declaration of the taxes to the consolidated state must be submitted to the relevant authorities by the 25th of the next month.

An informative declaration regarding the incomes from salaries and remunerations of administrators obtained in the previous year in Romania by people who are residents of other EU countries must be submitted to the tax authorities by 28 February of each year.

Termination of Employment

The individual labour contract may cease either lawfully, pursuant to parties’ mutual consent, on the date agreed, or further to the one of the parties’ initiative, under the terms and conditions provided by law.

Resignation: Based upon a written notification, the employee has the right to inform the employer of the termination of his/her individual labour contract after the completion of a prior notice term. The employee is not bound to justify such resignation. The notice term will be established by the parties in the contract or be subject to the provisions of the applicable collective labour contracts, and cannot exceed 20 calendar days for employees in executive positions and 45 calendar days for management positions.

Termination of employment: The dismissal represents the cessation of the individual labour contract based on the employer’s initiative and may occur for reasons:

- Due to the employee’s fault, or

- Independent of such fault

The notice period for dismissal is 20 working days.

Employees may not be dismissed in the following situations, among others, during:

- The employee’s temporary working incapacity

- Pregnancy, if the employer was aware of the woman’s condition before her dismissal

- Maternity leave

- Annual paid leave

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Iulia Lascau works at Euroglobal and is the Managing Partner of the Romanian office. She builds and inspires a team of auditors, accountants, tax advisors, and payroll consultants. Lascau contributes actively to business development and expansion, including in the company’s portfolio of well-known local and international clients. She started her career in finance in 1997 and earned her bachelor’s at the Academy of Economic Studies Bucharest. She has worked on the finance teams of multinational companies and in audit and tax consulting companies in senior positions. Lascau has an executive MBA from Tiffin University in cooperation with the University of Bucharest.