The Philippines is an archipelagic country located in Southeast Asia in the western Pacific Ocean. The archipelago comprises 7,641 islands, with Luzon, Visayas, and Mindanao being the largest. Manila is the capital city.

The Philippines is a democratic republic with a presidential system. The President serves as both the head of state and the head of government.

The economy is diverse, with sectors such as agriculture, manufacturing, services, and remittances from overseas Filipino workers playing significant roles. It is considered one of the emerging markets in Asia.

Labor Code

The Labor Code of the Philippines, which is Presidential Decree No. 442, as amended, primarily governs labor in the country. The Labor Code is a comprehensive piece of legislation that covers various aspects of employment, including labor standards, employment relationships, working conditions, and dispute resolution.

Minimum Wage

Minimum wage rates can vary by region. The minimum wage for non-agriculture jobs is PHP 570 to PHP 610, while the minimum rate for agriculture workers, be it plantation or non-plantation workers, is PHP 533 to PHP 573.

Working Hours, Conditions

The standard workday is typically eight hours, and the standard workweek is six days, resulting in 48 hours per week.

Overtime Pay

Any work performed beyond the regular eight hours a day is considered overtime. Overtime work is subject to additional compensation, usually at a rate higher than the regular hourly wage.

Employees

Employment contracts can take various forms depending on the nature of employment, duration, and specific terms agreed upon by the employer and employee. The following are common types of employment contracts in the Philippines:

- Regular Employment Contract—Also known as "Regular Employment" or "Permanent Employment,” this provides for an indefinite period of employment that typically involves full-time engagement with the company and includes statutory benefits and protections under labor laws

- Fixed-Term Employment Contract—Specifies a definite period for the employment relationship and is common for project-based work, seasonal employment, or specific assignments and may include a provision for renewal or conversion to regular employment

- Probationary Employment Contract—Usually issued for a limited period (commonly 90 to 180 days) to assess the employee's performance and suitability for the position. It also allows the employer to observe the employee's skills and capabilities before confirming regular employment. The terms and conditions during the probationary period are often outlined in the contract.

- Project-Based Employment Contract—This is tied to a specific project or task and is common in industries with project-oriented work, such as construction or software development. It also specifies the project's duration, scope, and compensation.

- Part-Time Employment Contract—Involves a reduced number of working hours compared to full-time employment that is suitable for individuals who do not work the standard eight-hour day or 40-hour week. The terms and conditions, including salary and benefits, are adjusted based on part-time status.

- Seasonal Employment Contract—Temporary employment during specific seasons or peak periods that is common in industries such as agriculture, retail, and tourism. It also specifies the start- and end-dates based on seasonal demand.

- Casual or Daily-Hire Employment Contract—Typically used for occasional or intermittent work where employees are hired on a daily or per-task basis and offers flexibility for both the employer and employee

Taxes

In the Philippines, taxes are levied by both the national and local governments. The Bureau of Internal Revenue (BIR) is the primary agency responsible for national taxation, while local government units handle local taxes.

For resident and nonresident aliens engaged in trade or business in the Philippines, the maximum rate on income subject to final tax (usually passive investment income) is 20%. For nonresident aliens not engaged in trade or business in the Philippines, the rate is a flat 25%.

Below is an overview of key taxes in the Philippines:

National Taxes

Income Tax

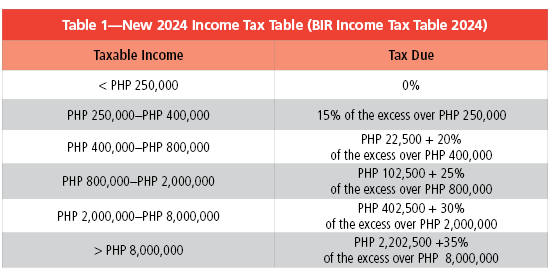

Individuals and corporations are subject to income tax. Progressive tax rates are applied to individual income. Effective January 2024, the new and updated Income Tax Table in the Philippines (BIR Tax Table 2024) follows the revised rates following the new BIR TRAIN – Tax Reform for Acceleration and Inclusion Act, implementing the Income Tax Provisions of the Republic Act 10963 (see Table 1).

Corporate Tax

A domestic corporation is subject to tax on its worldwide income. On the other hand, a foreign corporation is subject to tax only on income from Philippine sources.

Corporations are generally taxed at a flat rate of 25% of their net income.

Value-Added Tax

The standard value-added tax (VAT) rate is 12%, with certain transactions being exempt or subject to a 0% rate.

Withholding Tax

The withholding tax is applied to income payments such as salaries, professional fees, and dividends. Tax is withheld at the source and remitted to the BIR. Individuals can use BIR’s Withholding Tax Calculator.

Estate Tax

In the Philippines, a 6% estate tax is imposed on the net estate of a decedent which must be filed and paid within one year from the death of the decedent.

Donor's Tax

The new donor’s tax is 6% of the total net gifts exceeding PHP 250,000 exempt gift made during the calendar year.

Excise Tax

The excise tax is levied on specific goods such as petroleum products, alcohol, and tobacco. Rates vary depending on the product.

Social Security Tax

In the Philippines, the Social Security System (SSS) is a government agency that manages the social security program. The SSS provides various benefits to its members including retirement, disability, sickness, maternity, and death benefits, as well as loans.

Employees and employers contribute a percentage of the employee's monthly salary to the SSS.

For 2024, the total contribution rate is 14%, with the employer contributing 9.5% and the employee covering 4.5%.

Local Taxes

Real Property Tax

This tax is collected by local government units on real properties such as land and buildings. Rates vary and are set by the local government.

Business Taxes

Local governments may impose business taxes on entities operating within their jurisdiction.

Community Tax

Individuals are required to pay a community tax, or cedula, annually.

Other Local Taxes, Fees

Local governments may impose various other taxes, fees, and charges.

Tax Compliance

The following forms need to be filed as part of tax compliance:

- Annual Income Tax Return: Individuals and corporations are required to file annual income tax returns

- VAT Returns: Businesses registered for VAT must file regular VAT returns

- Withholding Tax Returns: Entities making income payments subject to withholding tax must file withholding tax returns

- Tax Clearance: Required for certain transactions, such as the sale of real property

Time Off

Employees are entitled to various types of leave in the Philippines, including the following:

- Annual Leave (Vacation Leave): Employees who have worked for at least one year are entitled to a minimum of five days of annual leave with pay. The employer and employee may agree on the scheduling of the vacation leave.

- Sick Leave: Employees who have worked for at least 90 days are entitled to a 10-day sick leave with pay per year. Sick leave can be used for the employee's own illness or injury, but a medical certificate may be required.

- Maternity Leave: Women are entitled to a 105-day maternity leave with pay for live childbirth, regardless of the mode of delivery. An additional 15 days are granted for single mothers or for those who qualify as solo parents.

- Paternity Leave: Men are entitled to a seven-day paternity leave, with pay for the first four deliveries of the legitimate spouse with whom he is cohabitating.

- Special Leave Benefits for Women: Women are entitled to special leave benefits for gynecological surgery, miscarriage, or emergency termination of pregnancy

- Solo Parent Leave: Solo parents are entitled to a total of seven working days of leave each year, which may be taken as a whole or on a staggered basis

- Emergency Leave: Employers may grant emergency leaves for situations such as accidents, calamities, and other unforeseen events

- Bereavement Leave: Employees are entitled to a maximum of three days of bereavement leave with pay for the death of an immediate family member

- Other Special Leaves: The Labor Code also recognizes other special leaves, such as special leave for women who are victims of violence, leave for victims of human trafficking, and leave for victims of violence against women and children

National Holidays

In the Philippines, national holidays are established by law issued through Presidential Proclamations. National holidays can be categorized into regular holidays and special (non-working) holidays. Table 2 shows the full list of 2024 holidays.

Foreign Hires

To hire foreign nationals in the Philippines, employers need to secure an Alien Employment Permit (AEP) from the Department of Labor and Employment (DOLE) and obtain the appropriate working visa. This involves extending a formal job offer, creating an employment contract, and submitting necessary documents to DOLE. After AEP approval, foreign nationals apply for a working visa through the Bureau of Immigration while employers may provide orientation on Philippine labor laws. Additionally, foreign employees should be registered with the SSS, PhilHealth, and Pag-IBIG. Seeking professional guidance is crucial to ensure compliance with current regulations.

Visas

There are various types of working visas for foreign nationals seeking employment in the country. The following are some common working visas in the Philippines:

- 9(G) Pre-Arranged Employment Visa—Issued to foreign nationals with a job offer from a Philippine employer. Requires an approved employment contract and AEP from the DOLE.

- Special Work Permit (SWP)—Temporary work permit for foreign nationals engaging in short-term work or specific projects in the Philippines that are issued for a limited period and may be extended in certain cases

- 47(A)(2) Visa—Issued to foreign nationals participating in certain assignments or activities, such as technical experts, specialists, or executives that requires an endorsement from the government agency concerned with the specific project

- Treaty Traders and Investors Visa (9(D) Visa)—For nationals of countries with which the Philippines has a treaty of commerce and navigation and granted to foreign nationals coming to the Philippines for substantial trade or investment activities

- Special Non-Immigrant Visa Under Republic Act No. 8756—Issued to foreign nationals attending international conventions or participating in international agreements that are applicable to those who will hold a conference, symposium, or similar event in the Philippines

- Special Resident Retiree's Visa (SRRV)—For foreign nationals who wish to retire in the Philippines. Provides certain benefits, including the option to work, if it is for the same employer.

- Student Visa (9(F) Visa)—For foreign nationals enrolled in educational institutions in the Philippines that allows part-time work during the school term and full-time work during school breaks

Culture

The Philippines’ rich cultural heritage is influenced by its history of colonization, trade, and indigenous traditions. It has a vibrant arts scene, traditional music and dance, and a mix of indigenous and foreign cultural elements.

The country is known for its beautiful beaches, coral reefs, and natural attractions. Popular destinations include Boracay, Palawan, Cebu, and Manila.