Operating a payroll department in one country can be a challenging task filled with unique processes, constantly changing legislation, and seemingly unending compliance issues. For companies looking to expand overseas, the complexity multiplies when factoring in cultural differences, labor practices, wage and hour rules, and changing requirements. While many countries are complex, a few stand out to global payroll professionals as extremely challenging.

These challenges become greater when there are multiple levels of taxation, starting at the national level and then adding state, provincial, and local taxes. Requirements based on economic sector or type of business can also complicate the payroll function.

For example, taxes in Canada are levied at both the federal and provincial level. All of the provinces have a progressive individual income tax rate except Alberta, which has a flat individual income tax rate. Switzerland adds another layer of complexity by adding cantons and municipalities to its jurisdictions allowed to levy taxes. If you live in Switzerland, the amount of income paid depends on your canton and the administrative districts within the canton in which you live.

For example, taxes in Canada are levied at both the federal and provincial level. All of the provinces have a progressive individual income tax rate except Alberta, which has a flat individual income tax rate. Switzerland adds another layer of complexity by adding cantons and municipalities to its jurisdictions allowed to levy taxes. If you live in Switzerland, the amount of income paid depends on your canton and the administrative districts within the canton in which you live.

The World Bank Group's “Doing Business Project,” which is annually updated, ranks 190 countries' business regulations and enforcement measures and provides some insight into how difficult it is for organizations to comply with tax laws specifically.

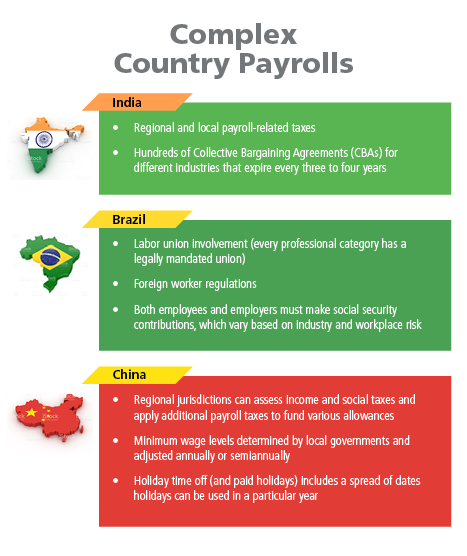

According to “Doing Business 2017,” some countries where paying taxes will be the most difficult include Venezuela (ranked 185 in taxes), Nigeria (182), Cameroon (180), Brazil (181), India (172), Vietnam (167), Colombia (139), China (131), and Italy (126). The United States ranks 36th, with Puerto Rico separately ranked at 135.

In Kenya, which is ranked 125, for example, the study projects that small and medium-sized companies will spend more than 195 hours preparing tax payments throughout the year. Companies in Brazil are expected to spend the most time preparing and filing taxes during 2017: 2,038 hours, according to the study.

Italy

Italy has regional and local payroll-related taxes that can involve complex monthly reports and declarations due to the government.

Twenty regions are authorized to impose additional income taxes and can increase the tax annually from the base rate within limits set by national law. In addition, municipalities may impose a surtax. For example, Rome has a particular rate for its municipal surtax while Milan, Italy's second largest city, assesses the surtax at a different rate.

Collective bargaining agreements (CBAs) that are negotiated between unions and employers’ associations in Italy also add an additional layer of complexity. There are hundreds of CBAs for different industries, and they can even vary at the local level. CBAs expire every three to four years and have to be renegotiated, often with new base salaries. Despite their complexity, all employers must abide by these CBAs.

Another aspect of Italian payroll that makes processing extremely challenging is the mandatory severance pay called Trattamento di Fine Rapporto (TFR). Every employee is entitled to TFR even if terminated for just cause or by resignation. An employer sets aside a certain amount of salary each month, calculated by a formula that is revalued annually. Pay for non-management employees at termination is quite complex and includes a percent for years of service as well as an inflation factor.

The calculation of TFR for managers, effective since 2011, considers age and other factors in determining final pay.

Brazil

Regularly found to have one of the most complex tax systems in the world, Brazil’s payroll is complicated by labor union involvement in pay.

Every professional category in Brazil has a legally mandated union to which employers must remit the tax. The Brazilian Consolidation of Labor Laws legislation also requires all employees to pay a union dues tax, even if they are not members of a union. The tax is regulated by the Ministry of Labor and payable to the individual unions.

Brazil's foreign worker regulations also can create headaches for companies. A foreign company offering permanent employment to foreign workers in Brazil must have at least $50 million invested in Brazil and registered with the Brazilian Central Bank (Banco Central de Brasil). Foreign employees hired in Brazil must receive payments in Brazilian reals.

For social taxes, both employees and employers must make social security contributions, which vary based on industry and workplace risk as determined by the Ministry of Labor and Employment. Small companies may be eligible for reduced tax rates, and tax relief could be available for employers in certain economic sectors that may choose to pay some of the taxes based on their gross revenues.

However, Brazil has made strides in recent years to update its payroll processes. Currently being tested is a new digital reporting system, called eSocial, for reporting employee data to government institutions, including the revenue service, social security institute, and labor ministry. The eSocial system is to be required for many employers January 1, 2018, and for generally all employers no later than July 1, 2018.

France

France’s employment-related taxes are soon to become more complex for employers as the country implements a monthly income tax withholding requirement on resident employee wages. France announced its intention to apply withholding at the source in 2015, with implementation to occur in 2018. The new French government, however, has now delayed the requirement to January 1, 2019. But that is not the only additional payroll implication employers need to consider when doing business in France.

While French residents brace for withholding-at-source, a system is set up already to withhold income taxes from foreign workers. Calculating termination or redundancy payments can be based on intricate formulas and depend on the type of termination, length of service, and other factors.

Some French employers are liable for payroll taxes on wages if their businesses are not subject to the value-added tax (VAT) or subject to the VAT on only 10% or less of total sales. The payroll tax is based on all resident or domiciled employees' total annual remuneration, or annual salary, regardless of its location of business. Therefore, foreign employers also are liable for this tax. Some additional exceptions to this tax apply. New companies, in particular, are responsible for calculating their VAT percentage based on current year revenue—rather than previous year. Foreign workers are not subject to this payroll tax but are subject to an alternative withholding tax.

France, however, has begun the process of gradually implementing a system to replace its notoriously onerous reporting requirements for dozens of social welfare, health insurance, pension, and other related public and private agencies that collect social contributions. The so-called declaration sociale nominative, or DSN, allows companies to electronically transmit payroll data via their payroll software programs, third-party payroll providers, or certified accountants, and it consolidates some 20 existing payroll reporting obligations into one system.

China

Regional jurisdictions create additional complexities in payroll administration throughout China as they can assess income and social taxes and apply additional payroll taxes to fund various allowances for workers, such as a surcharge for heating in the northern areas or to account for excess heat in the southern areas.

Minimum wage levels are determined by local governments and are adjusted annually or semiannually. China's minimum wage regulations require two minimum wages: a monthly minimum wage, which applies to full-time workers, and an hourly minimum wage, which applies to part-time workers. The calculation for sick leave compensation in China also can vary depending on location, salary paid, work experience, and employment contract.

There has been additional complexity in administering holiday time off (and paid holidays) in China due to a China General Office of the State Council policy of declaring a spread of dates the holidays can be used for in a particular year. The government has been discussing changing the holiday requirements which, for two key holiday periods, the Spring Festival and National Day celebrations, lists weekend days following the week of the celebration as required work days for employees to make up for the other paid weekdays taken off from work.

Overtime pay in China has two key components: an hourly amount determined by hours worked each day beyond the standard 40-hour workweek, and the premium amount of pay determined by the type of day on which the overtime occurred. The hourly rate of pay for overtime work on weekdays is 150% of base pay. Overtime work on a weekend increases that premium to 200% of base pay, and a 300% premium is paid for overtime worked on a holiday.

In addition, required termination or redundancy pay is calculated based on several criteria, to include whether a required 30-day notice has been made, the employee’s years of service, and whether an employee’s wages are more than a certain amount in excess of local monthly average wages.

Bloomberg BNA’s payroll solutions provide timely news, analysis, and tools enabling payroll professionals to create effective policies and comply with federal, state, and international laws and regulations.

Bloomberg BNA’s International Payroll Decision Support Network is the global compliance solution for payroll professionals. The International Payroll Decision Support Network with 90 country primers provides vital support, best practice insights, and the latest in global developments affecting your organization.

Visit www.bna.com/us-international-payroll for more information.

Molly Ward is a manager at Bloomberg BNA, where she works with international correspondents to deliver quality news content to business professionals. She started her career as a research analyst for Bloomberg BNA’s International Payroll Decision Support Network.

Molly Ward is a manager at Bloomberg BNA, where she works with international correspondents to deliver quality news content to business professionals. She started her career as a research analyst for Bloomberg BNA’s International Payroll Decision Support Network.