During the webinar “Managing International Payroll Data,” Kerry Hudson, Director at Fitzgerald & Law, covers a significant amount of information—from data-gathering and process, to working with third-party providers, to timetables and reporting. The 90-minute webinar is available on demand.

A critical aspect of managing sensitive information is first to determine which team members will handle employee data and make sure those parties know the latest in data protection laws and how those laws can be used to reduce employer risk.

Once a company is satisfied with the stakeholders who are protecting their information, the next step is to begin the process of preparing payroll, which requires making a decision on the essential elements your company wants in the software. This could include information on recruitment, human resources, employee benefits, pensions, and more.

Once a company is satisfied with the stakeholders who are protecting their information, the next step is to begin the process of preparing payroll, which requires making a decision on the essential elements your company wants in the software. This could include information on recruitment, human resources, employee benefits, pensions, and more.

“In addition, when considering international payroll, country-specific legislation and collective agreements must be understood,” Hudson said.

Hudson urges companies to have an absence tracking policy in place for employees around the world. Absences include annual leave, public holidays, sick leave, maternity/paternity leave, study leave, and compassionate or bereavement leave.

“Absence tracking can be a challenge for businesses, but it has such an impact on employee pay,” Hudson said. “It’s really important to try and get that right.”

During the webinar, one payroll professional participating in the course explained to Hudson that she pays individuals in 25 different countries and asked if it would be best for her to keep track of her employees manually or on a time and attendance system.

“It’s all about working closely together with your in-house team responsible for that head count,” Hudson said. “It’s best to have a software package that can capture the data. I think it’s a challenge because each country will have different protocols.”

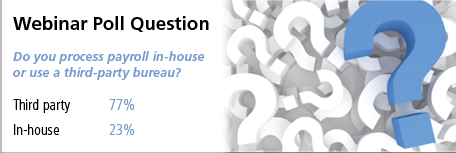

It also will depend on how well your third-party provider works with you. Before outsourcing your international payroll to another company, Hudson advises businesses to have it sign a service level agreement (SLA) so both parties will understand the scope of work—tasks, timetable, procedures, and fees.

“This is often an area that needs discussion and real open communication to be very clear on the services,” Hudson said. “Part of the agreement must also cover responsibilities like data management. A third party needs to safeguard employee data.”

Another participant chimed in during the webinar to ask Hudson what she recommends as best practices for working with third-party vendors.

“Clear and open discussion at the very outset,” Hudson said. “When you’re engaging with them, be very clear on your expectation of the work they will do, time frames, and cost for that service. It’s important for both parties to get off on the right foot at the very beginning.”

Kiko Martinez is the Associate Editor for the American Payroll Association and for the Global Payroll Management Institute. He has 15 years of experience in journalism and public relations.

Kiko Martinez is the Associate Editor for the American Payroll Association and for the Global Payroll Management Institute. He has 15 years of experience in journalism and public relations.