A standardized, consistent approach to managing expatriate shadow payrolls will make your program easier to administer, provide better support for employees, and allow for better data for year-end tax returns.

In the Global Payroll Management Institute (GPMI) webinar “The Ins and Outs of Expatriate Shadow Payroll: The Payroll Nobody Sees!” Celergo’s Michele Honomichl gave an overview of the shadow payroll process.

Companies with expatriates in certain situations run a shadow payroll in the host location to calculate the host tax withholding for the employee and pay it to the local government. It is known as a shadow payroll because expatriates do not see the process.

“They’re not managing it, participating in it, won’t get a pay slip, and they aren’t paying those taxes because typically the employer pays those taxes on their behalf,” said Honomichl, Celergo Founder, Executive Chairman, and Chief Strategy Officer. “If the employer is paying for something on behalf of the employee, it needs to be grossed up or rolled over. You’re going to have to tax the tax.”

Shadow payrolls typically are used in host locations that require payroll tax withholding, such as Germany, and in home locations that tax on worldwide income, such as the United States.

“If you just have one expatriate, you have all the complexity of an expatriate program just for that one person,” Honomichl said.

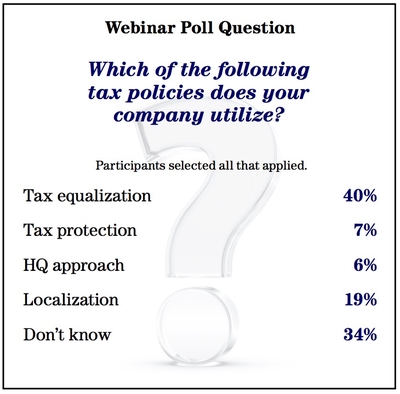

The webinar presented three types of host tax programs:

- Employee is on Tax Equalization and the employer pays the Host Tax (gross-up needed)

- Employee is treated like a local, on local payroll and pays host tax (no gross-up needed)

- Employee is on a home payroll but pays host taxes via a “Host Tax Deduction” on home payroll (no gross-up needed)

Honomichl said a shadow calculation includes the employee’s compensation package, benefits in kind, and taxes. She explained the details of each during her virtual presentation.

She also recommended organizations use a matrix for host tax calculation that lists all elements paid to or on behalf of the expatriate:

- Compensation, including salary, COLA, and transportation allowances

- Benefits-in-kind, including rent, property management, and storage

- Relocation allowances such as cultural training and moving expenses

She advised the webinar audience to review the taxability of each element. Best practices include having a tax return provider in each country approve the matrix and review it annually, and to provide payroll with documentation for host tax calculation.

“The number one thing I want people to remember is that it does not matter where the employee is paid. It matters where it is earned,” she said. “If the employee is U.S. to Germany, if he is paid a split with a portion paid in the U.S. and a portion paid in Germany, the entire compensation package is taxable in Germany regardless of where it’s paid.”

View the full webinar on demand.