As an independent payroll consultant, it’s always a challenge knowing whether a business relationship is going to turn out as expected. In 2017, I was approached by a former colleague to provide assistance with a U.K. company that had been having trouble managing and administering payrolls across the U.K. and Europe due to old systems, poor practices, and lack of experienced payroll staff.

While I was supporting improvements for these payrolls, the company went through an acquisition in the United States, nearly doubling in size to 3,500 employees in 49 states. They wanted to utilise my experience in managing global payrolls to project-manage the merger of two separate U.S. companies and payroll teams, both running a managed payroll service with the same vendor onto a brand-new vendor platform and managed service.

Without prior experience with a U.S. payroll, I was a bit daunted at the prospect. I lacked the expert payroll knowledge that I have in the U.K., but I concluded that surely a payroll implementation is the same around the world.

There are multiple payments, deductions, statutory legislation, and a number of employees, plus company rules and state, local, and country (federal) laws—and we always end up with a net pay. So, I took on the challenge and used my experience to ensure we followed the right overall principles and ended up with a successful implementation.

During the project in 2017, I worked throughout the United States (my home is the U.K.) traveling between the states of Florida, Kansas, and New York. Consistent with the lifestyle of a global payroll professional so familiar to our readers, I worked across multiple time zones. These included all U.S. time zones, the U.K., and India, where some of our programming team was based. Conference calls were interesting, often taking place late into the U.K. evening. One of the benefits of multi-cultural calls included sharing some fabulous English phrases with my U.S. colleagues that I do hope they continue to use today! Luckily, I had a great team based in the United States, and with their American Payroll Association (APA) training and experience they supported me in some of the more technical areas I needed help with.

In typical global consultancy mode, the first thing I looked at was how we could make improvements and changes to bring the two companies together. I examined what wasn’t working well and whether things could be improved; identified where there was duplication; and more importantly, where rules and payroll processes were different across the two companies.

My approach was to work with both payroll teams and come up with a “wish list” of all the things that we knew would benefit payroll, the employees, and the company.

We wrote a number of business cases including establishing a single pay entity, changing pay frequency from semimonthly to biweekly, moving from paying current to paying in arrears, implementing a new time recording system, and consolidating over 100 paid time off plans. Then we sent them all for approval. Then came something we really didn’t expect; they were all approved! Our project commenced, and the hard work started.

Below are some of the challenges we faced and how we overcame them. I’m pleased to say these great outcomes were achieved in under a year.

Establishing a Single Pay Entity

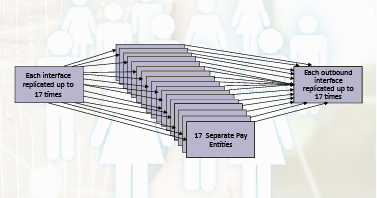

Over time, with continuous acquisitions, the number of pay entities increased. With the new acquisition, a further four pay entities would need to be added, taking it to 17 separate pay groups within the payroll system.

This meant that unnecessary complexity was added throughout the pay process—the consequence of multiple input and output files.

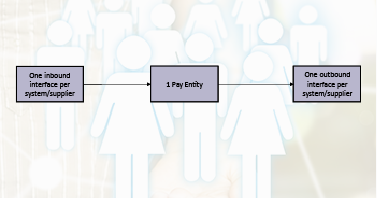

Having challenged the rationale behind separate pay entities, we confirmed that there was no reason—corporate legal, employment law, or tax—to operate more than one pay entity. Indeed, moving to one entity would considerably simplify processing and would probably also facilitate further improvements elsewhere in the organisation. The recommendation was to move to one pay entity as part of the scope of the new U.S.-managed payroll service implementation.

The existence of multiple separate input and output files required manual manipulation to consolidate, rework, or separate into other files. Maintaining control of this number of inputs and outputs was time-consuming. Furthermore, it added unnecessary risk to the accuracy and legal compliance throughout the whole payroll process.

Managing Risk, Accuracy

Each pay entity had up to 15 different input files. These included HR, benefit deductions, variable pay, commissions, garnishments, manual entry, and up to 10 output files, e.g., benefit payments, employee payments, GL interfaces, garnishments, etc. These equate to approximately 420 files in and out of the payroll every pay run.

At that time, payrolls were run both weekly and semimonthly, which meant there could be over 1,000 files involved in the payroll process every calendar month.

Proposed Solution

We proposed to consolidate the various existing separate pay entities into a single pay entity across both companies that would extend across the United States. This would reduce the number of inbound and outbound interfaces to 25 cents per pay run, and around 100 per calendar month, thereby reducing the risks associated with the high level of manual intervention and simplifying the overall process.

Other Considerations for the Employee’s Benefit

According to U.S. fiscal rules, if an employee changes their pay group in any tax year, their balance for tax purposes is reset at zero. This resulted in the employee having to claim any overpaid deductions through their own personal tax return at the end of the tax year. To minimize the negative impact on the employee, data changes were being delayed until the start of the new fiscal year. Moving to one pay entity resolved this issue, as the employee would always be in the one pay group regardless of the business area they worked, resulting in all required changes being made as necessary throughout the year.

Inbound and outbound file suppliers, e.g. benefit providers, would probably see some benefit from the reduction in the numbers of separate files they provided or received. We didn’t attempt to quantify this benefit, as we wanted to focus more on the solution design, but we planned to work with procurement to determine whether this would have any positive financial implications with service providers later on during the process.

One of the more complex tasks through our implementation, and one that needed the most thought and planning around communication, was moving from a semimonthly to a biweekly pay frequency and ensuring that the 3,400 employees, especially those classed as nonexempt, were completing accurate and regular time sheets.

In Part 2 of this feature, I’ll explain exactly how we achieved this and overcame the many challenges we faced.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Eira Hammond is the Managing Director for Eira Consulting Limited, an independent business consultancy specialising in project management, systems, and processes. She has more than 35 years of experience working with and managing payroll and HR teams in all sectors worldwide. Hammond was the Chair of the Board of Directors for the Chartered Institute of Payroll Professionals (CIPP), an organization for which she was a Director for more than 10 years and has been a tutor in the foundation degree for payroll management for nearly 15 years. She has gained an instantly recognizable name as an inspirational speaker, presenter, and writer, regularly speaking at conferences, publishing articles in a variety of international industry journals, and actively networking on social media.