On August 31, 2018, the second draft of the Individual Income Tax (IIT) Law was passed. The new law makes changes to many elements of the calculation and enforcement of IIT in China—focusing on expanding deductibles, adjusting tax brackets, and changing residency rules.

The aim of the new IIT law is to ease the tax burden for low- to mid-income earners while taking a tougher stance on both foreign workers and high-income earners.

As the cost of living in China has rapidly increased in recent years, the new IIT law offers some relief for lower income earners by reducing their tax burden.

This is also done through expanded tax deductions—including for children and the elderly—which come at a time when China’s population is rapidly aging and the government is encouraging families to have more children.

A day before the IIT law was passed, the State Council also announced Renminbi (RMB) 45 billion (US$6.59 billion) worth of tax cuts. Both the tax cut and the IIT reform aim to boost consumption amid China’s escalating trade war with the United States and signs of a slowing economy.

The new tax brackets and standard deduction amounts started on October 1, 2018, while the remainder of the new personal income tax laws came into force as of January 1, 2019.

Here are a few of the key changes that will affect the calculation and enforcement of IIT on comprehensive income. This article does not discuss in detail income from operations, which is subject to different tax rates and calculations.

Calculation

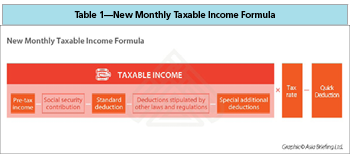

The formula to calculate IIT is in Table 1. The components that have been affected by the new law are highlighted.

Table 1—New Monthly Taxable Income Formula

Standard Deduction Raised

The standard deduction on comprehensive income increased from RMB 3,500 (US$512.10) for resident taxpayers and RMB 4,800 (US$702.30) for nonresident taxpayers to a unified RMB 5,000 (US$731.60) per month. This started on October 1, 2018.

This will raise the annual threshold to RMB 60,000 per year, which is equivalent to an extra annual deduction of approximately US$8,779.20 per year.

These changes will apply to resident and nonresident taxpayers.

New ‘Special Deduction’ Category Available

The new IIT law also provides a new category of “special additional deductions.”

Under a revised Article 6, resident taxpayers will now be able to deduct the following additional items from their comprehensive income:

- Education expenses for children

- Expenses for further self-education

- Healthcare costs for serious illness

- Housing loan interest

- Housing rent

- Support for elderly (added in the final draft)

Charity Deduction Now Deductible

An individual who donates an amount (not exceeding 30% of their income) to charitable causes, such as education and poverty alleviation, can now deduct this from their taxable income.

Tax Incentives for Certain Categories of Income

The new IIT law now provides discount incentives for certain categories of income. Article 6 stipulates that the income derived from labor services, income from author’s remuneration, and income from royalties are to be calculated with a 20% discount before forming part of the monthly “pre-tax income” (see formula above in Table 1).

In addition to this, author’s remuneration will be subject to a further 30% discount to be applied on the monthly pre-tax income.

Tax Cut Skewed Toward Low- to Mid-income Earners

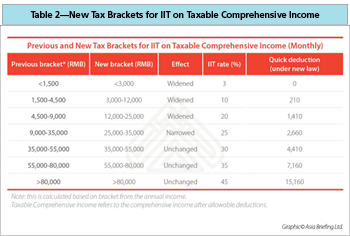

The new tax brackets shown in Table 2 also went into effect on October 1, 2018.

For comprehensive income: the lower tax brackets have been expanded. This means that the lower tax rates are now applied on a wider range of income levels, while the higher tax brackets remain the same.

Table 2—New Tax Brackets for IIT on Taxable Comprehensive Income

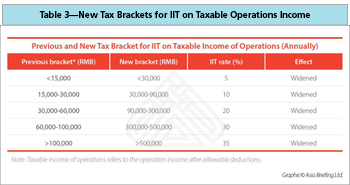

Similarly, the brackets for operation incomes have also been expanded to reflect what is seen in Table 3:

Table 3—New Tax Brackets for IIT on Taxable Operations Income

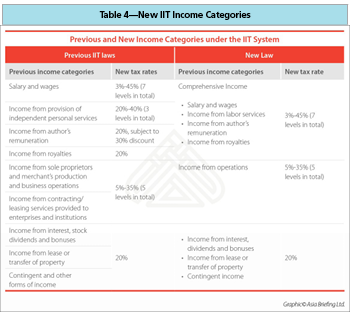

New Consolidated Categories of Taxable Income

The categories of “income” subject to IIT have now been simplified and amended under Article 2 of the IIT Law. The 3%-45% progressive tax rate now applies to income derived from labor services, author’s remuneration, and royalties (collectively known as “comprehensive income”).

In effect, these three types of income that were traditionally taxed at a flat rate of 20% are now taxed at progressive rates according to the tax brackets.

See a summary of changes in Table 4.

Table 4—New IIT Income Categories

Expatriates Now Subject to ‘183-day-rule’ of Residency

Article 1 of the IIT law provides that a foreign individual who resides in China for an accumulated 183 days or more in a year is considered a “tax resident,” and therefore subject to Chinese tax on their worldwide income.

This stipulation will replace the previous five-year rule, under which a foreign individual was subject to Chinese taxation on worldwide income if they lived in China for more than five years.

This previous five-year threshold was easily circumvented by expatriates who would choose to leave the country for an aggregate of 91 days per year or more than 31 consecutive days to “reset the clock” on the five-year threshold.

IIT Liability for Resident Taxpayers Now on an Annual Basis

Article 11 of the IIT law stipulates that, for tax residents, IIT will now be calculated on an annual rather than monthly basis.

However, withholding agents will continue to withhold the tax in advance on a monthly basis and nonresidents will continue to pay tax on a monthly basis.

Tax Authorities Given Additinoal Anti-tax Avoidance Powers

Article 8 provides tax authorities with additional powers over tax avoidance schemes, particularly in relation to transactions involving non-arm’s length asset transfers and commercial arrangements where inappropriate tax benefits are derived.

Prepare for the Transition

The IIT reform marks a significant change to China’s taxation policies. With the introduction of the new IIT law, low- and mid-income earners enjoy greater tax relief, while all individual taxpayers benefit from a broader range of deductibles.

At the same time, foreign workers may be taxed with greater scrutiny, and tax authorities have been given greater capabilities to enforce rules and expand tax collection.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

This article was first published in China Briefing.

Since its establishment in 1992, Dezan Shira & Associates has been guiding foreign clients through Asia’s complex regulatory environment and assisting them with all aspects of legal, accounting, tax, internal control, HR, payroll, and audit matters. As a full-service consultancy with operational offices across China, Hong Kong, India, and ASEAN, we are your reliable partner for business expansion in this region and beyond.

For inquiries, please email us at [email protected]. Further information about our firm can be found at www.dezshira.com.