Indonesia’s government issued Government Regulation 78 of 2019 (GR 78, 2019), which sets out a variety of income tax incentives for businesses investing in specific industries and provinces in the country, on 13 December 2019.

These incentives come in the form of tax deductions, the accelerated depreciation of fixed tangible assets, and the accelerated amortization of intangible assets. The regulation also increases the period for fiscal loss compensation, in addition to setting the income tax rate on dividends for foreign taxpayers at 10%. The development bodes well for businesses as the tax allowance schemes have been expanded to 183 from 145 sectors.

GR 78, 2019, along with GR 45, 2019, which was issued earlier last year, are designed to encourage more foreign investment and develop major industries. As such, investors should seek the assistance of registered local tax advisors to better understand how these incentives can best benefit their business.

What Are the Criteria for the Incentives?

Investors will need to meet various requirements to be eligible for the incentives under GR 78, 2019.

They are only allowed to:

- Invest in specific sectors as listed in Appendix I of the regulation (page 28)

- Invest in specific sectors in certain provinces in Indonesia as listed in Appendix II of the regulation (page 71)

These sectors include pharmaceuticals, geothermal energy, and IT, among others. Additionally, investors must:

- Prove that their investments are of high financial value

- Prove that the sector they are investing in is export-oriented

- Have their business absorb a large workforce (labor-intensive)

- Utilize high volumes of local content in any production process

Net Income Deduction

Taxpayers that fulfill the aforementioned requirements are eligible to receive a net income reduction of 30% of their total investment of any fixed tangible assets. This incentive is granted for up to six years with annual deductions set at 5%.

The fixed tangible assets, which include land, must be utilized in core business activities. The assets must also be documented on principal business and investment permits, as well as investment registration certificates. Moreover, the assets must be obtained in new condition, unless they are being imported or relocated from overseas.

Accelerated Depreciation of Assets

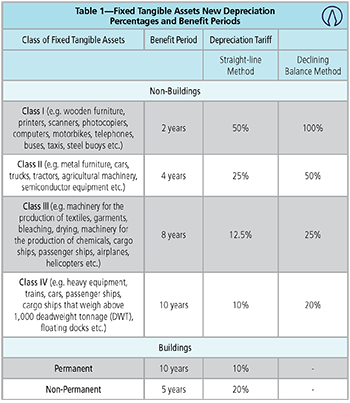

Under GR 78, 2019, taxpayers are eligible to receive a tax incentive in the form of the accelerated depreciation of their fixed tangible assets. This type of depreciation reduces the taxable income much earlier in the life of the asset, and thus businesses can reduce their tax liability.

There are two methods to measure depreciation used in the regulation: straight-line method, and the declining balance method.

Under the straight-line method, the depreciating value of the asset is spread evenly for every year the asset is still functional, useful, and profitable. The formula for calculating straight-line depreciation is as follows:

Straight-line depreciation = (cost of the asset - estimated salvage value (value of an asset at the end of its residual life)) ÷ estimated useful life of the asset.

Through the declining balance method, a constant percentage decrease is applied to the value of the asset each year. This results in greater depreciation in the early years of the asset and smaller depreciation in the later years.

GR78, 2019 sets out the two methods and their new depreciation percentages as well as the length of the benefit periods in Table 1.

Table 1—Fixed Tangible Assets New Depreciation Percentages and Benefit Periods

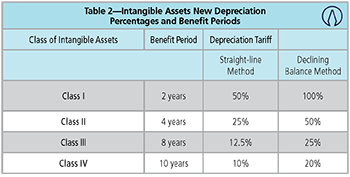

Accelerated Amortization of Intangible Assets

GR 78, 2019 allows taxpayers to accelerate the amortization of their intangible assets. The benefit period and depreciation tariffs are as follows in Table 2.

Table 2—Intangible Assets New Depreciation Percentages and Benefit Periods

Fiscal Loss Compensation

In Indonesia, businesses that are operating at a loss can be compensated in the following tax period for up to five years. Under GR 78, 2019, this period can be extended for up to 10 years.

An additional one year of compensation is granted if investors implement one of several options laid out in the regulation. These are:

- Invest in a sector and region as stated under GR 78, 2019

- Invest in industrial or bonded zones

- Engage in activities related to renewable energy

- Assign 10 billion Rupiah (US$714,000) on social infrastructure programs

- Utilize at least 70% domestic raw materials or components by the second year of operations

- Employ at least 300 local workers and maintain this number for four consecutive years

To gain a further two-year extension, investors can:

- Employ 600 Indonesians and maintain this number for four consecutive years

- Assign at least 5% of their total investment value to research and development aimed at improving their products or services

- Export at least 30% of their total sales in a fiscal year (applies to specific sectors and are not located in bonded zones)

Imposition of Dividends

The new regulation states that the rate of income tax on dividends paid to foreign taxpayers who do not have a permanent establishment in Indonesia is set at 10%, unless there is an applicable double tax agreement (DTA) in place, from which the lower rate between the two countries is used.

OSS Submission

To apply for these incentives, taxpayers will need to submit their application to the government’s Online Submission System (OSS), and the approval will be issued within five working days.

This article was first published by ASEAN Briefing.

Since its establishment in 1992, Dezan Shira & Associates has been guiding foreign clients through Asia’s complex regulatory environment and assisting them with all aspects of legal, accounting, tax, internal control, HR, payroll, and audit matters. As a full-service consultancy with operational offices across China, Hong Kong, India, and ASEAN, we are your reliable partner for business expansion in this region and beyond.

For inquiries, please email us at [email protected]. Further information about our firm can be found at: www.dezshira.com.