On December 21, 2018, the Chinese State Administration of Taxation announced the “IIT Special Deduction Procedure (Trial Implementation)” (or “Trial Implementation”). The Trial Implementation marks the first phase in a gradual reform and it took effect on January 1, 2019.

On December 21, 2018, the Chinese State Administration of Taxation announced the “IIT Special Deduction Procedure (Trial Implementation)” (or “Trial Implementation”). The Trial Implementation marks the first phase in a gradual reform and it took effect on January 1, 2019.

The Trial Implementation raises the ceiling for two categories of deductibles, reforms tax-exempted allowances for expatriate taxpayers, and changes the way taxpayers claim special tax deductions. Employers and taxpayers need to review these new developments.

IIT Special Deductions

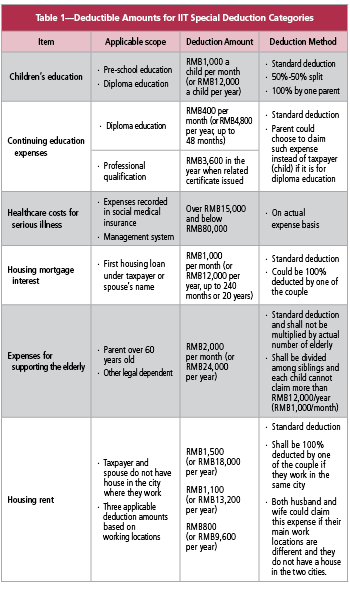

The Trial Implementation defines six categories for the IIT Special Deduction:

- Children’s education

- Continuing education expenses

- Healthcare costs for serious illness

- Housing mortgage interest

- Expenses for supporting the elderly

- Housing rent

Compared with the previous draft version, the Trial Implementation will affect two categories—healthcare costs for serious illness and housing rent. The standard deduction amounts for both increased to the following (also see Table 1):

1. For healthcare costs for serious illness, the annual deductible ceiling amount increased from Renminbi (RMB) 60,000 to RMB80,000

2. For housing rent, the monthly deductible increased from RMB1,200 to RMB1,500 in first-tier cities (including capital cities), and the monthly rental cost claim increased from RMB1,000 to RMB1,100 in cities that have a population of more than 1 million

Table 1—Deductible Amounts for IIT Special Deduction Categories

Notably, under the Trial Implementation, the deductible for healthcare costs for serious illness can be used by the taxpayer and their spouse or children. This new measure will provide more advantages to families.

Expatriates Affected

The newly added special deductions are available for both domestic and expatriate employees. In the past, all foreign employees were entitled to apply some tax-exempted allowances (i.e., housing, laundry, home visit, education, etc.).

Under the new law, expatriates can still apply those tax-exempted allowances, but this tax incentive for expatriates will only be valid until the end of 2021. During the transaction period (or the three years between the start of 2019 and the end of 2021), expatriates can still apply those tax-exempted allowances, or they can apply for the six special deductions.

However, once the expatriate has chosen whether to use the tax-exempted allowances or six special deductions, they cannot change policies during one calendar year. Further, after the three-year period expires in 2022, expatriates will no longer enjoy the tax-exempted allowances policy and will have to follow the same tax law as domestic employees.

How to Claim Special Tax Deductions

The Trial Implementation stipulates that taxpayers who want to claim special tax deductions have to provide their personal information and keep the relevant documents as evidence for five years. In other words, taxpayers need to register via an IIT application (which requires face recognition) or physically go to the local tax bureau to complete personal registration.

However, foreign taxpayers may need to physically visit the tax bureau and get the registration done in person.

Once the taxpayer has their personal account activated by the bureau, they may claim the special tax deductions through their employer or directly through their annual tax filing.

If the taxpayer chooses to claim through their annual tax filing, then the Trial Implementation stipulates that the special tax deduction can be managed by the individual via annual tax clearance if the taxpayer does not want to share personal information with their employer. Accordingly, taxpayers can choose to not disclose personal information to a third party (such as an employer); this may help taxpayers protect their privacy, providing a degree of flexibility.

Taxpayers should note that local authorities may need time to determine how to manage deductions under the Trial Implementation. Accordingly, taxpayers and their employers should study the relevant laws and consult with their trusted local advisors to learn more about claiming special tax deductions under the Trial Implementation.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Helen Kong is Manager of the International Payroll Service Team at Dezan Shira & Associates. She has been working in the HR field for Dezan Shira since 2008 and leads a specialized team in Dalian for payroll and HR administrative outsourcing services. Kong has expertise in providing tax planning and advisory services for foreign individual income tax matters and has also helped many newly established companies on HR start-up related services. Before joining Dezan Shira & Associates in 2008, she worked at a U.S. Fortune 500 company. She achieved her bachelor’s degree at Massey University in New Zealand, and she holds a Level One China Human Resources Certificate.