An emerging trend is for companies to outsource the “build to gross” (BTG) workflow of the payroll processing cycle to third parties. Traditionally, the “gross to net” (GTN) aspect of the payroll cycle has been outsourced to payroll service providers, with companies retaining the BTG section in house. With the new trend, outsourced service providers either have to collaborate with companies that can assist with time and attendance software or form strategic alliances with companies that have bespoke software designed to calculate gross earnings, or failing that, develop their own software to facilitate the calculation of gross earnings. What is required is a scalable system to manage global time and attendance and be capable of calculating the gross pay.

An emerging trend is for companies to outsource the “build to gross” (BTG) workflow of the payroll processing cycle to third parties. Traditionally, the “gross to net” (GTN) aspect of the payroll cycle has been outsourced to payroll service providers, with companies retaining the BTG section in house. With the new trend, outsourced service providers either have to collaborate with companies that can assist with time and attendance software or form strategic alliances with companies that have bespoke software designed to calculate gross earnings, or failing that, develop their own software to facilitate the calculation of gross earnings. What is required is a scalable system to manage global time and attendance and be capable of calculating the gross pay.

Any solution requires detailed pay practices as a starting point. (The topic of setting up pay practices was covered in a previous edition of GPMI.) The question therefore is what are the areas/steps requiring consideration or undertaking in the BTG process and what tools can automate this process?

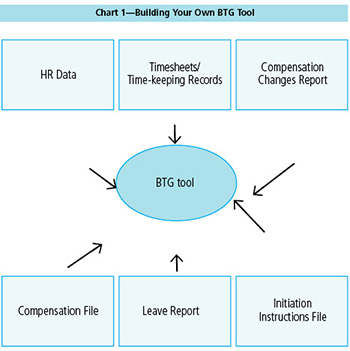

There are six possible sets of data to be considered when designing or building a system to facilitate the calculation of gross earnings:

- Human Resources (HR) Data

To calculate gross pay, the basic HR data of the employees is required. This data would provide information such as the start and termination dates of employees and the working schedule linked to each employee (in terms of their employment contract). There would be country-specific requirements where other personal factors influence the level of earnings, such as qualification levels or years of service in a particular industry. This data is obtainable either directly from the organization’s Human Resource Management (HRM) system or via manual input templates. As companies move towards greater automation, the preferred method of obtaining this data would be via an electronic data download. Most HR systems can generate an electronic file that will contain the data needed.

- Timekeeping Records

The next set of information required is the detailed timekeeping records of each employee. The records should cover a defined period and include details of absenteeism for sickness, vacation, or any other company approved/allowed leave. Examples would be maternity, paternity, bereavement, jury duty, moving residencies, or community volunteering time off. The assumption is that the employee would be credited with normal time if there is no indication to the contrary that the employee has taken time away from the workplace. The timekeeping information is necessary to ensure the correct recording of the breakdown of gross earnings and that leave provisions are accurate. In some countries, the employer can receive compensation from the state for payments made to cover maternity/paternity time off, which is another reason for ensuring the accurate components of gross earnings.

- Compensation “Change” Records

To calculate the gross earnings or pay, the compensation changes for the employees are required. The records should show the compensation rate/additional payment and the date the change is effective from, as well as the end date. Additionally, the value of the compensation before the change should be recorded, as this will enable the system to calculate any retroactive adjustment due to the employee. Having the full compensation name as well as the payroll code (as will be displayed on the payslip) is additional and useful information.

- Compensation Records

Depending on the BTG calculation tool used, the full compensation record for each employee may be required. This may be an optional data set depending on the software tool used to calculate the gross pay. These records would include all compensation and benefits paid to employees (all earnings due to the employee in the month). Normally, this would be reported as a rate per hour/day or as a fixed value.

- Leave Reports

An additional set of information that may be required are detailed leave reports. In most cases, these would be provided electronically by a data feed, either from an employee self- service system (ESS) or from the timekeeping system. These extracts should provide the closing balance of previous pay period leave types (these will be the opening balance in the current period). All leave types should be recorded as in some countries there is a requirement to provide the information on the payslip/pay statement provided to employees and/or to provide dates of maternity/sickness to a controlling body. My experience has shown that providing employees with as much detail as possible on their pay statements reduces the volume of queries raised by employees. Thus, employers should move towards greater disclosure.

- Initiation Instructions Document

At the start of each pay period cycle, outsourced payroll service providers normally would be supplied with a document containing additional instructions, which needs to be followed in order to process the payroll. For the purposes of this explanation, I have called these “initiation instruction” documents. This document could cover additional instructions regarding new hires or leavers. Two frequent examples occur where the company decides to waive the standard exit instructions for a particular employee or where a new starter is provided with additional vacation accrual at the start of the employment contract. This information would be recorded on the initiation document. Where compensation changes are not yet recorded in the HR system or there are entries that have missed the cut-off dates on which data was transferred from the HR system, these may also be provided in this document.

Build to Gross—What Tools to Use?

BTG functionality is usually part of an organization’s finance system. However, depending upon the complexity, and a global organization with many countries of varying populations will almost certainly be complex, it is often impractical and costly to do so.

Other options could include the use of a time and attendance system capable of collecting the data and then applying the appropriate rules. However, for flexibility, you may choose to develop your own tool.

Building a BTG business application gives the power to make software work any way you like. Designing fields, lay out of buttons, and even the name given to them can ensure that the product is one that can be easily used (see Chart 1).

Possible tools for this include Microsoft’s HTML Applications technology built into Windows or data analytics tools such as ACL and Idea. Such analytics tools are designed for data extraction and analysis, lending them to be used for BTG application. The advantages of this software is that it reduces time providing the results for large headcounts and enhances automation.

The rules sets (pay practices) for each pay group/location/country are set up in the software, and this results in separate BTG reports for each different geographic location/pay group. Pay practices should always start with the generic rules applicable to an organization. Rules that differ from region to region can then be added to the generic rules. Pay practices should cover how joiners’ and leavers’ compensation will be dealt with as well as whether there are special rules governing benefits in pay periods that are less than the standard pay period length.

Items to be covered in the pay practice should also include, but not be limited to:

- Base pay rate (BPR)

- Overtime

- How salaries and/or benefit changes that occur mid-month are dealt with

- Business travel time

- Company cars and car allowances

- Excess fare allowances

- Relocation allowances

- Temporary allowances

- On-call allowances

- Overtime and incomplete time data

Results derived from the BTG tool would be required in the calculation of the GTN stage of the payroll processing. (The GTN stage follows the BTG stage.) Whatever tool is used, it is important that the results from BTG can be transferred electronically to the GTN “engine.” This reduces the risk of data being incorrectly entered into another system tool and is more efficient from a time perspective—this is particularly important when, as is inevitable, a revision is required. The BTG will often need to be recalculated before the GTN can be updated and this can all take time.

Some payroll service providers manage both BTG and GTN stages of the payroll cycle for clients. Before beginning the process of developing an in-house system, global payroll professionals should review the service offering of the existing service providers. During a request for proposal (RFP), the same due diligence should be undertaken as would be with making a decision regarding choosing a GTN payroll service provider.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Sharon C. Tayfield, MCIPP, is a Senior Account Manager in the Global Outsourcing Division of BDO LLP (UK). BDO is a global accountancy and business advisory firm. She graduated with a Bachelor of Commerce majoring in Accounting, Taxation, and Managerial Accounts and Finance. She followed this with a Higher Diploma in Education. She went on to obtain a Diploma in Advanced Property Practice with Distinction in 1993 and then in 2001, successfully completed a Higher Diploma in Financial Markets and Instruments. In 2014, she completed the CIPP Payroll Technician Certificate. She is a registered tax practitioner in South Africa and a member of the U.K.’s Chartered Institute of Payroll Professionals (CIPP).