The Republic of North Macedonia lies in the Balkan Peninsula in Southeast Europe, landlocked by Kosovo, Serbia, Bulgaria, Greece, and Albania.

After declaring its independence from communist Yugoslavia in 1991 under the name of the Republic of Macedonia, a dispute with Greece over the name led to provisional descriptions being used (such as the former Yugoslav Republic of Macedonia) until a resolution was met in 2018 to rename itself as the Republic of North Macedonia.

North Macedonia is a member of the United Nations, Council of Europe, the World Trade Organization (WTO) and other international organizations. The country is also a candidate for joining the European Union (EU) and has applied for NATO membership.

Applicable Laws

North Macedonia’s labor laws and procedures are regulated with the Labour Relations Law (Official Gazette Nos. 62/05, 106/08, 161/08, 114/09, 130/09, 50/10, 52/10, 124/10, 47/11, 11/12, 39/12 and subsequent changes), the Collective Agreements (concluded on a national level), other legal acts, and the Individual Employment Contract concluded between the employer and the employee.

Social Insurance Foundation

All gross salaries are subject to social insurance and tax deductions, deductible from the employee’s gross salary but payable by the employer on his/her behalf.

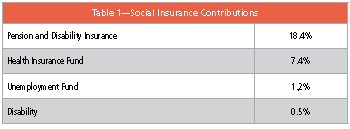

As of this writing, the social insurance deductions from gross salary are calculated based on the percentages in Table 1.

The employer is obligated to pay all contributions and taxes concurrently with the payment of net salaries. Currently, there is a ceiling for the gross salary on which social security contributions are calculated in an amount equal to 16 national average gross salaries.

Personal Income Tax

Personal income taxes are levied on the salary amount remaining after the above social insurance deductions are calculated, less a fixed amount portion of the salary—currently Macedonian denar (MKD) 8,000—which remains untaxed. The personal income tax rate is progressive, with the first MKD 90,000 in income per month taxed at 10% and the remainder taxed at 18%.

Employment Procedure

For an employment relationship to be established, the first step that must be taken is the publication of the vacancy by the employer (through daily newspapers or using the national employment agency publication mechanisms or private HR-specialised agencies). The employment officially commences with the completion of a written employment contract between the employer and the employee.

The employment contract (which can be concluded for a predetermined duration up to five years or for an indefinite period) must be kept at the work premises at all times and must specify certain employment aspects, such as the employment commencement date, location, duration, full- vs. part-time, working hours, salaries and benefits, vacation leave allowances, and other details the employer requests, provided that they are in accordance with the Labour Law.

Should provisions of the individual employment contract be in breach of the Labour Law, they are rendered invalid.

The employer must also register the employee for social insurance and in the health fund and provide the employee with a copy of the registration document.

Protection of Employment

Holidays: Employees are entitled to between 20-26 days of vacation leave annually (depending on job performance, years in service, and employment contract terms).

A first-time employee gains the right to this vacation leave after six months of completed service. Prior to the completion of six months in service, the new employee is granted the right to two days of leave for every month spent working at the company. The leave of absence can be split into two separate leave periods. However, the employer must grant the employee at least 12 of the 20-26 days of leave within the calendar year. The remaining days of the leave for that year must be used before June 30 of the following calendar year.

Employees are permitted an additional seven days’ leave from work during the calendar year with compensated pay, in instances and under conditions determined by the collective agreement, particularly in cases of marriage, death of a close family member, and for professional or other kinds of examinations required by the employer.

Illness: There is no annual limit on the number of sick days an employee can take. In case of an employee’s inability to work due to illness or injury, the employer is entitled to pay salary remuneration for the first 30 days of illness.

The level of remuneration due to the employee on sick leave depends on the duration of the leave:

- 1-15 days of duration = 70% of average salary in the last 12 months

- 16 or more days of duration = 90% of average salary in the last 12 months

- After 30 days the reimbursement is paid by the health insurance fund

If the employee is sick again within the first three days of the expiry of the previous sick leave, the employer is entitled to request from the first instance medical committee confirmation of the new sick leave, or an extension of the expired previous sick leave. Approved sick leave, while on annual leave, is not computed in the annual leave.

Maternity: Maternity leave amounts to nine months of continuous work leave during pregnancy, birth, and maternity, and one year of leave for the birth of more than one child (twins, triplets, etc.). Expecting mothers may begin maternity leave as early as 45 days before delivery. New mothers can return to the place of work before the end of the full maternity leave only upon their own consent. Female employees who have adopted a child are entitled to a leave until the child is 9 months old.

Compensations during the maternity leave are covered by the State Fund for Health and Insurance, provided that all social contributions have been regularly paid by the employer prior to the maternity leave.

The employer cannot (during the employee’s pregnancy and maternity leave), under any circumstances, terminate the employment contract. In addition, pregnant women and women with children younger than one year may not be asked to work hours longer than those defined in the employment contract. Women with children between the ages of 1 and 3 may only be asked to work overtime upon their written consent.

Payroll Calculation Procedure

Each month, after the employer completes the necessary salary and social contributions/taxes payments, the employee is given a pay slip (outlining the gross salary and all deductions paid from it). In North Macedonia, all payments (net, contributions, personal tax) are made concurrently on the basis of an encrypted single payment order (salary declaration) for all employees at the same time.

Termination of Employment

When an infinite duration agreement is signed between the employer and the employee, the employer has the right to terminate the employment (providing a written notice of at least 30 days) only when there are justifiable grounds for terminations. Justifiable grounds include:

- The employee not fulfilling working obligations/duties (even after a written warning);

- The employee violating the work discipline/order (even after written warning);

- The employee disregarding employer’s working hours;

- The employee fails to request leave of absence or notify about sick leave or misuses sick leave;

- The employee is in breach of confidentiality agreement; and

- Economic, technological, or structural transformations of the employer’s organisation.

The employment may not be terminated during any type of approved leave (sick, maternity, annual vacation).

Employees may terminate employment at any time provided that they submit a written notice at least one month before.

In cases of a defined duration employment contract, the employer can unilaterally terminate the employment before the end of the determined time period only in very specific cases. Should the employee be willing to continue working past the agreement expiry date, an infinite employment agreement is completed.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Elena Kostovska holds a BSc degree in Computer Management Information Systems and an MBA with a concentration in Marketing. With more than 15 years of working experience in North Macedonia and abroad, she has an extensive background in both profit and non-profit organisations. Kostovska has undertaken the setup and client base growth of the Eurofast Skopje office since the beginning of operations in the country and oversees the day-to-day provision of high-quality services to a wide range of clients. In recent years, she has been heavily involved in Eurofast's payroll service line, both in terms of group-level relationship management and new business development as well as hands-on involvement in complex payroll projects.