South Africa is a country at the southern tip of the African continent and is known as the “Rainbow Nation.” Archbishop Desmond Tutu used the term to describe post-apartheid South Africa after the first fully democratic election in 1994.

South Africa is a country at the southern tip of the African continent and is known as the “Rainbow Nation.” Archbishop Desmond Tutu used the term to describe post-apartheid South Africa after the first fully democratic election in 1994.

The nation is characterised by several distinct ecosystems:

- The inland safari destinations that cover vast scrublands populated by “big five” game animals

- The Western Cape’s lush wine lands

- The sheer cliffs at the Cape of Good Hope

- The forest and lagoons along the Garden Route

- The city of Cape Town beneath the flat-topped Table Mountain

The coastline stretches 2,798 kilometres. It begins with a desert border in the northwest, winds down the coastline of the Skeleton Coast (named for the area’s shipwrecks), to Cape Agulhas, then past green hills and wide beaches on the eastern coast of the Indian Ocean to a border with Mozambique.

Legal System

South African law is based on Roman-Dutch law and the 1996 Constitution. South Africa is a multi-party democracy with an independent judiciary. Until 1994, the country was known for apartheid. South Africa’s remarkable ability to put centuries of racial hatred behind it in favour of reconciliation is still considered a social miracle. This inspired similar peace efforts elsewhere. Nelson Mandela was the first President of South Africa following the first democratic elections.

The highest law of the land is the Constitution. This came into force on 4 February 1997. The Constitution’s Bill of Rights offers protection in a number of areas whilst also setting the foundation for basic rights such as housing and access to services. Protecting those rights is the country’s independent judiciary. There are 13 parties in Parliament, with the African National Congress being the current governing party. It has a strong majority, although the opposition parties are robust and vocal.

Business Bank Account Requirements

South Africa has a well-developed and highly regulated banking system. The country’s central bank, the South African Reserve Bank, controls the banking sector. Banks are regulated by an act of parliament based largely on British, Canadian, and Australian legislation. Recently, South Africa has amended its exchange control and financial market regulations in an effort to attract investors from other countries.

Unlisted companies will require the following documentation to set up a bank account in South Africa:

- CIPRO (Companies and Intellectual Property Commission) Certificate or proof of submission

- Memorandum of Association (CM2)

- Articles of Association (CM44)

- Certificate of change of name of company, if applicable (CM9)

- Identification documents of directors, signatories, principal executive officer, shareholders with 25% or more voting rights, and persons acting on behalf of company

- Proof of physical or trading address of business

- The business’ last three months’ bank statements (if existing)

Tax Registration, Filings

Employees have to register for personal income tax and provide the employer with their tax number when they begin employment. The South African Revenue Services (SARS) has passed legislation that places a responsibility on the employer to ensure that each employee has a tax number. This can be done in a number of ways, and further information can be obtained from the SARS website [www.SARS.gov.za]. Employers also need to register with SARS to obtain a PAYE (tax withholding) number. A monthly electronic PAYE filing, called an EMP201, must be submitted to SARS via an e-filing system. Payments are also made monthly and need to be made on or before a business working day before the 7th of the following month.

Employers have biannual and annual filing obligations, and the tax authority announces the dates annually. The interim filing season normally runs from 1 September to 31 October of each year, with the final employer filing season running from 1 May to 31 May. Filings are submitted using a SARS-developed, free software package (e@syFile™ Employer). The software allows employers to complete their reconciliation submissions offline and then send these to SARS via e-filing.

Social Security Registration, Filings

Social Security Registration, Filings

Each employer needs to register with the Department of Labour to obtain an Unemployment Insurance Fund (UIF) number. Employees do not need to register. UIF contributions are withheld via the payroll. The current rate is 1% employer contribution and 1% employee contribution. Contributions are calculated on UIF earnings. Payment is made along with the PAYE payment to SARS, and an electronic return is submitted to the Department of Labour each month. The maximum earnings on which UIF contribution is calculated are currently set at R178,464 per annum, R14,872 per month, or R3,432 per week. In certain instances UIF is not required to be paid, the most common being students or non-South African residents who will be repatriated at the end of a contract period.

The UIF provides short-term financial payments to workers when they become unemployed or are unable to work because of maternity, adoption leave, or illness. It also provides financial payments to the dependents of a deceased contributor.

Basic Conditions of Employment

The Basic Conditions of Employment Act (BCEA) covers the minimum requirements for employment in South Africa:

- Employment Contract—The BCEA requires employers to give employees certain details of their employment in writing. This information should be given at the start of the employment contractual relationship and should contain information regarding the employer, employment, payment, and leave details. The notice and/or contract period also needs to be stipulated in the document.

The document also should cover whether any period of employment with a previous employer will count toward the current period of employment, list any other documents that form part of the contract, provide details of where the worker can get copies of these documents, and have a description of any council or sectoral determination in operation in the employer’s business sector.

- Minimum Wage—There is no single national minimum wage in South Africa. Minimum wage is set at a sectoral level and area level. Minimum wages are set for sectors that have low union density or where the market wages are quite low.

Working Hours and Overtime

An employer may not require or permit an employee to work more than 45 hours per week, nine hours a day (for five days or less in a week), or eight hours a day (for five days or more in a week). Employees are required to have a meal break of at least 30 minutes after five hours of work. Employees also are required to have a rest period of 12 hours each day and 36 consecutive hours each week. (The 36-hour period must include Sunday unless otherwise agreed).

By mutual agreement the employer and employee can agree to extend the working hours to 12 consecutive hours (including the meal interval) but they may not exceed 45 hours per week. Overtime cannot exceed 10 hours per week.

Employees who do not usually work on a Sunday should be remunerated at double the normal hourly wage for work performed on Sunday. Employees who usually work on a Sunday must get 1.5 times the normal hourly wage for overtime. Workers who usually work on a Sunday but work less than or the same as their ordinary shift must get their normal daily wage.

Instead of getting a higher rate, there is an option for workers to agree to get paid time off in exchange for working on a Sunday. BCEA has an earnings limit, and employees only have to be paid overtime if they earn below that limit.

Leave Entitlements

Leave Entitlements

- Maternity Leave—Pregnant women may take four months of maternity leave starting one month before their due date. Employees may not return to work within six weeks after the birth unless their doctor or midwife verifies that it is safe. An employee who is pregnant or nursing may not do work that is unsafe for her or her child. Maternity leave does not have to be paid leave.

- Paternity Leave—There is no specific legislation covering paternity leave, but Family Responsibility Leave could be used for this purpose.

- Family Responsibility Leave—Family Responsibility Leave in South Africa permits employees to take up to three days of paid leave a year (12-month period) to attend to certain family responsibility events. In terms of the BCEA, employees only qualify for the three days after completing four months of service. The employer may require the employee to provide reasonable proof of the event before granting the leave.

- Annual Leave—BCEA legislation requires that employees get a minimum of 21 consecutive days of annual leave each year. Employees should only be paid out for annual leave when employment is terminated. (Leave encashment should therefore only occur on termination of services). Workers must get annual leave of at least 21 consecutive days, or one day for every 17 days worked, or one hour for every 17 hours worked. A public holiday cannot be counted as annual leave.

- Sick Leave—Employees may take the number of days they would normally work in a six-week period for sick leave on full pay in a three-year period.Therefore an employee working five days a week would be entitled to 30 days sick leave in a three-year period. Employers may insist on proof of illness before paying a worker for sick leave. During the first six months of employment, workers are entitled to only one day of paid sick leave for every 26 days worked.

- Notice Requirements for Termination of Employment—Notice must be given in writing, except when it is given by an illiterate employee. If an employee has worked for six months or less, then the notice period is one week. Where the employee has been employed for a period of longer than six months but less than one year, then two weeks’ notice must be given. Where an employee has worked for one year or more, then four weeks’ notice must be given. (A collective agreement may reduce the four-week notice period to a period of not less than two weeks.) Notice must be per the contract of employment. Note that labour laws make it difficult to “dismiss” an employee. Caution is always advised when dealing with these matters.

Employers must pay a severance payment to retrenched workers. The payment must be equal to at least one week’s pay for each completed year of continuous service. Over and above severance pay, employees are entitled to any other amounts that they are legally entitled to in terms of their normal employment contract. Employees are not entitled to severance pay if they do not have a valid reason for refusing other employment with the same employer, or with another employer (in cases of group companies). A tax directive stating how much tax to withhold will be required from SARS when a severance payment is involved. Normal resignations will not require a tax directive.

Income Tax

Income Tax

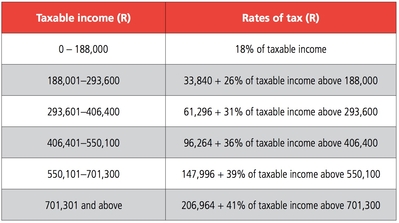

South African residents are taxed on their worldwide income. The highest tax rate is 45%. The tax rates in operation for the period 1 March 2016-28 February 2017 are shown in Table 1. Employees are entitled to a rebate (tax-free allowance) amounting to a primary rebate of R13,500. For taxpayers 65 years and older, an additional rebate termed the secondary rebate is provided. In the 2017 tax year, that is set at R7,407. A further rebate, the tertiary rebate, is available to taxpayers aged 75 years and older. (R2,466 for the 2017 tax year)

Employment Equity Act

This Act requires designated employers to compile and implement an Employment Equity Plan aimed at promoting equal opportunities and affirmative action and also attempting to eliminate unfair discrimination. The definition of a designated employer includes those employers who have a headcount exceeding 50 employees or have a turnover greater than a certain legislated amount, (schedule 4 of the Act). The Act was supposed to redress the employment disadvantages of black people, women, and those with disabilities, (termed “designated groups”). The employer is required to implement plans/actions to achieve employment equity. These plans are subject to annual review, and an employer who does not fulfill the requirements set out by the legislation will be subjected to fines. Reports have to be delivered to the local Department of Labour office or Labour Centre or posted, faxed, or emailed to the Department of Labour.

Conclusion

Legislation is constantly changing in South Africa, and anyone involved in payroll in the country is advised to keep up to date with key changes to ensure continued compliance and minimise the financial exposure as a result of noncompliance penalties.