Qatar is a wealthy country in the Middle East, located on the northeastern coast of the Arabian Peninsula, with Doha as its capital. It has a population of around 2.8 million, mostly expatriates. Qatar is an absolute monarchy, ruled by Emir Sheikh Tamim bin Hamad Al Thani. The country boasts one of the highest per capita incomes globally, thanks to its extensive oil and natural gas reserves. Major industries include oil and gas production, petrochemicals, and financial services.

Labor Code

In Qatar, the labour code ensures fair treatment for workers and outlines regulations on working conditions, wages, and dispute resolution. Foreigners looking to establish businesses navigate these regulations, including license requirements and compliance with local labor laws, in a growing economy geared towards foreign investment and entrepreneurship.

Minimum Wage

The minimum monthly wage in Qatar is 1,000 QAR, introduced in March 2021. Employers that don't directly provide food and housing must offer allowances of at least 300 QAR for food and 500 QAR for housing.

Qatar Wage Protection System

The Wage Protection System (WPS) ensures timely salary payments through an electronic system managed by the Qatar Central Bank and Ministry of Labour. This allows government authorities to monitor wage payments to ensure employment contracts are honored.

Working Hours, Conditions

Generally, the standard working week is 48 hours, spread over six days with Friday as the weekly day off. During Ramadan, Muslims work six hours per day or 36 hours per week. Specific hours vary by industry and employer policies.

Overtime Pay

Overtime pay is mandated by labour laws, ensuring employees receive extra compensation—currently 125% of their regular wage according to Article 75—for hours worked beyond the standard schedule.

Employees

Employees in Qatar encompass a diverse range of categories, including Qatari nationals and expatriate workers in skilled, labour, domestic, and managerial roles.

They may be employed under various contract types, including full-time and part-time arrangements, across both public and private sectors. This diversity reflects Qatar's dynamic economy and its efforts to integrate a multinational workforce while ensuring adherence to labour regulations and rights.

Taxes

As of 2024, Qatar does not impose personal income tax on individuals, including residents and nonresidents. Additionally, there is no tax on capital gains, dividends, or interest income. However, businesses in certain sectors may be subject to corporate tax, particularly those involved in oil and gas production and foreign banks operating in the country.

Qatar's tax regime aims to attract foreign investment and skilled professionals by offering a tax-free environment for personal income. It's essential to consult updated sources or professional advice for any recent changes or specific tax obligations that may apply to businesses or individuals operating in Qatar.

Social Security Tax

There is no social security system in Qatar. Qatari nationals receive state help including sickness, medical care, maternity cover, childcare, pensions, and unemployment benefits. Foreigners working in Qatar are eligible for limited social services. There are no state pension schemes for foreign workers, although some international companies offer corporate pension schemes.

Capital Gains Tax

Qatar-sourced capital gains derived by nonresidents are subject to 10% income tax.

Corporate Tax

The corporate income tax rate is 10%. Foreign employers must file their tax return no later than four months after the end of the tax year. There is a 35% tax rate for entities dealing with oil and gas operations. No extensions are given for filing business tax returns in Qatar.

Withholding Tax

A unified 5% withholding tax applies to services used within the country, even if performed abroad. It covers payments like interest, royalties, and technical fees, excluding dividends.

Payments to nonresidents without a Qatar permanent establishment (PE) require withholding, filed monthly online through Dhareeba, the GTA’s online tax portal, with penalties for non-compliance.

Value Added Tax

Value Added Tax (VAT) is expected to be introduced in Qatar in 2024. The standard VAT rate is expected to be 5%, with exemptions and zero-rated goods and services.

Time Off

Employees in Qatar are entitled to various types of leave that include the following:

Annual Leave

The time periods for annual leave are outlined in Qatar Labour Law Article 79, which states that anyone employed for one year or less is not entitled to annual leave. Employees who have worked five years or less are entitled to a minimum of three weeks paid annual leave, while those who have been continuously employed for five years or more are entitled to a minimum of four weeks paid annual leave.

Article 68 of Qatar Labour Law directs the employer to pay the worker prior the date of his annual leave due remuneration for the work he performed up to the date of the annual leave in addition to the due leave allowance.

According to Article 72 of Qatar Labour Law, a worker’s wages during annual or sick leave shall be calculated based on his or her basic wage on the date of entitlement. If the employee works on a piecework basis, the entitlement shall be calculated based on his or her average wages for the three months preceding the date of entitlement.

According to Article 80, the employer can specify the annual leave dates, per the company’s work requirements. The employer can also divide the annual leave upon the worker’s consent. However, such a division shall not be divided into more than two periods. For example, an employer (with the worker’s consent) can divide the annual leave of 24 days into two periods of 12 days each (or any fraction), but it should not be split into three periods of 8 days each.

An employee who wishes to carry forward his or her leave must provide a written request to the employer and can be allowed to carry forward half the annual leave days. For example, if an employee has 24 days, they can request to carry forward no more than half of those days.

All workers are entitled to the minimum days of annual leave and shall not waive their entitlement to annual leave. If the employee is terminated before they take their annual leave, the former employers shall be paid a cash allowance equivalent to the basic wage.

Sick Leave

According to the Qatar Labour Code, sick leave is granted after three months of employment. Sick leave is traditionally paid time off from work provided voluntarily by an organization to its employees. Often this can be beneficial to both the employer and the sick employee. Sick people coming to work pose a risk of spreading disease to others. Offering paid sick leave can help prevent the spread and keep employees productive.

According to Article 82 of Qatar Labour Law, sick leave is granted for 12 weeks at the following rate:

- First two weeks: Full Pay

- Next four weeks: Half Pay

- For further six weeks: No Pay

The following are the conditions for granting sick leave:

- Sick leave shall only be granted after three months have passed since the first day of work

- A medical report from a competent physician approved by the employer should be provided

As a general practice, when a worker is absent due to illness, they must notify their employer as soon as possible, either by themselves or another person. At the end of the twelfth (12) week of sick leave, the worker’s service may be terminated if it is determined by a competent physician that he is unable to resume his duties.

Resignation/Death Due to Sickness

If the worker resigns from work because of sickness (with the approval of a competent physician) before the end of six weeks to which he is entitled to sick leave with pay, the employer shall pay the worker the balance of his entitlement. Similarly, if the worker dies due to sickness before the end of six weeks to which he is entitled to sick leave with pay, the employer shall pay the worker’s family the balance of his entitlement.

Maternity Leave

According to Article 96, a female worker who has spent a whole year in service with the employer shall be entitled to maternity leave with remuneration for a period of 50 days.

A medical report from a licensed physician stating the expected delivery date is required before leave can be granted.

Leave includes the prenatal (before delivery) and postnatal (after delivery) period, provided that the postnatal period is not less than 35 days. A pregnant female worker is entitled to her full salary during maternity leave.

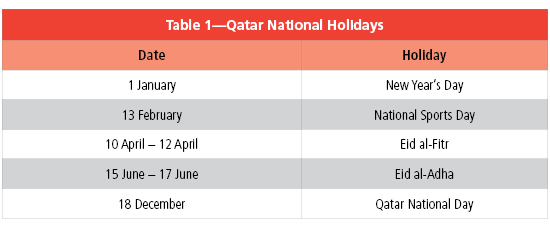

National Holidays

There are five public holidays in Qatar in 2024 (see Table 1).

Foreign Hires

Foreign hires play a crucial role in Qatar's economy, contributing skills and expertise under Qatari employer sponsorship. They require valid work permits and visas, with Qatar's legal framework protecting their rights and promoting cultural integration.

Qatar imposes a unified 5% withholding tax (WHT) on certain payments made to nonresident individuals or companies for services used or benefited from within Qatar, even if the services are performed outside the country. This WHT applies to payments such as interest, royalties, technical fees, commissions, and other services, excluding dividends.

Nonresidents without a PE in Qatar are subject to this WHT. They must file monthly WHT statements online through Dhareeba and ensure compliance with Qatar's tax regulations.

Visas

Qatar issues working visas through a structured process overseen by the Ministry of Interior. This includes employment visas, work residence permits, and family residence visas for dependents joining foreign workers.

The cost of a work is covered by the employer. Expatriates living in Qatar who wish to bring their families can apply for a family residence visa and must provide documentation such as a marriage certificate, birth certificates, and education records. To be eligible for a family residence visa, employees must work in a specialised or technical profession.

Culture

Qatari culture blends Islamic traditions with modern influences due to rapid development. Hospitality, family ties, and Islamic values are central.

Traditional cuisine includes dishes like machboos and harees. Poetry and calligraphy are valued arts. Festivals like Eid and National Day are celebrated.

Qatari attire reflects cultural pride. Modernization has introduced global influences while efforts are made to preserve heritage through museums and initiatives.